The categorisation of countries into relevant international benchmark indices affects the allocation of capital across borders. The reallocation of countries from one index to another affects not only capital flows into and out of that country, but also the countries it shares indices with. This column explains the channels through which international equity and bond market indices affect asset allocations, capital flows, and asset prices across countries. An understanding of these channels is important in preventing a widening share of capital flows being impacted by benchmark effects.

This post was originally published on www.voxeu.org. Read the original post here.

In a context where investors hold increasingly globalised portfolios, the issue of which countries (and which securities) belong to relevant international benchmark indices has generated significant attention in the financial world (Financial Times, 2015). The reason is that how countries are grouped has implications for the allocation of capital across borders.

As institutional investors become more passive, they follow benchmark indices more closely. These indices change over time. One reason is that index providers reclassify countries, adding or removing them from certain groups. For instance, when they upgrade a country from frontier to emerging market, the investment funds that target these countries and follow their corresponding indices have to change their portfolios accordingly. These changes can result in large capital reallocations given the $37 trillion invested in worldwide open-end funds (ICI 2016) and that most funds follow a few well-known stock and bond market indices. The resulting reallocations can produce unexpected effects in international capital flows, explained by how financial markets work and not necessarily by economic fundamentals.

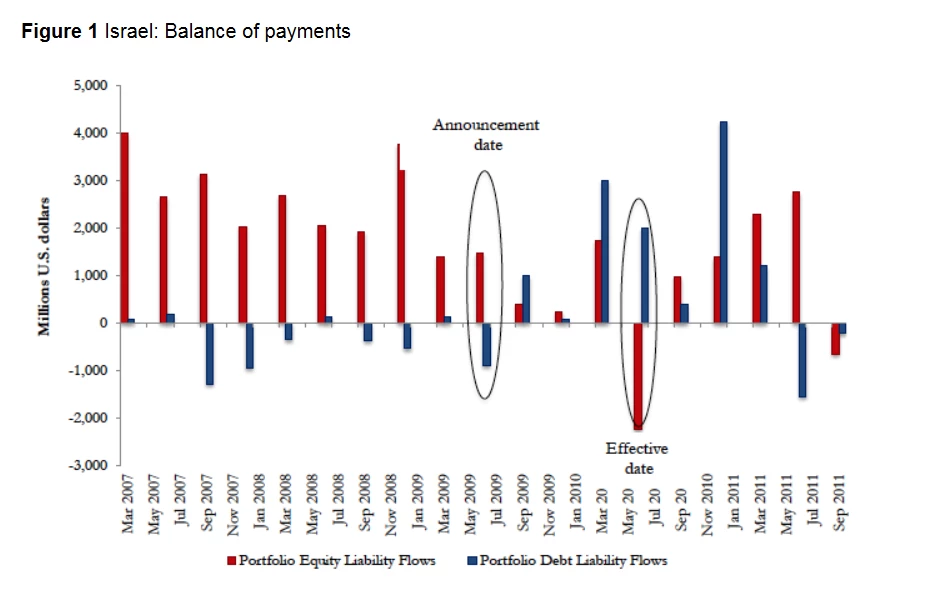

A clear example of these counterintuitive reallocations occurred when the MCSI announced in 2009 that it would upgrade Israel from emerging to developed market status, moving it from the MSCI Emerging Markets (EM) Index to the World Index. When the upgrade became effective in May 2010, Israel faced equity capital outflows of around $2 billion despite its improved status (Figure 1). This occurred because Israel became a smaller fish in a bigger pond. Israel’s weight in the MSCI EM Index decreased from 3.17 to 0, while it increased from 0 to 0.37 in the MSCI World Index. Israeli stocks in the MSCI index fell almost 4% during the week of the announcement and significantly underperformed against the stocks not included in the index. The week, prior to the effective date (when index funds rebalanced their portfolio), there was a 4.2% drop in the MSCI Israel Index, versus a 1.5% fall in the Israeli stocks outside the index.

