© Wangwukong/GettyImages

© Wangwukong/GettyImages

The Russian invasion of Ukraine threatens the uneven recovery of developing East Asia and Pacific (EAP) countries. The invasion comes on top of the economic distress caused by the lingering COVID-19 pandemic, the financial tightening in the United States, and the pandemic resurgence and the economic slowdown in China. While commodity producers and fiscally solid countries in the region may weather these shocks with less difficulty, these events will dampen the growth prospects of most economies in the region. Overall economic growth is projected to slow to 5 percent in 2022— 0.4 of a percentage point less than expected in October. If global conditions worsen and national policy responses are weak, growth could ease further.

[Download report: Braving the Storms: East Asia and Pacific Economic Update, April 2022]

The outlook for East Asia and the Pacific can be illustrated in the following charts:

1. Economic recovery had resumed in the final quarter of 2021

By end 2021, recovery appeared to be gaining traction, led by China. The rest of the region too posted strong growth in the fourth quarter of 2021, following a dip in the preceding three months due to the Delta COVID-19 variant . However, the recovery was uneven across the region, and output remained below pre-pandemic levels in many economies.

2. Three emerging shocks will dampen the recovery

Three international developments now threaten the recovery. Most serious is the war in Ukraine, which is leading to a spike in commodity prices, strains in financial markets, and loss of business confidence. This comes on top of a structural slowdown in China, exacerbated by growing COVID infections amid the country’s a zero-COVID policy and continuing difficulties in an over-leveraged real estate sector, and financial tightening in the United States as inflation accelerates. These emerging shocks will affect the region through trade and financial channels. How individual countries are affected will depend on their exposure and resilience to these shocks.

3. Fuel and food price spikes will hurt commodity importers

While most East Asia and Pacific countries are not directly exposed to Ukraine or Russia through trade or finance, they will feel the effects of global repercussions, most immediately and significantly because of the spike in fuel and food prices. While some (Indonesia, Malaysia) are less dependent on imported fuels, most other countries are net energy importers. Rice prices too are likely to increase -- rice and wheat are substitutes – as will the prices of fertilizers and energy, weighing even on rice exporters like Thailand and Vietnam.

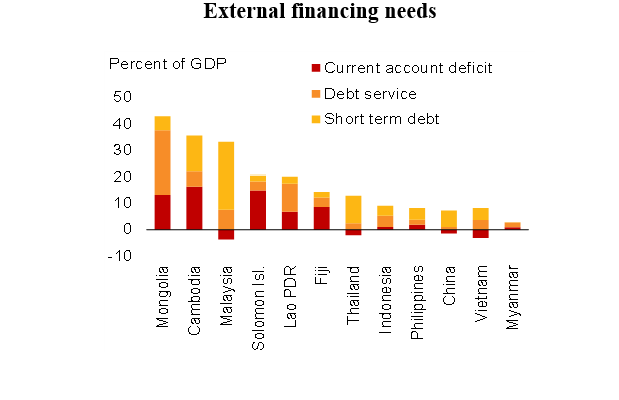

4. Interest rate hikes will pinch countries with large deficits or debt obligations

Tightening financial conditions will affect most countries that have large external financing needs, including those holding large external debt (Lao PDR, Mongolia), and countries that rely on short-term capital flows (Cambodia, Malaysia, Thailand).

5. Slowing global growth will weigh on exporters

As global growth slows, so will demand, weighing most on export-oriented economies (Cambodia, Malaysia, Thailand, Vietnam) for whom half or more of domestic value-added is destined for foreign markets. China now matches the United States in significance as a destination for exports of several countries in the region.

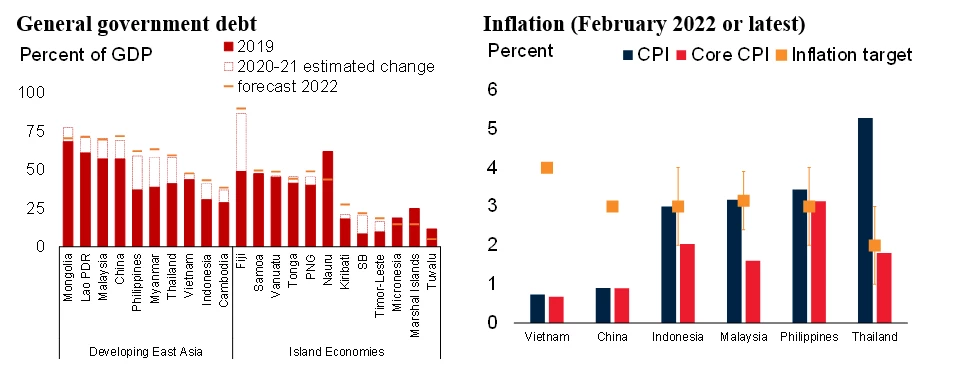

6. Government support capacity is constrained, and inflation further limits options

Government support capacity has been stretched thin by the pandemic. The scope for supportive fiscal policy in most countries is constrained by debt that has increased by 10 percentage points of GDP on average. While core inflation remains low, rising consumer prices combined with global financial tightening are beginning to limit options for supportive monetary policy in some countries.

