Indonesia digital finance

Indonesia digital finance

Since the early 2000s, policy and institutional reforms in Indonesia have contributed to a period of sustained financial stability and helped cushioned the impact of the COVID-19 crisis . The nineties saw a rapid expansion in private sector credit, but this unraveled with the Asian Financial Crisis (AFC). The AFC left deep scars and refocused the authorities’ efforts on rebuilding and modernizing the financial system. This included restructuring of individual banks, establishing deposit insurance, ending government funding-related distortions, and improving supervision and regulation. In addition, policy reforms in capital markets development, financial inclusion, payment systems and disaster risk finance represented key elements of the financial sector development agenda. These efforts enhanced financial stability and maintained the fundamental role of the financial sector in supporting the real economy, both during the pandemic and during the uncertain recovery period.

However, Indonesia will need to continue to develop its financial system if it is to break the middle-income ceiling. All high-income countries grew by expanding the reach, depth, and efficiency of their financial sectors. A deeper financial system can channel more resources to fuel faster and better-quality growth. Yet Indonesia’s financial sector is small compared to peers, and both efficiency and inclusion lag peer countries. Capital markets do not yet provide sufficient funding for investment and are not yet an alternative to banks.

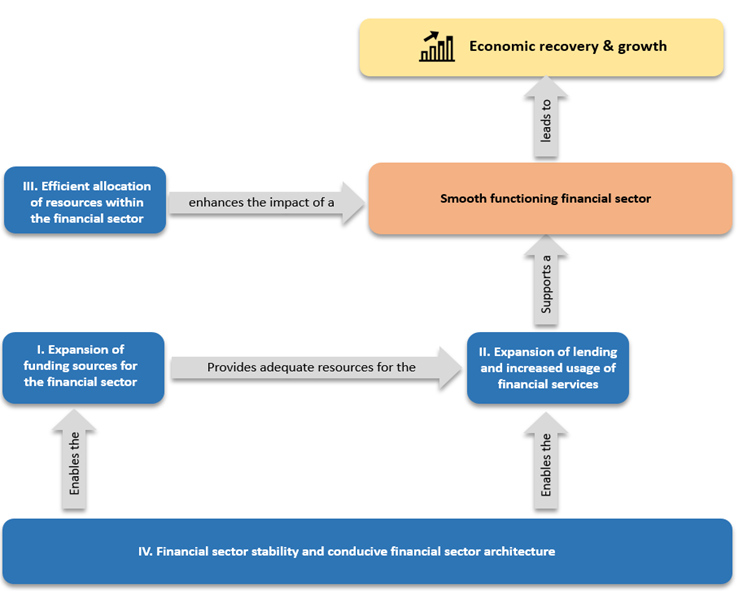

A new wave of reforms will help deepen the financial sector. The June 2022 Indonesia Economic Prospects proposes some options. Four steps could deepen the financial sector (Figure 1): (I) increasing the sector’s funding base; (II) expanding lending and increasing usage of financial services; (III) ensuring that savings go into the most productive investment opportunities in a less costly, faster, safer, and more transparent way; and (IV) maintaining financial stability with a conducive financial sector architecture.

Figure 1: Conceptual framework for opportunities to deepening the financial sector

To expand the funding sources for the financial sector, digital access and growth of institutional investors should be prioritized. Financial services that rely on digital technologies for their delivery and use by customers can play a major role in expanding funding sources by lowering costs, increasing speed, transparency, security, and increasing the availability of more tailored services for the poor. Expanding the size of institutional investors (i.e., pension funds, insurance companies, mutual funds) helps channel important sources of capital to complement bank lending and increase diversification of financing sources through capital markets.

To expand lending and increase the use of financial services, products and services for individuals and small and medium-sized businesses and the development of green finance are crucial. Basic saving accounts and agent network services have already been successfully introduced in Indonesia. Yet, expanding large-volume and recurrent payment streams (i.e., government-to-person payments, utility payments, employer payrolls etc.) could further increase access and reach the underserved individuals. Digital loans can reduce or eliminate reliance on fixed assets as collateral and reach small and medium-sized businesses without formal credit histories. The development of green financial markets can play a central role in facilitating investments in and a transition towards a more sustainable economy.

To promote a more efficient allocation of financial sector resources, digital finance, competition and financial infrastructure play a key role. First, digital finance can improve efficiency by fostering financing at scale and greater risk diversification through innovative product design, by integrating new technologies and improved data models. Second, there is a need to increase competition. The banking system is dominated by a few players with market power. State-owned banks play an important role in servicing government businesses as well small and medium-sized businesses, and pricing does not always reflect risk. Third, a sound financial infrastructure supports an efficient financial sector. In Indonesia this means more effective credit information systems, collateral registries for financial institutions to move beyond immovable assets as collaterals, a more effective insolvency framework accessible to smaller firms, and solid consumer protection framework.

Finally, to ensure financial stability, it is necessary to build a solid financial sector architecture. Integrated supervision of financial conglomerates, legal protection of supervisory staff and interagency coordination for crisis management are important. Moreover, assessing and managing climate-related risks for the financial sector is emerging as a key priority.

What can be done to address these challenges and seize these opportunities? Significant steps have been taken with the recent promulgation of Law No. 4/2023 on Developing and Strengthening the Financial Sector, which paves the way for financial deepening while strengthening financial efficiency and resilience. This is in line with the three-pillar reform strategy to facilitate the deepening of Indonesia’s financial sector outlined in the June 2022 Indonesia Economic Prospects, focused on increasing demand and supply of finance, improving the allocation of resources through the financial sector, and strengthening the capacity to withstand financial and non-financial shocks.

The role of the financial sector is even more important today, against the backdrop of deteriorating global economic outlook, heightened uncertainties, and tighter external financing conditions. Indonesia has a number of policy options to deepen the financial sector, which will be essential to advancing the country’s development agenda.

Join the Conversation