Maasai women make, sell and display their bead work in Kajiado, Kenya. | © Georgina Goodwin/World Bank

Maasai women make, sell and display their bead work in Kajiado, Kenya. | © Georgina Goodwin/World Bank

Informal business is widespread in the developing world, accounting for over 70 percent of employment in a typical developing country (Loayza 2018). However, informal businesses have worse management and accounting practices, lower productivity, and fewer employees than their formal sector counterparts (Amin and Okou 2020, Aberra et al. 2022), resulting in a considerable share of businesses not fully benefiting from appropriate technologies, efficient production methods, and access to essential public services (Loayza 2018).

Researchers have looked at factors driving informality from economic and institutional perspectives and their work points out that informality is a symptom of underdevelopment and bad governance (Schneider and Enste 2000, Loayza 2016). So how do informal businesses explain their own choices? The World Bank’s new Informal Sector Enterprise Surveys shine a light on this question.

Voices of Informal Businesses

Between 2017 and 2022, the World Bank Enterprise Surveys team conducted over 15,000 detailed interviews of representative samples of informal businesses in 24 cities across 7 countries. The surveys found that burdensome regulations and an absence of benefits were preventing informal businesses from formalizing. Forty-two percent of firms responded that three or more obstacles concurrently prevented their formalization. Fifty-one percent of informal businesses identified taxes, 47 percent identified the time and cost to register, and 56 percent stated “no benefit to being registered” as a reason for informality (figure 1).

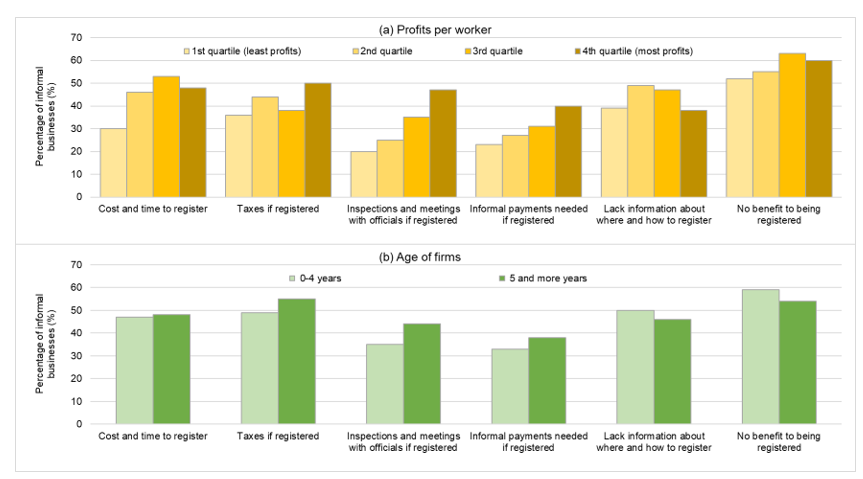

Barriers to formalization vary considerably across countries. For example, 70 percent of respondents in Zimbabwe identified time and cost to register as a barrier to formalization, 22 percentage points higher than the countries with the next highest percentage. There is also considerable variation in the reasons for not registering between more and less profitable informal businesses (figure 2.a), and between older and younger ones (figure 2.b). Overall, taxes, inspections and meetings with officials, and bribery were larger obstacles for more profitable and older businesses, whereas younger businesses considered the information gap a greater obstacle to formalization than their older counterparts by 4 percentage points (50 versus 46 percent). As businesses grow and pass “the test of time,” they tend to be more regulated and attract more attention from corrupt officials. This explains, in part, why the median informal sector business employs only two workers including the owner or manager (Aberra et al. 2022).

Figure 1. Businesses Have Multiple Business Environment and Governance Concerns for Not Formally Registering

Source: World Bank Informal Sector Enterprise Surveys.

Note: Data for India combine responses to two questions referencing GST or PAN registrations. Country level results are the simple average of the cities surveyed. Estimates at the city level are calculated using sampling weights.

Figure 2. Obstacles to Formalization Vary by Business Profitability and Size

Source: World Bank Informal Sector Enterprise Surveys.

Note: For profits per worker, data are not available for India and Zimbabwe.

Informality and the Business Environment

The voices from informal businesses echo a body of research that informality stems from excessive regulation and an inefficient state (De Soto 1989). Costly entry regulations impede the creation of formal businesses and force new entrants to be larger (Klapper et al. 2006), while burdensome regulations, particularly in product and labor markets, induces informality and reduces growth (Loayza et al. 2005). In low- and medium-income countries, higher corporate income tax rates are also associated with informality (Cisneros-Acevedo and Ruggieri 2022). And bureaucratic corruption is associated with hiding business output (Johnson et al. 2000). Cross-country data support that informality is higher in countries where regulations are onerous (figure 3.a) and corruption is prevalent (figure 3.b). The business environment is particularly important as firms grow because excessive regulations prevent them from expanding (see, for example, Almeida and Carneiro 2009).

Moreover, informal businesses use public infrastructure and services but do not contribute to the taxes needed to pay for them. In turn, the unavailability of infrastructure and services is associated with more informality (Ingram et al. 2007), forming a vicious circle. Worse still, informal workers are less likely to invest in their children’s education, increasing their children’s chances to be trapped in the informal sector (IDB 2008).

Figure 3. Informality Is More Prevalent with Burdensome Regulations and Widespread Corruption

Source: World Bank Informal Economy Database; World Bank Doing Business; World Bank World Governance Indicators.

Note: The relationships are significant at the 5 percent level, controlling for GNI per capita. Data refer to the simple average of 57 countries available between 2015 and 2019.

A Cry for Change

“When people talk, listen completely.” – Ernest Hemingway

The World Bank’s new corporate flagship, Business Ready, is one stride in this direction. It aims to generate economy-specific and detailed knowledge on key regulatory areas that incentivize businesses to formalize and workers to be formally employed in up to 180 economies. Its sister project, Subnational Business Ready, adapts the Business Ready approach to a subnational context and measures businesses environment differences across locations within a country. These projects will establish valuable development data that inspire peer learning and reforms that foster long-term inclusive growth.

We thank Norman Loayza, David Francis, Gemechu Ayana Aga, and Nona Karalashvili for insightful comments.

Click to find out more about the Informal Sector Enterprise Surveys, which answer a wide array of policy questions beyond those discussed in this blog. The team also recently released data for the Central African Republic. Fieldwork is currently underway in Indonesia and Tanzania and will soon begin in Cambodia.

Join the Conversation