This blog was edited by its author subsequent to publication to clarify that the EUR 20 to 25 billion for broadband infrastructure represents the majority of all investments needed.

The issue of affordable connectivity gained prominence last week when photographer John Stanmeyer won World Press Photo of the Year for

his eloquent picture of people standing on a beach at night in Djibouti, trying to access cheaper wireless service from neighboring Somalia. In a new study “

Broadband Networks in the Middle East and North Africa: Accelerating High –Speed Internet Access

” (launched February 6 in Abu Dhabi) my colleagues Carlo Maria Rossotto, Michel Rogy and I looked at prices and other market structures in places like Djibouti when we set out to understand what it will take to expand broadband internet in the Middle East North Africa (MENA) from its current low base.

The issue of affordable connectivity gained prominence last week when photographer John Stanmeyer won World Press Photo of the Year for

his eloquent picture of people standing on a beach at night in Djibouti, trying to access cheaper wireless service from neighboring Somalia. In a new study “

Broadband Networks in the Middle East and North Africa: Accelerating High –Speed Internet Access

” (launched February 6 in Abu Dhabi) my colleagues Carlo Maria Rossotto, Michel Rogy and I looked at prices and other market structures in places like Djibouti when we set out to understand what it will take to expand broadband internet in the Middle East North Africa (MENA) from its current low base.

Analysis of 19 national broadband markets in the region gave us a number of insights. Our findings confirm that price is a key determinant in broadband penetration (and Djibouti on this count fares the worst). Countries in the region would benefit from the same proven policy approach built around market competition which allowed more developed economies to pursue broadband Internet expansion. At the same time, we found that, unlike other regions, MENA has a unique and historic opportunity to leverage dynamic demographics, widespread underused fiber optic networks owned by utility companies, and inter-regional connectivity. I’ll expand briefly on these three opportunities which, combined with policy and regulatory reform, could set the region on a faster and more affordable course toward internet expansion.

First, demographics. The urbanization level in MENA is quite high at roughly 63 percent of the population (urbanization in the Maghreb and Iran is similar to the regional average, whereas in most other countries of the region the urbanization rate is 80 percent or higher) and its population is primarily young (about 50 percent of the population is under 24 and only 6 to 7 percent are above 65 years old). So far, the demand for internet access generated by young urbanites has been mostly addressed through the use of xDSL in the limited footprint of the traditional copper telephony network and through fragmented 3G coverage, particularly in North Africa (about 96 percent of all fixed broadband connections were xDSL as of December 2012). Fiber optic and 4G penetration (if present at all) is marginal in most of the countries: Fiber to the Home / Building is widespread only in the Kingdom of Bahrain and in the United Arab Emirates.

According to our rough estimates (based on 10 Mbps for 100% of population and 30 Mbps for 50% of population, using a combination of FTTC and LTE technologies), it will take from EUR 20 to 25 billion for MENA to take a giant leap toward widespread high speed broadband Internet access infrastructure. (This amount represents the majority of all the investments needed to complete the needed backbones, backhaul and international connectivity.) Much of this investment can be coupled with real estate development, and demand for better homes. Indeed, real-estate developers and telecommunications operators can share different elements of the active and passive infrastructure, network operations, and services and thus expand the frontiers of commercial viability of the fiber optic infrastructure. This innovative public-private partnership approach could work particularly well in a region where dynamic demographics (e.g. very young population, its high growth rates, declining household size, etc.) are contributing to rapidly growing housing needs over the next 25 years.

A coordinated approach to civil works could also bring better broadband connectivity in the region, and result in major business opportunities, capable of creating jobs in infrastructure while enabling growth and employment in value-added, knowledge-intensive activities. MENA is a booming region in terms of the scope of construction works both in terms of the real estate discussed above and deployment (modernization) of the utility infrastructure throughout the region. Nonetheless, when it comes to construction, there is only one country (Kingdom of Bahrain) out of 19 which has put in place a certain framework on how to systematically coordinate civil works, which, in itself, are quite an expensive endeavor (civil works represents about 80 percent of broadband network deployment costs). Although partnerships between utility companies and telecommunications operators could save substantial amounts of time and money, these partnerships are rare in MENA. We advocate for a review of the construction processes to save time and financial resources whenever infrastructure deployment involves a significant amount of civil works.

