Hydromet office

Hydromet office

Natural hazards can trigger unnatural disasters—deaths and damages often resulting from human acts of omission and commission. The impact of climate change is only expected to exacerbate this, increasing the frequency and severity of certain climate-induced disasters like floods, drought, and wildfires across Central Asia. And that means the costs associated with such events will rise as well—especially where disaster preparedness is lacking.

Disaster risk financing is one crucial component of disaster preparedness. Financial resilience to climate-induced and other natural hazards can boost countries’ capacity to bounce back after disasters—rebuilding better and restarting inclusive growth faster. It can also help more effectively manage the associated contingent liabilities—unexpected expenditures that government are obliged to cover in case of disasters—and protect crucial social spending on education or healthcare jeopardized by budget cuts. A regional pooling of disaster risk financing using aptly layered instruments can protect social spending and generate fiscal savings.

While the World Bank has helped countries like Kyrgyz Republic, Tajikistan, and Uzbekistan with developing disaster risk financing strategies and catastrophe insurance pools, climate change knows no borders and disaster costs can overwhelm a single country. On disaster risk financing, the region must come together and do more to advance on a region-wide approach to engage global private markets, maximize efficiencies in financing, and boost payout speed and reliability (Figure 1).

Figure 1. Risk layering creates savings on disaster financing by combining financing tools involving risk retention by the government, risk transfer to markets, and fast disbursement of funds after disasters.

Lessons learned from outside the region

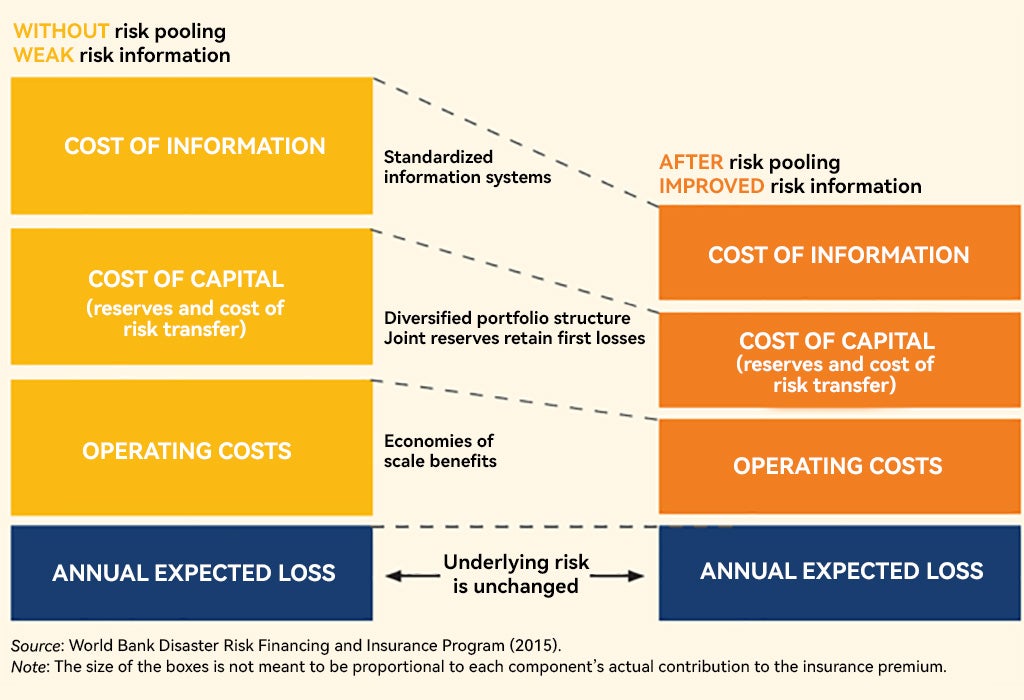

Global experience suggests that taking a regional approach to disaster risk financing could generate numerous benefits, including significant savings. Figure 2 shows through the example of a CAT bond issuance for the Pacific Alliance countries that savings from pooling can come from (i) reduced cost of information thanks to standardized information systems, (ii) reduced cost of capital thanks to diversified portfolio structure where pooled reserves back stop first losses, and (iii) reduced operating costs thanks to economies of scale. Pooled reserve funds, risk insurance pools, or catastrophe bonds could be efficient regional financing solutions for disaster risk in Central Asia.

Countries can retain some disaster risk and finance it through a pooled reserve fund at a regional level—to which each country contributes less than if it was to create a national reserve fund on its own. For example, the EU Solidarity Fund helps provide gap financing for member countries to complement their funding of vital emergency and recovery operations in locations affected by catastrophes. Since 2002, the fund has been used for more than 100 disasters.

Risk insurance pools are another fiscal insurance option that transfers part of the risk to markets cost-effectively. Among the largest insurance pools is the Caribbean Catastrophe Risk Insurance Facility (CCRIF) that, since its inception, has already provided 54 timely payouts. This pool helped lower premiums compared to the cost of coverage if countries would have approached the open market individually. An analysis, conducted for two countries joining the CCRIF, estimates that risk pooling can offer premium savings of 27 percent.

For high severity disasters, one proven financial solution are CAT bonds—an insurance-linked market security that allows entities exposed to natural disaster risk, such as governments, to transfer a portion of that risk to bond investors. In 2018, several countries of the Pacific Alliance (Colombia, Peru, Chile, Mexico) sponsored a regional CAT bond against earthquakes for a total coverage of $1.36 billion. While this CAT bond provided individual coverages for each country, it also enabled saving on some transaction costs.

Figure 2: Pooling risks across Central Asian countries and hazards can decrease the cost of disaster risk financing and insurance against multiple perils—consider the example of cost-saving sourced under the Pacific Alliance CAT bond.

A way forward for Central Asia

During a recent workshop on developing a regional multi-hazard disaster risk assessment in Central Asia, the World Bank presented a proposal to explore a regional solution for disaster risk financing. This solution could take different forms – it could be a regional reserve fund, or a pooled insurance solution, or a cross-country capital market instrument. Workshop participants indicated such a solution could address immediate or longer-term reconstruction needs, target climate-induced hazards, or also diversify across other major natural disasters such as earthquakes.

To explore concrete regional solutions, the World Bank is launching a study implemented jointly by its financial sector development and disaster risk management teams, and supported through the Strengthening Financial Resilience and Accelerating Risk Reduction program funded by the European Union. This analytical study will devise optimized disaster risk financing solutions at the regional level. It will use cutting-edge modelling and financial structuring to help make Central Asia more resilient to climate-induced and other natural hazards, and safeguard more public resources for greater investment in human capital and public infrastructure that Central Asia desperately needs.

Join the Conversation