Una mujer nigeriana en un quiosco de servicios entrega dinero a un cliente

Una mujer nigeriana en un quiosco de servicios entrega dinero a un cliente

In 2020, as communities across the globe struggled to contain the spread of COVID-19 and manage the health and human costs of the pandemic, governments initiated large and unprecedented emergency support measures to mitigate the worst immediate impacts of the pandemic. These measures included lockdowns that closed businesses, fiscal stimulus packages that included direct cash support for households and firms, monetary policies that reduced interest rates and eased lending conditions for financial institutions, and financial sector policies such as debt repayment moratoria for households and firms, as well as credit guarantee schemes. These crisis policies have helped limit the worst economic outcomes of the pandemic in the short run. However, they also revealed and worsened a number of economic fragilities that could threaten a sustainable and equitable economic recovery. This is a real concern considering that the economic effects of the pandemic are proving to be more persistent and severe for low- and middle-income countries.

Our new 2022 World Development Report: Finance for an Equitable Recovery examines the central role finance plays in the economic recovery from the pandemic, so that everyone, including vulnerable groups such as poor adults, women, and small businesses, are able to recover.

An encompassing view of pandemic-related economic risks

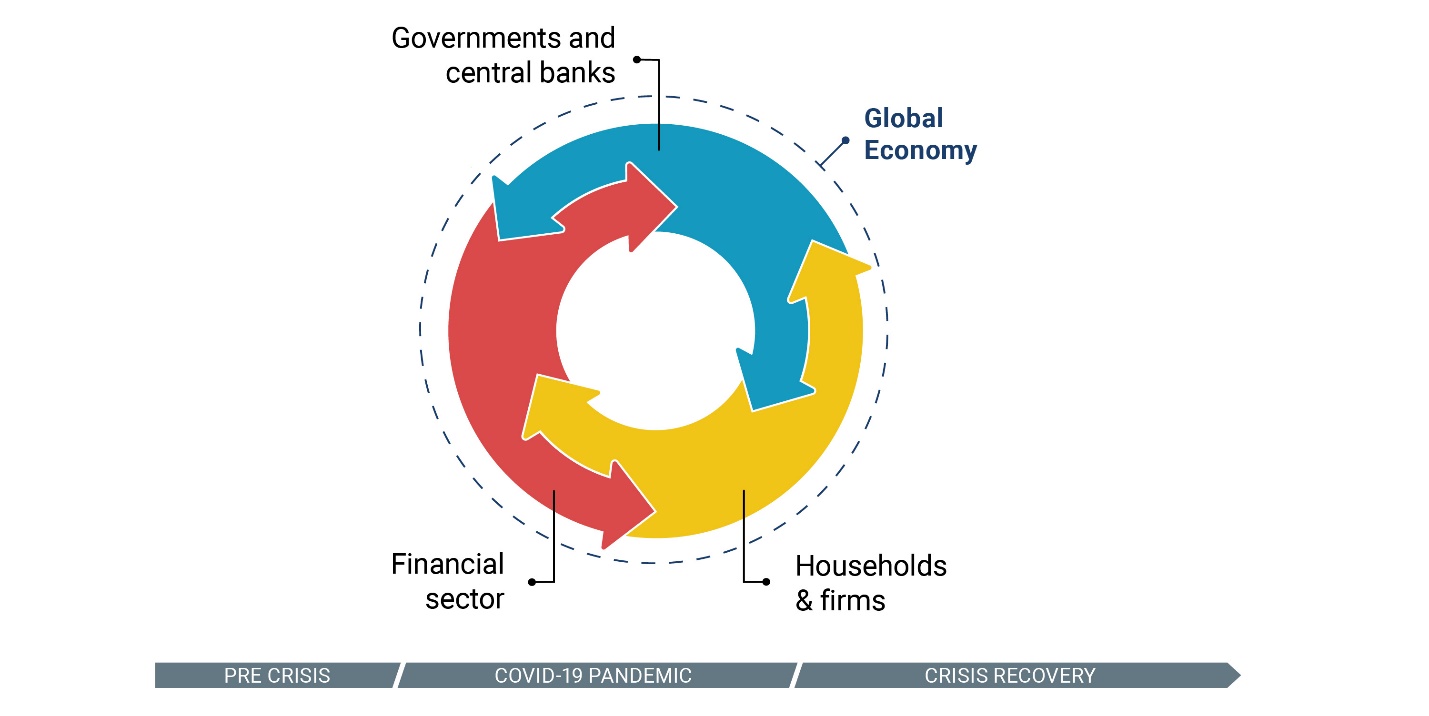

Although households and businesses have been most directly affected, the consequences of the COVID-19 crisis have repercussions for the entire economy through numerous mutually reinforcing channels that connect the financial health of households and firms, financial institutions, and governments. Because of these interconnections, elevated financial risks in one sector can easily spill over and destabilize the wider economy, if left unchecked. When households and firms undergo financial stress the financial sector faces a higher risk of loan defaults and is less able to provide credit. Similarly, when the financial position of the public sector deteriorates—for example, as a result of higher debt and debt service—its ability to support households and firms may weaken. This relationship is not predetermined. Well-designed fiscal, monetary, and financial sector policies can counteract and reduce these intertwined risks, and they can help transform the links between sectors of the economy from a vicious “doom loop” into a virtuous cycle.

Managing and reducing interconnected financial risks to households, businesses, banks, and governments is key to economic recovery in developing countries

Resolving financial risks though effective policies for an equitable recovery

This World Development Report focuses on solutions for four key areas of risk: weakened bank balance sheets, delayed redeployment of productive assets caught up in failing firms, challenges for lenders to identify sound borrowers during a period of economic disruption, and rising sovereign debt. In an ideal situation, governments would implement relevant policies in parallel in each of the four areas. However, since few, if any governments have the resources and political leeway to tackle everything at once, countries will have to prioritize the most important policy actions needed.

Policy Area 1: Managing and reducing loan distress