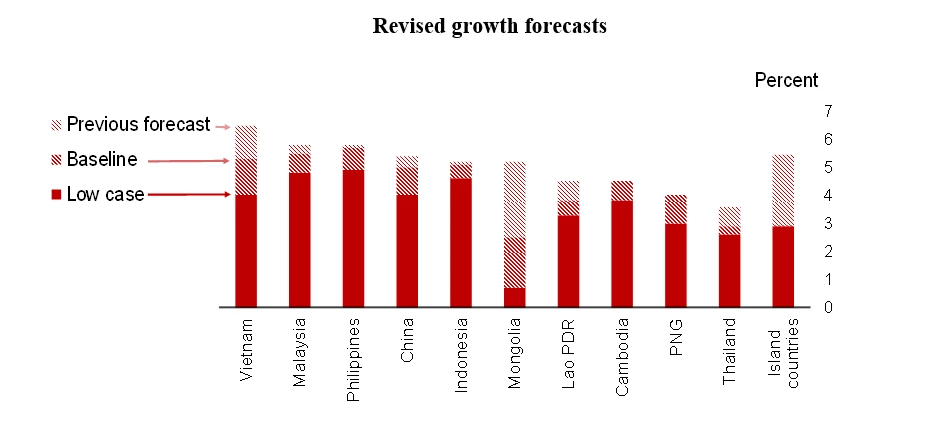

7. The upshot: growth projection downgrades

The triad of shocks and the limited capacity for government support, suggest an outlook that falls short of previous expectations. Projections for regional growth in 2022 have been reduced from 5.4 percent to 5 percent, and if global conditions worsen the national policy response is meager, growth could slow further to just 4 percent. Some larger and commodity-producing countries may be better positioned to weather these shocks, but the repercussions could be harsh for some other countries. Mongolia produces commodities, but its coal exports have been hit by COVID-related Chinese border controls, and its significant imports from and through Russia have been affected by the war and sanctions. The countries in the Pacific, who were struggling with recurrent natural disasters and the decline of tourism, must now confront their first COVID-19 infections, and big food and fuel import bills.

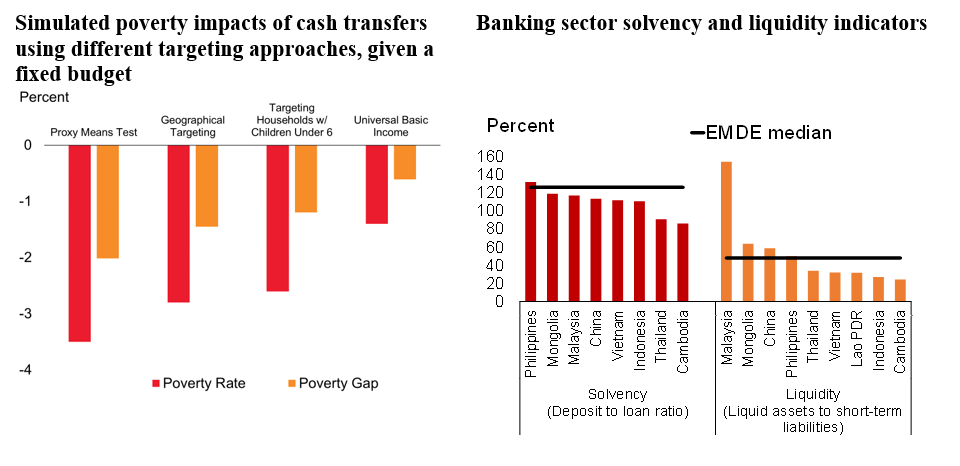

8. To brave the storms: target fiscal assistance, identify financial vulnerabilities

To mitigate risks, revive growth, and reduce poverty, first steps should include increasing the efficiency of fiscal policy and strengthening macroprudential policies. Targeted support to households, rather than unselective transfers and price regulations, would deliver gains while creating space for productivity-enhancing investments. While banks in most East Asia and Pacific countries are generally well-capitalized, identifying and addressing vulnerabilities that may have arisen during the pandemic could mitigate the risks from financial tightening.

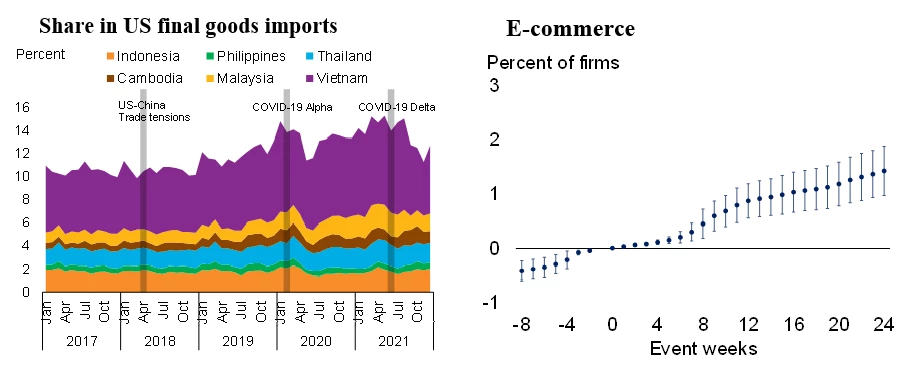

9. To regain momentum: seize new export opportunities, expand new technology use

Comprehensive trade-related reforms would enable more EAP countries to take advantage of shifts in the global and regional trade landscape, as Vietnam is doing. Improved access to skills and finance could help firms adopt productivity-enhancing technologies. Exposing firms to greater domestic and international competition would strengthen their incentives for doing so.

Join the Conversation