Lake development project, Tunis, Tunisia. (Sana Dimassi Ep Rekik/World Bank)

Lake development project, Tunis, Tunisia. (Sana Dimassi Ep Rekik/World Bank)

A quick internet search of World Bank offices in Tunisia reveals an interesting coincidence – they are located at the very heart of one of the country’s most successful Public-Private Partnerships (PPP) project: the “Lake District” redevelopment project. Although this could make for a great trivia question, it exposes a more concerning fact: the neighborhood, which was redeveloped back in 1983, has only been succeeded by a handful of other large-scale PPP projects in the country.

Indeed, over the last four decades, Public-Private Partnerships have faced significant challenges in Tunisia - particularly the shortage of expertise and resources within the civil service to carry out project preparation , tendering, and monitoring. “However, PPPs offer our country a unique opportunity to finance and deliver high-quality public infrastructure and services, whilst leveraging the valuable resources and expertise of the private sector,” says Atef Majdoub, President of the Instance Générale de Partenariat Public Privé (IGPPP). “We are truly committed to increase such collaborations in the near future and the IGPPP is proud to have been given the administrative and financial autonomy to carry out this mission successfully.”

The Project Development Fund: Enhancing PPP sustainability and effectiveness

Since 2020, the World Bank has been providing technical assistance to accompany the IGPPP in its design and set-up of a Project Development Fund (PDF) for PPPs in Tunisia through the Compact with Africa Trust Fund. The PDF was formally created in the first quarter of 2022. It is expected to start operations in 2024 for an initial period of five years. The PDF instrument addresses historical barriers to PPP development in Tunisia via three key actions:

- Reinforced capacity to develop a robust PPP project pipeline: Achieved through the formulation of project screenings and prioritization criteria. Indirect capacity gains are also expected through the transfer of knowledge from private sector expertise or the increased exposure to international best practices and know-how.

- Strengthened PPP project preparation: Including the development of business cases, feasibility studies, and public tenders to better review and evaluate project proposals, negotiate PPP contracts, as well as carrying out the commercial and financial close with equity investors and debt providers.

- Improved PPP project monitoring: Ensuring the supervision of private partners’ compliance during the construction and initial phases of PPP projects. This includes a more thorough follow-up on the day-to-day operations of PPP projects over the course of their implementation.

Project pipeline: Capitalizing on regional and national priorities.

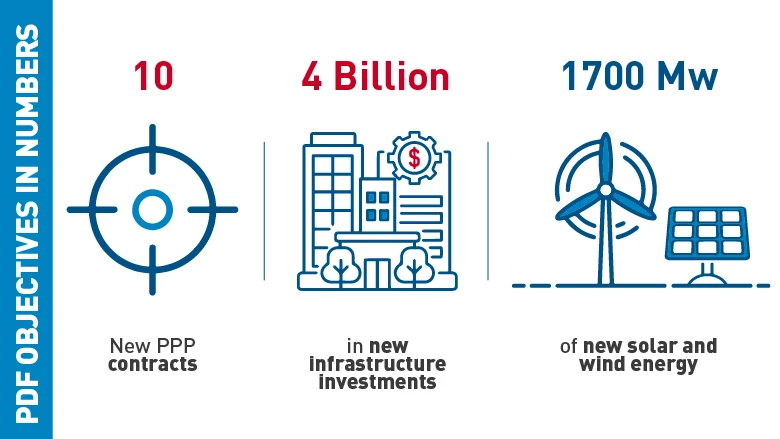

With the expectation of leveraging private sector participation and continued support from the World Bank and other donors, the IGPPP is now proposing an exciting and robust project pipeline of more than US$ 4 billion in total PPP investments. The PDF will enable a strengthening of Tunisia’s PPP framework and the instrument is capitalizing on high-potential projects in industries that offer strong growth prospects as well as a strategic alignment with national priorities. Resultingly, foreseen projects include sectors such as renewable energy (1700 MW of solar and wind energy), water sanitation, green hydrogen, the Sfax tram network (Tunisia’s 2nd largest city), as well as water desalination and wastewater treatment programs.

Alexandre Arrobbio, the Country Manager in Tunisia, the PDF’s says the project pipeline is truly relevant for the challenges Tunisia faces today such as renewable energy and sustainable management of water, which are also paramount to the vision portrayed in the new Country Partnership Framework (CPF) for Tunisia and the Bank, and Alexandre explains that focusing investments on high-impact sectors is key to achieving more tangible results in the face of regional and global challenges such as climate change. It allows Tunisia to capitalize on its ability to produce renewable energy on a large scale and export excess production to one of the world’s largest markets, the European Union, whilst also strengthening its water security in the face of increasing hydric stress.

Looking ahead: Creating positive impact for the Tunisian people

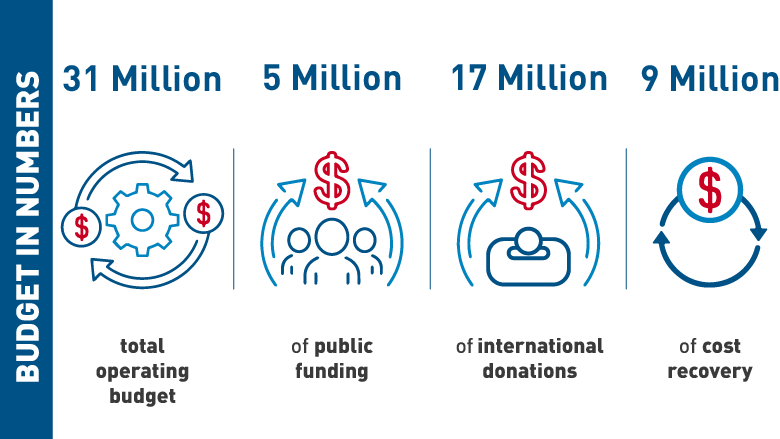

The PDF has already achieved important milestones like the legal implementation of the instrument in Tunisian law, as well as a TND 15 million public contribution to the fund’s operational budget – to which an additional US$ 17 million in international donations is expected. The instrument was presented at the 2022 Tunisia Investment Forum, the largest of its kind on a national scale, and is expected to gain traction rapidly over the coming months.

“Tunisia has a unique opportunity to be a leader in the region regarding PPP investments, as countries such as Jordan, Algeria and Egypt are currently undertaking similar work,” says Majdoub. “In fact, thanks to the successful fine-tuning of the PPP framework achieved through the PDF, we are very confident that the first large-scale projects will be operational by 2024!” This is a very welcome prospect for Tunisia and its focus towards achieving more climate-resilient infrastructure and quality public service delivery for its population.

For further reading on the World Bank's program in Tunisia:

How can PPPs be successful (6th July 2023)

PPPs in Tunisia: Creating a Project Development Fund (February 2023)

Tunisia Country Partnership Framework FY23-27 (15th June 2023)

Join the Conversation