E-commerce Kolkata

E-commerce Kolkata

At the end of 2019, a total of US$3.46 trillion will have been spent globally by online retail consumers. E-commerce (online trade) is seamlessly connecting buyers and sellers separated by geographical distances and logistical barriers. As such, not only can e-commerce be a powerful force for economic growth, but it can also help make the international trading system more inclusive. It enables enterprises, regardless of their size or domestic market share, to access new markets and give even remote consumers access a broader range of goods.

In South Asia, e-commerce has grown substantially in recent years, with both online retail (e-tailing) and online travel services gaining momentum. In India, a fast-selling product such as jewellery is exported every 5 seconds. Still, e-commerce in the region is way below its potential.

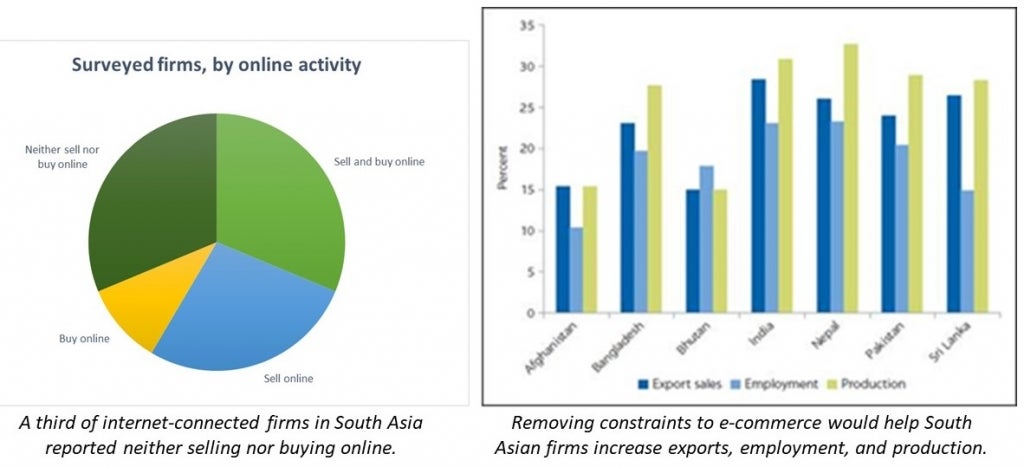

In 2015, while online sales were more than 15 percent of total retail sales in China and in the United Kingdom, and more than 11 percent in the Republic of Korea, they were but 1.6 percent in India and around 0.7 percent in Bangladesh. In a survey of more than 2,200 internet-connected firms in South Asia conducted in 2018 (South Asia E-Commerce Development Survey), more than a third of the sample reported neither selling nor buying online.

While online sales were more than 15% of total retail sales in China and in the United Kingdom, and more than 11% in the Republic of Korea, they were but 1.6% in India and around 0.7% in Bangladesh.

‘E-commerce in the region is way below its potential.’

In 2017, a World Bank team in India, Nepal, and Sri Lanka interviewed private sector actors and other key stakeholders. Based on this, and the South Asia E-Commerce Development Survey, the team found that key constraints to cross-border e-commerce included inadequate logistics and connectivity, payments restrictions, and digital regulations. In the South Asia E-Commerce survey cited above, small and medium enterprises reported that removing regulatory and logistical challenges to e-commerce would increase their exports, employment, and productivity by as much as 20–30 percent.

Interestingly, these barriers are significantly higher when trading with other South Asian countries. The main international e-partners of firms in South Asia are China, the United Kingdom, and the United States, and not other South Asian countries, despite their geographical and cultural proximity. This intraregional trade gap is not peculiar to the online sector. Although intraregional trade accounts for 50 percent of regional total trade in East Asia and 22 percent in Sub-Saharan Africa, in South Asia it is only 5 percent. In a region where current cross-border merchandise trade is one-third of its potential, could the development of e-commerce be a driver for regional integration?

The main international e-partners of firms in South Asia are China, the United Kingdom, and the United States, and not other South Asian countries, despite their geographical and cultural proximity.

A pathway to e-commerce development in South Asia

A recent World Bank report identifies a potential three-stage pathway for the development of regional e-commerce in South Asia:

- In the first stage, e-commerce regulation is often weak, and informal e-commerce tackles the tariff and logistics challenges of cross-border transactions.

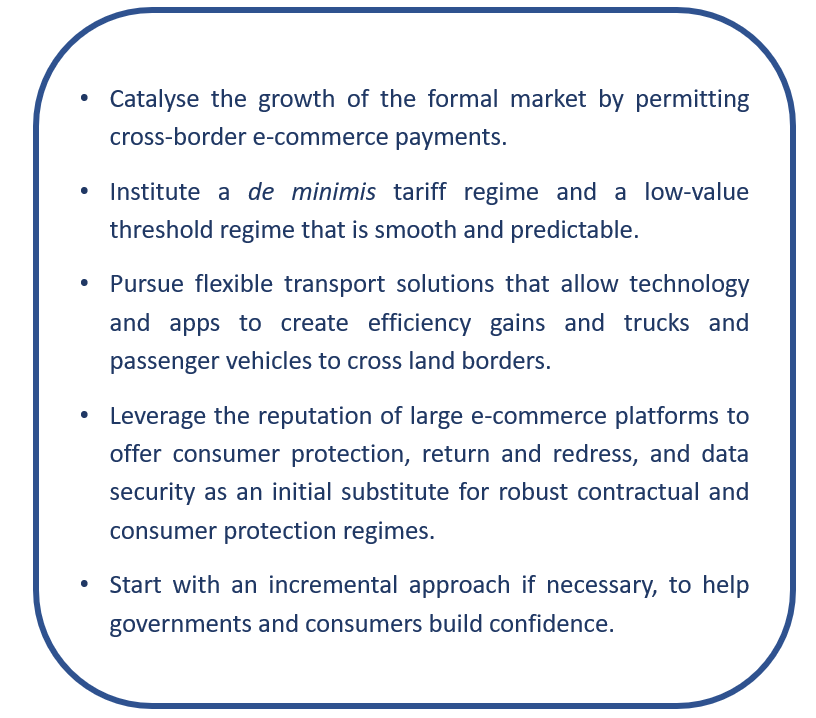

- The second stage would be the simplification of tariff, payments and logistical barriers, and with consumers depending on the reputation of big firms as a substitute for formal robust contractual and consumer protection regimes.

- The third stage would be more formalized regional platforms and regulations, which governments are more likely to be interested in if the second stage reaches a critical mass.

The same World Bank report also outlines practical steps to kick-start the process, which involve a combination of measures to gradually overcome the regulatory complexities of e-commerce, including issues such as payments, delivery, market access regulations, consumer protection, and data privacy. Once the market has taken off, more ambitious ideas could be implemented, adopting a regional lens, such as the creation of a South Asian e-transport framework, or a South Asian B2C (business to consumer) e-tailing market.

The opportunities for growing cross-border online trade in the region are significant. E-trade is already happening informally across land borders, and there are many high-demand products that could easily be catered to online by South Asian firms -- for example those that bundle goods with strong services (design, after-sales services), entertainment, or products that can be customised to local taste. And, with 28 percent of the region’s population younger than 15, the millions of young people who today are growing more and more tech-savvy will become the consumers, entrepreneurs, and technicians of tomorrow. Could this be the beginning of South Asia 4.0?

Join the Conversation