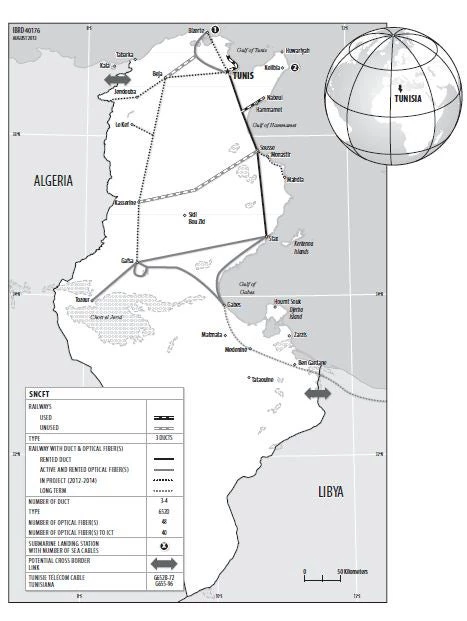

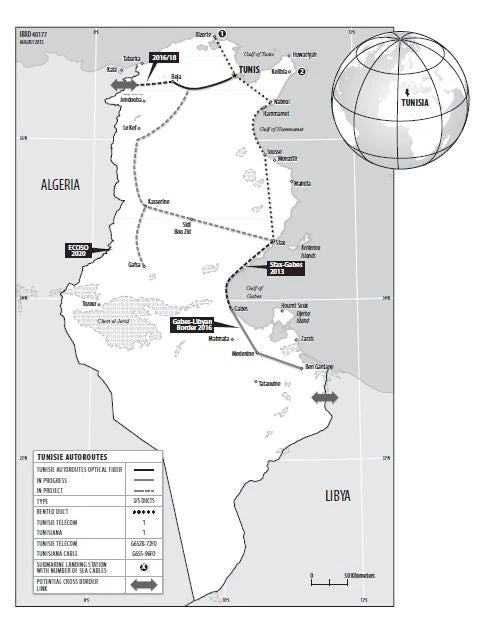

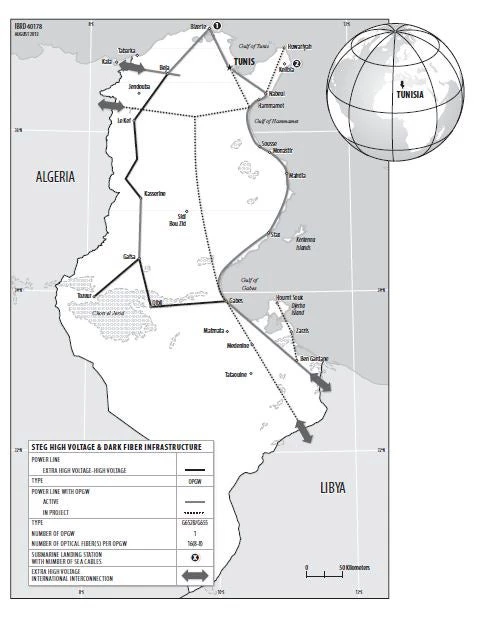

Underused fiber optic networks are another major opportunity highlighted by the study, which includes original research on the fiber infrastructure deployed by utility companies in charge of electricity, railway, and oil. While much can be achieved by commercializing the excess fiber capacity of these utility companies, our finding is that those opportunities have not yet been fully leveraged to extend national broadband Internet coverage and improve cross-border interconnectivity. A workable policy and regulatory framework that opens up this infrastructure for telecom operators (local, but also regional and international) is a prerequisite for this opportunity to materialize. The figure below provides as an example the existing fiber optic infrastructure in Tunisia which is both widespread and underutilized. At the moment of writing the report, out of three utility companies owning fiber optic and duct infrastructure across the country, one was not leasing excess capacity to telecom operators, one was open to the national incumbent operator only, and only one was open to all the players of telecom domain.

Lastly, there remains much that can be done to enhance cross-border connectivity. In terms of internet capacity coming to the borders and shores of each country, there is a significant gap of about 40-50 Terra-bits per second (Tbps) between the regional leaders, Saudi Arabia and Qatar, and the rest of the region. To reduce this gap, inter-regional connectivity will be critical to ensure further connectivity to international networks with ample capacity (i.e. submarine cables connecting Asia to Europe). Policy measures for open access to this cross-border connectivity will also help in speeding up network expansion and reducing the price of service. Currently, there are significant gaps in North Africa where there is no infrastructure that connects it to the Mashreq region. New networks through the Sahel – through Libya, Chad and Sudan – could increase connectivity to the submarine cables running along the East African coast.

What do you think of these opportunities? Hopefully our report will stimulate a discussion around innovative approaches to accelerate the roll out of high speed internet in MENA. The findings will be presented on February 26 to an influential audience of telecommunications professionals and policymakers at the GSMA Mobile World Congress in Barcelona. Please read the report and give us your ideas and comments!

Click to enlarge maps

Join the Conversation