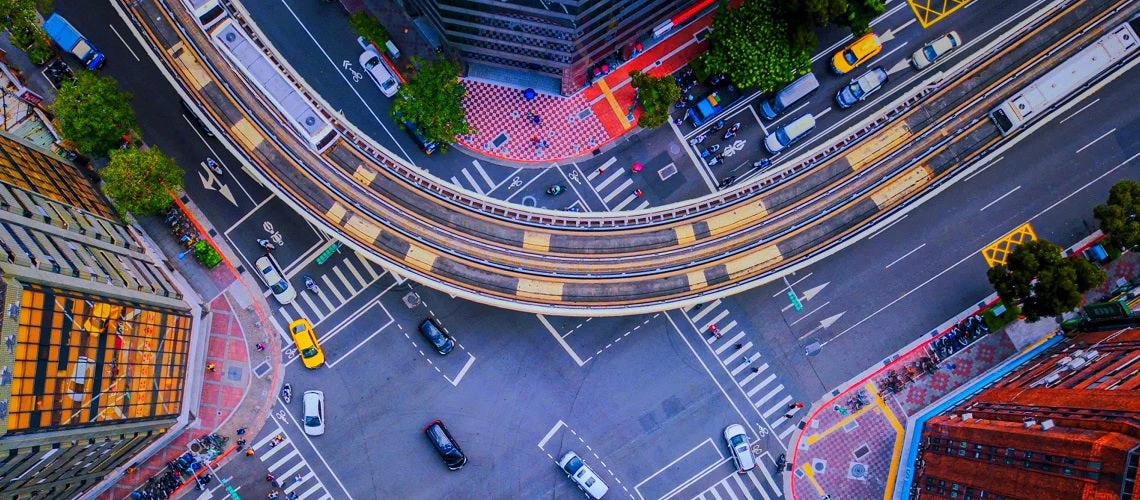

Aerial view of Taipei Downtown, Taiwan

Aerial view of Taipei Downtown, Taiwan

Around the world, cities have paid a high price for the COVID-19 pandemic. Thousands of municipalities are facing increased pressures to provide essential services while simultaneously coping with dramatic revenue declines. The situation is particularly severe in emerging markets where resources are sparse.

Now, as governments and investors direct funds to recovery efforts, city officials find themselves at a crossroads. The recovery choices they make today will set urban agendas for years to come. A new IFC report, “Ctrl-Alt-Del: A Green Reboot for Emerging Markets” analyzes how cities can allocate their resources to ensure a cleaner living environment for their residents, create jobs, and lay the foundation for a robust local economy.

The “Green Reboot” report estimates that if cities in 21 emerging markets studied by IFC prioritize climate-smart growth in their recovery plans, they stand to gain as much as $7 trillion in investments and could create 144 million new jobs by 2030. This analysis is the first of its kind to reframe this tremendous challenge as an investment opportunity. IFC also found that climate-smart growth plans have the potential to prevent up to 1.5 billion tons of greenhouse gas emissions, paying environmental dividends for people and eco-systems worldwide.

"The 'Green Reboot' report estimates that if cities in 21 emerging markets studied by IFC prioritize climate-smart growth in their recovery plans, they stand to gain as much as $7 trillion in investments and could create 144 million new jobs by 2030."

Where can municipal actions have the greatest impact?

Building retrofits represent a $1.1 trillion investment opportunity and have the potential to create nearly 25 million new jobs. The challenge is vast, requiring portions of the current building stock to be retrofitted every year. However, retrofits present attractive returns: the 2020 Global Status Report for Buildings and Construction found that green building projects have one of the highest ratio of jobs created per dollar spent. In Brazil, the Green Building Council is helping seven municipalities retrofit over 200 public buildings with lighting and heating, ventilation and air conditioning (HVAC) retrofits, as well as on-site solar generation.

Investing in low-carbon municipal waste and water could lead to a $2 trillion investment opportunity and the creation of more than 23 million jobs. The pandemic has underscored the need for cities to manage operational risks such as supply chain disruptions. Green investment can be crowded in to lower the cost of financing, focusing on the current demand for working capital loans to ensure continuous operations. IFC is helping several cities with feasibility studies on solid waste management, treatment and disposal, including Bogota, Izmir, Medellin, and Buenos Aires.

Green urban transport is a $2.7 trillion investment opportunity and has the potential to create more than 53 million jobs in emerging markets. Cities should employ a three-pronged strategy in transportation planning. First, address the length and number of journeys within the city through smart planning. Second, support mass transit schemes with a focus on safe post-Covid reopening. Finally, improve both private and public sector vehicular fuel efficiency through regulatory changes. In Ukraine, the city of Mariupol is investing in modern, environmentally friendly buses that will triple passenger capacity.

"Green urban transport is a $2.7 trillion investment opportunity and has the potential to create more than 53 million jobs in emerging markets. Cities should employ a three-pronged strategy in transportation planning."

What will it take to implement green recovery?

In order to implement a green road to recovery, most cities can leverage municipal funds through private-sector engagement. This combined approach can be used to solve ongoing urban challenges such as water and air pollution, traffic congestion, energy availability, and emergency preparedness.

Cities can implement four levers of action in their recoveries: 1) smart, long-term urban planning; 2) public-private partnerships; 3) policy incentives designed to crowd in private investment; and 4) green financial instruments, where regulators allow. The latter will have a catalytic role: municipal bonds can be issued as green bonds, pitched to investors with environmental commitments and leading to better financing terms. New bond products focused on resilience, sustainability, and climate transition are already attracting investors’ attention.

There are also promising sector-specific digital solutions, such as e-government payment systems, which allow municipalities to provide swift and efficient services to their citizens. Taken together, these tools allow cities to provide, for example, faster and safer mobility for their residents and create livable, environmentally sustainable urban environments.

IFC is helping cities structure green interventions, bringing together stakeholders, and creating the enabling environment needed to crowd in private sector finance. IFC’s tools like the new Advanced Practices for Environmental Excellence in Cities (APEX) app can help cities pinpoint projects suitable for green financing, develop strategies, and track performance.

Rebuilding resilient urban infrastructure in the wake of the COVID-19 is an enormous challenge. By prioritizing environmental sustainability, cities around the world can ensure that the benefits of a green rebuild are enjoyed by future generations.

Join the Conversation