Aerial shot of Dehli metro station with solar panels installed

Aerial shot of Dehli metro station with solar panels installed

In 2023, India experienced the hottest February since 1901, the first year the country’s Meteorological Department started its weather records. Extreme weather events like this are becoming frequent and are expected to get worse due to climate change. India is among the countries most affected by the impacts of extreme weather events.

As the world’s most populous country, with nearly 1.4 billion inhabitants, the carbon intensity of India’s economy has a direct impact on global emissions, and thus, on climate change. In 2021, India’s greenhouse gas emissions (GHG) amounted to some 3.9 billion carbon dioxide (CO2)-equivalent tonnes, making it the world’s third largest emitter, behind China and the United States, although GHG emissions per capita were only 2.8 CO2-equivalent tonnes, compared to a world average of 6.9 and 17.5 in the United States.

India’s longstanding commitment to the environment

The protection and improvement of the environment, as well as the safeguarding of forests and wildlife, are embedded in the country’s Constitution. In 2008, the Government of India launched its National Action Plan on Climate Change, with eight national missions that aim to reduce the economy’s emission intensity, improve energy efficiency, increase forest cover, and develop sustainable habitats. The climate policy is coupled with other policy goals, such as energy access and water security.

India’s 2030 climate targets submitted under the Paris Agreement include reducing its economy’s emission intensity by 45% compared to 2005 and increasing the share of non-fossil fuel-based energy resources to half of the installed capacity. To finance these and other commitments, the country needs around $170 billion per year in investments. However, with an average of $44 billion per year, estimated climate finance flows have fallen short.

During the 27th United Nations Conference of Parties (COP) in Egypt last November, India highlighted the need to scale up financial flows to emerging countries to strengthen their efforts to address and adapt to climate change. Immediately following the COP, the Government of India took important steps to mobilize private sector capital for its own needs.

A giant leap into sustainable finance

On February 1st, 2022, Union Minister for Finance and Corporate Affairs, Ms. Nirmala Sitharaman announced the Government of India’s plan to issue sovereign green bonds to mobilize resources for green infrastructure. The proceeds will be deployed in public sector projects that contribute towards reducing the carbon intensity of the economy. On January 25, 2023, India issued the first tranche of its first sovereign green bond worth INR 80 billion (equivalent to $980 million). On February 9, 2023, the Government of India announced the issuance of another INR 80 billion ($968 million) in sovereign green bonds.

"On January 25, 2023, India issued the first tranche of its first sovereign green bond worth INR 80 billion (equivalent to $980 million)."

Supporting renewable energy, energy efficiency and pollution control

The sovereign green bonds showcase India’s commitment to expanding renewable energy production and reducing its carbon intensity by supporting expenditures for renewable energy and electrification of transport systems. Investments in these sectors are particularly important as they represented around 41% of India’s GHG emissions in 2019 and are expected to account for two-thirds of emissions by 2050 as the economy continues to grow. Green bond proceeds allocated to renewable energy will support the rollout of well-proven renewable energy technologies (solar power, followed by wind and small hydro), as well as research and development of new technologies, such as tidal energy. This is very important to support India’s energy transition journey, as currently coal is the country’s main source of energy, accounting for 55% of the energy needs.

Other project categories eligible to receive funding from the sovereign green bond include renewable energy, sustainable water and waste management, energy efficiency, green buildings, climate change adaptation, sustainable management of living natural resources and land use, and terrestrial and aquatic biodiversity conservation. Bond proceeds will not be used to finance expenditures that involve extraction, production, and distribution of fossil fuels or where the core energy source is fossil-fuel based.

"The sovereign green bonds showcase India’s commitment to expanding renewable energy production and reducing its carbon intensity by supporting expenditures for renewable energy and electrification of transport systems."

Partnership with the World Bank

The World Bank’s Sustainable Finance and ESG Advisory Services provided technical assistance to the Government of India to establish the sovereign green bond program. This work is part of the World Bank’s efforts to leverage its expertise to help emerging markets mobilize private capital to meet large financing gaps for sustainable development. The World Bank Group is working with India to maximize finance for climate transition and green growth. The Rewa Ultra Mega Solar Power Project in Madhya Pradesh, one of the world’s largest solar power plants, for instance, combines a World Bank loan for infrastructure, IFC funding to mobilize local currency investments and advisory services to establish public-private partnerships and attract private capital.

India leads Asian emerging markets (excluding China) in green bond issuance

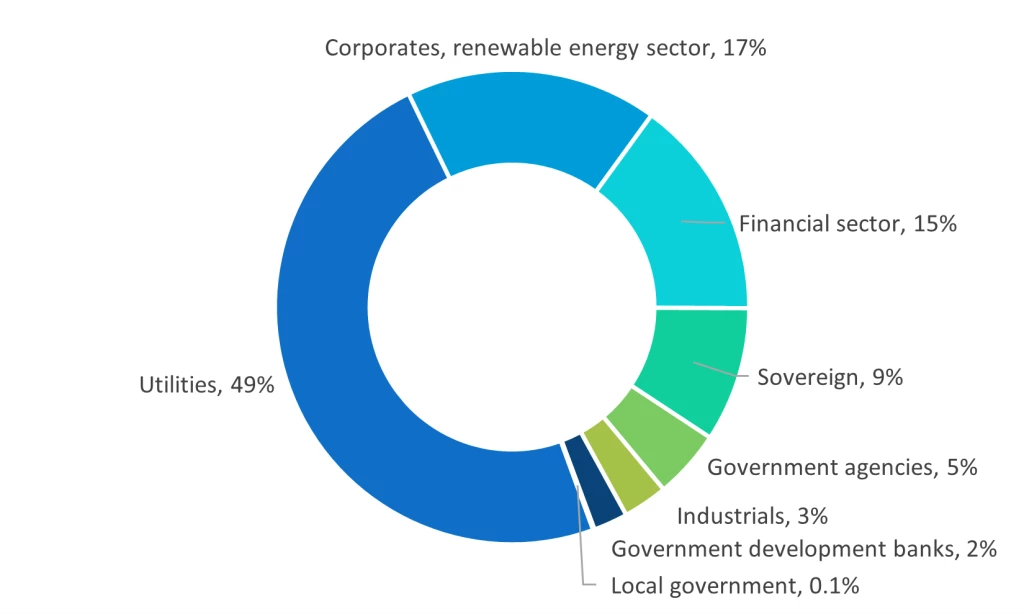

Financial institutions and government agencies have used the instrument since 2015. Indian green bond issuances have reached a total of $21 billion as of February 2023. The private sector was responsible for 84% of the total (see Figure 1).

The largest green bond issuer in India Greenko Group is funding hydro, solar, and wind power projects in several Indian states with its green bond proceeds. Ghaziabad Nagar Nigam, a civic body in Uttar Pradesh, is the first Indian local government to have issued a green bond (USD eq 20 million in 2021). Indore Municipal Corporation issued USD 87 million in green bonds in 2023.

Indian issuers have issued a greater amount of green bonds ($21 billion) than other emerging markets in Asia, excluding China. With the foray of the Government of India into the green bond market, we can look forward to more investments in green and climate-friendly projects and activities that will contribute towards India’s transition towards green, resilient, and inclusive development.

RELATED:

Climate Stories: From India to Indonesia, Green Bonds Help Countries Move Toward Sustainability

Video: How the World Bank Facilitates the Issuance of Green Bonds

Join the Conversation