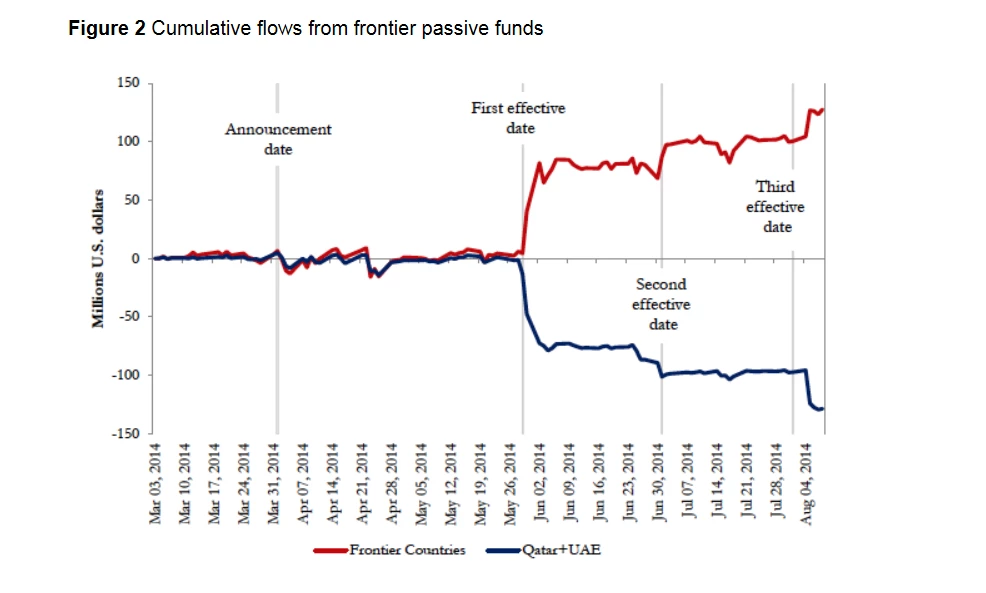

The effects of index reclassifications go beyond the countries and asset classes being specifically targeted. The upgrade in June 2013 of Qatar and the United Arab Emirates (UAE) from the MSCI Frontier Markets (FM) Index to the MSCI EM Index is a clear example of how countries sharing an index can be affected. These two countries accounted for around 40% of the MSCI FM Index when the upgrade became effective in May 2014. Thus, funds tracking closely the MSCI FM Index had to significantly increase their loading in the other frontier countries sharing the index, resulting in significant inflows and stock market price increases in countries such as Nigeria, Kuwait, and Pakistan (Figure 2).

