Panumas Yanuthai/ Shutterstock.com

Panumas Yanuthai/ Shutterstock.com

This blog is a biweekly feature highlighting recent working papers from around the World Bank Group that were published in the World Bank’s Policy Research Working Paper Series. This entry introduces seven papers published from October 1 to October 15 on various topics, including COVID-19, immigration, capital flows and others. Here are the highlights of select findings.

First, we present three papers that address topics related to the COVID-19 pandemic. In Measuring the Economic Impact of COVID-19 with Real-Time Electricity Indicators, Maria Vagliasindi examines the short-run economic impact of the pandemic itself using the dependent variable electricity consumption per capita as a proxy measure of economic activity in the short run. The paper COVID-19 Age-Mortality Curves for 2020 Are Flatter in Developing Countries Using Both Official Death Counts and Excess Deaths by Damien De Walque and coauthors takes a look at official COVID-19 death counts for 64 countries and excess death estimates for 41 countries. In A Mountain of Debt: Navigating the Legacy of the Pandemic, Ayhan Kose and coauthors examine how the COVID-19 pandemic has triggered a massive increase in global debt levels and exacerbated the trade-offs between the benefits and costs of accumulating government debt.

- Measuring the Economic Impact of COVID-19 with Real-Time Electricity Indicators shows the significant cost of lockdown measures in terms of reduction in economic activity but finds that the spread of the disease itself had an economic impact distinct from that of the lockdown measures. The analysis also shows that the use of expansionary fiscal and monetary policies also played a key role in mitigating such an impact, driving some initial recovery.

- COVID-19 Age-Mortality Curves for 2020 Are Flatter in Developing Countries Using Both Official Death Counts and Excess Deaths finds that a higher share of pandemic-related deaths in 2020 were at younger ages in middle-income countries compared to high-income countries. Figure 1 below shows how the slope of the age-mortality gradient for each country varies with its level of income. There is a positive association between income per capita and the age-mortality gradient, indicating that COVID-19 mortality increases more steeply for older age groups in richer countries.

Figure 1

- A Mountain of Debt: Navigating the Legacy of the Pandemic shows that both global government and private debt levels rose to record highs, and at their fastest single-year pace, in five decades. The paper also finds that the debt-financed, massive fiscal support programs implemented during the pandemic supported activity and illustrated the benefits of accumulating debt. However, as the recovery gains traction, the balance of benefits and costs of debt accumulation could increasingly tilt toward costs. Finally, the coauthors demonstrate that more than two-thirds of emerging market and developing economies are currently in government debt booms.

The fourth and fifth paper we introduce delve into topics associated with trade and development. In Non-Tariff Measures, Import Competition, and Exports, Massimiliano Cali and Angella Faith Montfaucon examine the competition effect of four specific non-tariff measures on the exporting activity of the universe of Indonesian firms. In Corruption in Customs, Ana Margarida Fernandes and coauthors present a new methodology to detect corruption in customs and apply it to Madagascar’s main port.

- In Non-Tariff Measures, Import Competition, and Exports the focus of the paper is on non-tariff measures that do not clearly address any negative externalities of imports and hence appear to be protectionist in nature. The results suggest that by restricting import competition, these measures reduce the survival of firms in export markets as well as the intensive and extensive margins of their exports. Non-tariff measures have a more negative effect than import tariffs in most cases and these results are robust to various checks.