Governments and financial institutions could mitigate this risk by emphasizing transparency, management of distressed loans, and proactive interventions for distressed banks. The debt moratoria, loan forbearance, and relaxed reporting rules implemented to relieve pressure on borrowers and lenders during the pandemic have created a lack of transparency about the health of bank balance sheets, particularly in the recognition of non-performing loans (NPLs), which affect the financial sector’s capacity to lend.

Policy Area 2: Improving the legal insolvency framework

Effective bankruptcy systems, stressing out-of-court workouts, including simplified and quicker frameworks for small businesses, can help avoid the risk of long-term and unresolvable debt distress. Creditors currently cannot rely on traditional credit risk analysis to assess whether borrowers in distress are facing short-term illiquidity or long-term insolvency. Borrowers furthermore cannot declare themselves insolvent in countries with nonexistent or limited insolvency mechanisms.

Policy Area 3: Ensuring continued access to finance

Innovations in digital financial tools and lending models, including alternative sources of data, product design, and lending context, can help keep credit flowing in regulatory environments that both support it and put in place mechanisms to ensure consumer and market protections. The ongoing impact of the crisis on business performance and household incomes could inhibit lending because of increased credit risk, reduced visibility into borrower viability, and diminished ability to realize value from collateral.

Policy Area 4: Managing higher levels of government debt

Countries with debts they are unable to service risk a protracted recession. Preventing that requires active debt management through reprofiling or restructuring debt, and longer-term reforms for debt transparency and tax policy. Many governments borrowed to pay for the massive economic support programs, leading to a roughly nine percentage point increase in total debt burdens among low- and middle-income countries.

Conclusion: crafting policy priorities for equitable recovery

Countries will need to consider their specific mix of internal and external risk exposure when crafting their precise policy priorities to reach an equitable recovery. For many low-income countries, tackling unsustainable government debt will be the first priority. Middle-income countries, whose financial sectors are more exposed to corporate and household debt may need to focus on policies supporting financial stability.

Finally, while the 2022 World Development Report concentrates on the key domestic financial and economic risks produced by the pandemic, a country’s recovery prospects will also be shaped by events in the global economy. For example, exchange rate and interest rate risks, which could emerge as economic activity in advanced economies recovers and stimulus programs are withdrawn, resulting in central banks tightening global liquidity and raising interest rates.

Addressing the financial risks that have arisen during the pandemic is important to ensure that governments and financial institutions can support the recovery, including through investments in services such as health care and education. It is also critical that households and firms do not lose access to financial services that underpin restored economic growth and resilience to economic shocks. Success in addressing risks will help limit the damage to development outcomes and maintain momentum for “greening” the world economy to combat the climate crisis.

Join the Conversation