An empty shopping cart in a grocery store

An empty shopping cart in a grocery store

In Tirana, Sonja, an elderly widow, anxiously examines her utility bills, wondering whether the government subsidies she receives will be enough to cover the increasing cost of her electricity bill. With rising prices at the grocery store, Sonja finds herself forced to contemplate which items she can eliminate from her shopping basket in order to make ends meet. Unfortunately, Sonja’s story is not unique in the Western Balkans, as thousands of households vulnerable to rising energy costs and food prices have been grappling with these challenges in recent months.

The Western Balkan region had experienced significant progress in poverty reduction prior to the pandemic. Between 2016 and 2019, there was an estimated 10 percentage point decrease in the share of the population living below the poverty line of $6.85 per day, which is used to measure poverty in upper-middle income countries. However, the pandemic-induced crisis of 2020 reversed the progress made. Just as poverty reduction was recovering, high inflation in 2022 severely impacted all six Western Balkan countries, with food and energy prices skyrocketing and eroding the purchasing power of households. This situation disproportionately affected the poor and vulnerable, who spend a larger share of their income on these essential items.

Typically, the inflation rate is measured through the consumer price index (CPI), which tracks the price changes of a fixed basket of goods and services. While this reference basket may reflect the average consumption patterns in the country, it does not account for the fact that different households have distinct consumption habits. Consequently, each household’s exposure to inflation depends not only on the price changes between the goods and services they consume but also on their specific consumption patterns. In countries where households allocate similar proportions of their budget to each consumption group, the inflation rates they experience will not differ significantly. However, in countries where households have very dissimilar consumption patterns, household-specific inflation rates will vary widely, challenging the traditional measurement approach.

In the recent Western Balkan Regional Economic Report, we show that the less well-off consistently face higher inflation rates compared to the better-off due to the variations in the goods and services consumed by households of different income levels. For example, the poorest decile in North Macedonia experiences an inflation rate approximately seven percentage points higher than households in the top decile.

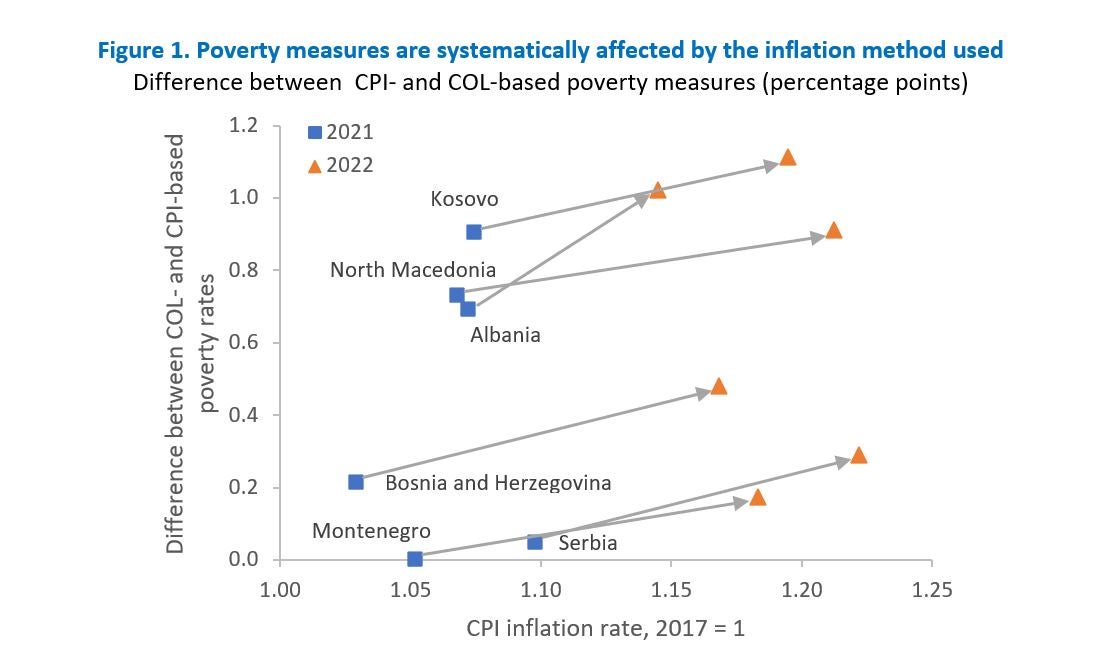

Inflation rates measured by the CPI are often used to adjust monetary values to account for price changes over time or across space. However, if household-specific inflation were used instead, the estimates for poverty and inequality rates, as well as the profile of the poor, would differ systematically (see Figure 1). These differences are more pronounced during periods of high inflation, such as in 2022. Holding income constant and using cost-of-living (COL)-based inflation instead of official CPI-based inflation, would result in a 0.7 percentage points higher poverty rate on average. Simulated results for Albania and Kosovo show a difference of over 1.0 percentage point. Hence, the traditional method underestimated poverty rates. But there is a clear way forward.

To protect the vulnerable population and promote economic growth, policymakers should take into account the heterogeneity of inflation rates experienced by different households. This approach allows for a more nuanced understanding of the tradeoffs faced by individuals like Sonja, whose personal inflation rate may differ from the CPI inflation measure. By considering COL-based measures of inflation, policymakers can design better policies for the poor, such as annual adjustments to benefit levels and eligibility criteria of government programs aimed at reducing poverty, which are typically based on inflation estimates.

Join the Conversation