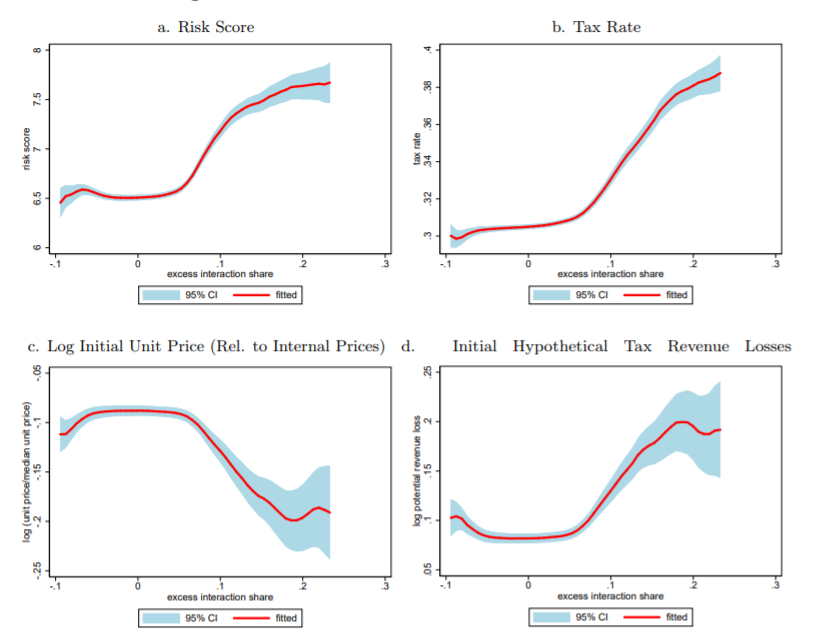

- Corruption in Customs introduces a novel approach to detect and quantify the prevalence and costs of a type of corruption scheme in customs and assesses the effectiveness of an intervention intended to eliminate such corruption. The approach identifies potential manipulation of inspector assignment by evaluating whether certain inspectors are paired excessively frequently with certain customs brokers, deviating from what conditional random assignment would predict. This methodology was applied to Madagascar’s main port, Toamasina and it unveiled that 10 percent of declarations were handled by inspectors that were not randomly assigned, plausibly because of manipulation of the IT system that assigns them. These customs inspectors are shown to provide preferential treatment to these deviant declarations by clearing them faster, being less likely to require value, weight, and tax adjustments, and failing to identify fraud. Overall tax revenues collected would have been 3 percent higher in the absence of the corruption scheme unveiled in this paper. An intervention to curb corruption by having a third party randomize inspector assignment validates the methodology used by the authors as it led to the temporary disappearance of excess interaction between inspectors and brokers. It also triggered a novel form of IT manipulation. The graphs under figure 2 show weighted local polynomial plots of a selected number of declaration characteristics capturing tax evasion risk on calibrated excess interaction shares for the period January 1, 2015 to November 17, 2017 (before the delegated randomization intervention). For more details on the graph and the calibration methods, please refer to the paper.

Figure 2 Tax Evasion Risk and Excess Interaction

Finally, we introduce the last two papers of this roundup that examine two very timely topics. In Economic and Fiscal Impacts of Venezuelan Refugees and Migrants in Brazil, Pablo A. Acosta and coauthors explore the short-run fiscal impact of Venezuelan refugees and migrants on the public expenditure and revenue of Roraima, the state bordering the República Bolivariana de Venezuela at the north and the main gateway of the Venezuelan refugees and migrants entering Brazil. In Decrypting New Age International Capital Flows, Carmen M. Reinhart and coauthors present a new methodology for examining off-chain transaction data that allows to probabilistically tag individual trades as “crypto vehicle transactions,” that are clearly distinguished from the use of Bitcoin as an investment vehicle.

- In Economic and Fiscal Impacts of Venezuelan Refugees and Migrants in Brazil, the coauthors, through the use of various administrative and survey data and a regression discontinuity framework, find that the population shock caused by the influx of forcibly displaced Venezuelans in the short-run did not have any statistically significant effect on the fiscal variables of Roraima. On the labor market, the paper finds that the population shock translated into an increase in unemployment among women and a decrease in employment among women and low skilled workers in the short-run.

- In Decrypting New Age International Capital Flows, results of the paper challenge the dominant view that Bitcoin is little used for transactions purposes (other than buying other cryptocurrencies), and that its value is almost entirely based on speculation. Exploiting extraordinarily rich and detailed public data on trades in 135 fiat currencies, the coauthors present the most systematic and detailed evidence to date on how crypto is used as a vehicle for international capital transfers, as well as for domestic transactions.

The following are other interesting papers published in the first half of October. Please make sure to read them as well.

- Commodity Price Shocks : Order within Chaos (Baffes,John,Kabundi,Alain Ntumba)

- Leveling Up : Impacts of Performance-Based Grants on Municipal Revenue Collection in Mozambique (Erman,Alvina Elisabeth,Solis Uehara,Carla Cristina,Beaudet,Chloé)

- Education Quality, Green Technology, and the Economic Impact of Carbon Pricing (Macdonald,Kevin Alan David,Patrinos,Harry Anthony)

- A Hard Rain's a-Gonna Fall : New Insights on Water Security and Fragility in the Sahel (Khan,Amjad Muhammad,Rodella,Aude-Sophie)

- Demand Analysis of Multiple Goods and Services in Vietnam (Vigani,Mauro,Dudu,Hasan)

- Fair Inheritance Taxation (Decerf,Benoit Marie A,Maniquet,François)

- Fiscal Policies for a Sustainable Recovery and a Green Transformation (Catalano,Michele,Forni,Lorenzo)

- Governance Drivers of Rural Water Sustainability : Collaboration in Frontline Service Delivery (Thapa,Dikshya,Farid,Muhammad Noor,Prevost,Christophe)

- Distributional Impacts of Taxes and Benefits in Post-Soviet Countries (Fuchs Tarlovsky,Alan,Matytsin,Mikhail,Nozaki,Natsuko Kiso,Popova,Daria)

- What Have We Learned about the Effectiveness of Infrastructure Investment as a Fiscal Stimulus A Literature Review (Vagliasindi,Maria,Gorgulu,Nisan)

- Social Contracts in Sub-Saharan Africa : Concepts and Measurements (Cloutier,Mathieu)

- Financial Incentives to Increase Utilization of Reproductive, Maternal, and Child Health Services in Low- and Middle-Income Countries : A Systematic Review and Meta-Analysis (Neelsen,Sven,De Walque,Damien B. C. M.,Friedman,Jed,Wagstaff, Adam)

- International Sourcing and Firm Learning : Evidence from Serbian Firms (Reasner,Mason Scott,Tan,Shawn Weiming)

- A Simple Method to Quantify the ex-ante Effects of “Deep” Trade Liberalization and “Hard” Trade Protection (Larch,Mario,Tan,Shawn Weiming,Yotov,Yoto Valentinov)

Join the Conversation