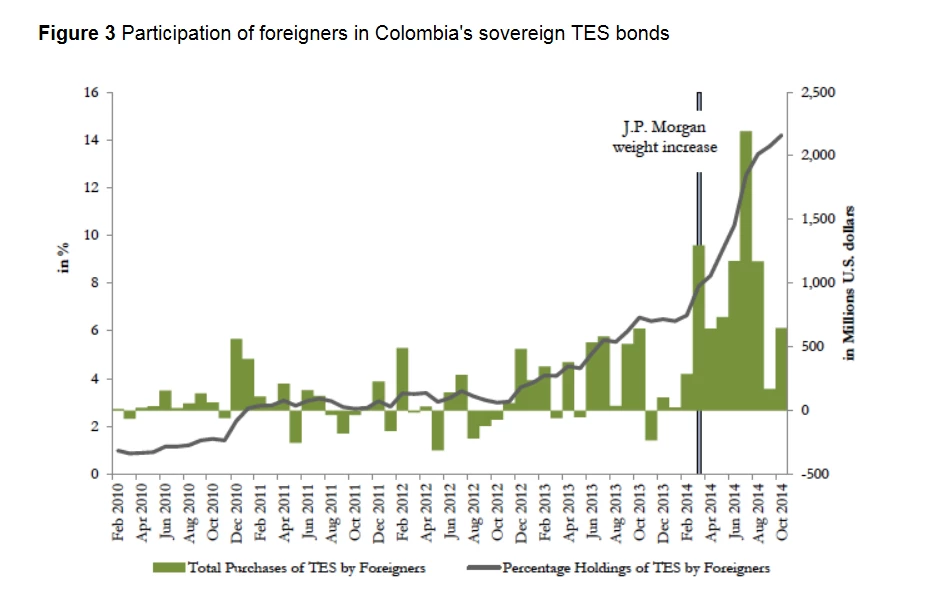

Upgrades in indices can also affect the overall economy. For instance, in March 2014 five local currency bonds from Colombia were included in J.P. Morgan’s flagship local currency bond index. As a consequence, there were large sovereign debt capital inflows by foreign investors (Figure 3), accounting for 10% of the total outstanding debt. This event led to a sharp appreciation of the Colombian peso and, subsequently, protests were held by local producers (Wall Street Journal 2014). It also impacted the overall economy through the banks. As foreigners started buying sovereign bonds, some local banks sold part of their allocation in these bonds and used the proceeds to increase credit to firms (Williams, 2016).

These movements in financial markets have led to speculations and market movements related to potential reclassifications. One recent and prominent example is that of China, when, on 14 June 2016, MSCI delayed introducing its A-shares as a part of the MSCI Emerging Markets (EM) Index for a second time. The upgrade would have implied a jump in China’s weight in the index from 26 to 40% (MSCI 2016). If all funds tracking the MSCI EM Index ($1.4 trillion) were to reallocate their funds, a back-of-the-envelope calculation suggests that inflows into Chinese local equity markets would have increased by $196 billion. The 14% weight increase could have also led to a decrease in the weight of other countries in the MSCI EM Index and significant capital outflows for them.

Even Brexit could affect indices and capital flows within Europe (MSCI 2016). If the UK ceases to be part of the EU, it will likely be removed from the MSCI regional indices that track the EU. This would generate reallocations out of the UK and into the other countries following these indices, by the investors that track them.

The effects of benchmark indices on capital flows are not just the consequence of reallocations. Other effects include how mutual funds invest in and out of countries as they receive injections/redemptions of funds from their underlying investors. Investment funds tend to allocate inflows proportionally to the weight each country has in the index. Thus, larger weights imply both larger inflows during injections and larger outflows during redemptions. These weights vary by how countries perform relative to other countries in the index, not in absolute terms or relative to any other country.

In a recent study, we systematically document the different benchmark effects, showing the various channels through which prominent international equity and bond market indices affect asset allocations, capital flows, and asset prices across countries (Raddatz et al. 2015). Benchmarks have statistically and economically significant effects on the allocations and capital flows of mutual funds across countries. For example, a 1% increase in a country’s benchmark weight results, on average, in a 0.7% increase in the weight of that country for the typical mutual fund that follows that benchmark, including active funds that declare that benchmark only as a strategic reference. These benchmark effects on the mutual fund portfolios are relevant even after controlling for time-varying industry allocations and country-specific or fundamental factors. Exogenous events that modify benchmark indices affect benchmark weights and funds’ asset allocations. Furthermore, asset prices move both during the announcement and effective dates of the benchmark changes in response to the expected and effective capital movements.

Academics, financial institutions, and policymakers have already started paying attention to the potential effects of benchmarks on capital flows and asset prices, as well as on herding, momentum, and risk taking (BIS 2014, Arslanalp and Tsuda 2015, IMF 2015, Shek et al. 2015, Vayanos and Woolley 2016). Indeed, the Financial Stability Board recently released a consultative document laying out policy measures to address structural vulnerabilities arising from asset management activities, that recognises the widespread use of benchmarks and the price spirals described in this column as a relevant risk to financial stability (FSB 2016). But more work in this area would be welcome as passive investing continues expanding and affecting a larger share of capital flows across countries.

Join the Conversation