Bank insciption on a building | © shutterstock.com

Bank insciption on a building | © shutterstock.com

Today’s central banks are pivotal institutions in every modern economy, and most central banks are independent institutions with the authority to perform critical functions. These functions often include creating money, setting interest rates, running the payment system, supervising financial institutions, backstopping the financial system, and managing foreign currency reserves.

Central banks play a pivotal role in responding to crises, and central bank independence has enabled them to respond quickly. The most recent crisis, which is still ongoing – the COVID-19 pandemic – has witnessed central banks reacting with a speed, scope, and scale unprecedented in history. Central banks responded with extraordinary measures to ensure financial system stability and faster economic recoveries across the globe. A key element of the response measures was deploying foreign exchange reserves to provide foreign exchange liquidity to domestic market participants if and when necessary.

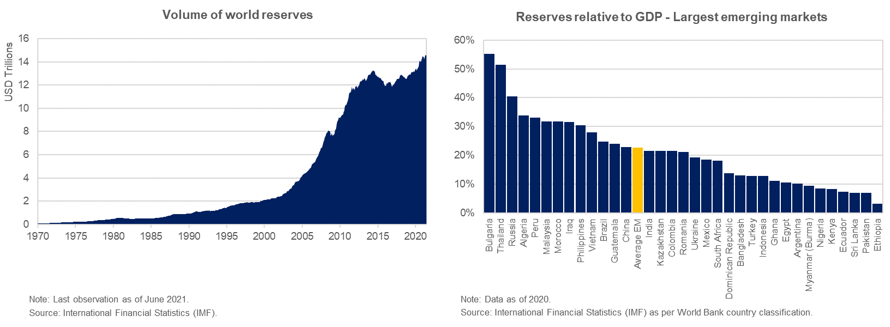

Holding and managing a country’s official foreign reserves are among a central bank’s core functions. Central banks’ reserve management operations have always been part of their monetary policy function. Holding foreign reserves has various purposes. Most notable are self-insurance for balance-of-payments crises and support of exchange rate policies. In some countries, reserves also support financial stability by providing lender-of-last-resort functions in foreign currency. The availability of sufficient reserves has insulated countries against disruptions and volatility in international capital markets and successive financial crises, including the ongoing COVID-19 pandemic. Foreign reserves have grown significantly over the past four decades, and they are now at record highs (see figure 1).

Figure 1. Accumulation of Foreign Reserves Worldwide

To carry out these functions and create resilience in times of crisis, central banks need an appropriate governance framework for their reserve management operations. Given the complexity of central banks and the multiple responsibilities they assume, it is critical for their governance framework to define clearly their decision-making structure: what to decide, who must decide, and how decisions must be made.

The buildup and active deployment of reserves have transformed how central banks manage these funds. Figure 2 shows the basic structure of governance arrangements for central banks and reserve management, which typically establish the policy-making structure and are based on three main channels of governance: a top-down delegation of authority, a top-down policy framework, and bottom-up reporting lines and oversight mechanisms. An effective governance framework ensures clear delegation and separation of responsibilities, as well as accountability for investment decisions within effective risk limits.

Source: J. Johnson-Calari and I. Strauss-Kahn. 2020. “Good Governance: Principles, Pitfalls, and Best Practice.” In Asset Management at Central Banks and Monetary Authorities: New Practices in Managing International Foreign Exchange Reserves, edited by Jacob Bjorheim, chapter 18. Zurich, Switzerland: Springer.

While many observers stress the importance of an appropriate governance structure, little information is available on how the specific governance arrangement of their reserve management operations influences how much risk these institutions take in their reserve management operations and how diversified their reserve pool is with respect to the number of eligible assets and currencies. We explore this question in a new research paper that uses a unique data set of 105 central banks from the Second RAMP Survey on Central Bank Reserve Management Practices to investigate whether investment policies for central bank foreign reserve portfolios are linked to the governance arrangements for reserve management.

We aim at determining how governance and organizational arrangements matter for investment policies and central bank risk taking. More specifically, we explore whether the following are true and their impacts:

- An independent investment committee exists that approves the investment management guidelines.

- The middle office reports to the board or the investment committee.

- The middle office reports performance and risk metrics to the investment committee.

- The central bank organizes its front, middle, and back offices in one or separate departments.

- The ministry of finance has the obligation to cover the central bank’s negative equity.

- Risk and returns of the reserve management operations are reported directly to the board.

We assess the impacts of these different arrangements with respect to relevant indicators of investment policies and risk taking, such as the central bank’s allocation to nontraditional asset classes, number of eligible currencies and asset classes, portfolio risk, and investment horizon or duration. The implication for central banks is that portfolios with longer investment horizons, more currencies, and a broader set of asset classes have performed better historically while limiting downside risk.

Our analysis yields four key findings:

| 1. | Reserve portfolios are more diversified in central banks in which the middle office directly reports to the board . Therefore, internal governance arrangements matter for foreign reserve portfolio investment policy and can be changed to reflect this. Figure 3 displays the regression coefficients for central banks in which the middle office reports to the board, with 95% significance and controlling for reserve adequacy and the macro and broader governance environment. Central banks in which the middle office reports to the board have more eligible assets and currencies (2.9 and 3.1 times more on average, respectively) than central banks in which the middle office does not report to the board. |

Figure 3. Impact of the Middle Office Directly Reporting to the Board on Investment Policies

| 2. | Reserve portfolios are more diversified in central banks where the back, middle, and front offices are separated . This holds when controlling for the level of reserves, the macroenvironment, and the broader governance environment. Central banks that can define their own organizational structure can act on this finding. |

| 3. | Central banks’ reserves are composed of fewer eligible currencies and are therefore less diversified in countries where the ministry of finance has an obligation to cover negative equity . Central banks in countries with the obligation to cover negative equity have, on average, almost three eligible currencies fewer than those without this obligation. This is a challenging area for central banks to take action, but the policies can be altered. |

| 4. | Central banks where the board actively exercises portfolio oversight and the middle office reports directly to the board on investment policies usually have reserve portfolios that are more diversified . |

Our research provides new, quantitative evidence for a simple yet important conclusion – any central bank can improve its internal governance regardless of the external governance environment, and such improvements can produce much better outcomes on reserve management. Given the essential role of reserves in times of crisis, this conclusion has significant implications for economic development. Therefore, central banks should consider exploring options for improving governance and reserve management, including through the World Bank Treasury’s Reserve Advisory and Management Partnership.

Join the Conversation