Image: Canva

Image: Canva

Nearly two decades ago, a UN report entitled “Who cares wins” coined the term environmental, social and governance (ESG). Today, sustainability reporting is common in the private sector. Most governments, however, do not hold themselves to the same standard and fail to systematically report on the environmental impact of their estate. In this blog, we take a look at an outlier, the UK, and consider lessons for other countries.

The greening of public assets requires laws that mandate the government to act. In the UK, the 2008 Climate Change Act has been the catalyst for greening the country’s vast public estate—consisting of hospitals, schools, offices, and military bases. It made the UK the first country to establish a long-term legally binding framework to cut carbon emissions and committed the government to cut emissions by at least 80% by 2050 from 1990 levels (In 2019, the UK government amended the law and made Net Zero by 2050 a legally binding target—the first major economy to do so). At the government level, departments and other governmental organisations have since 2011 published progress reports on Greening Government Commitments, which set targets to reduce the administration’s impacts on the environment.

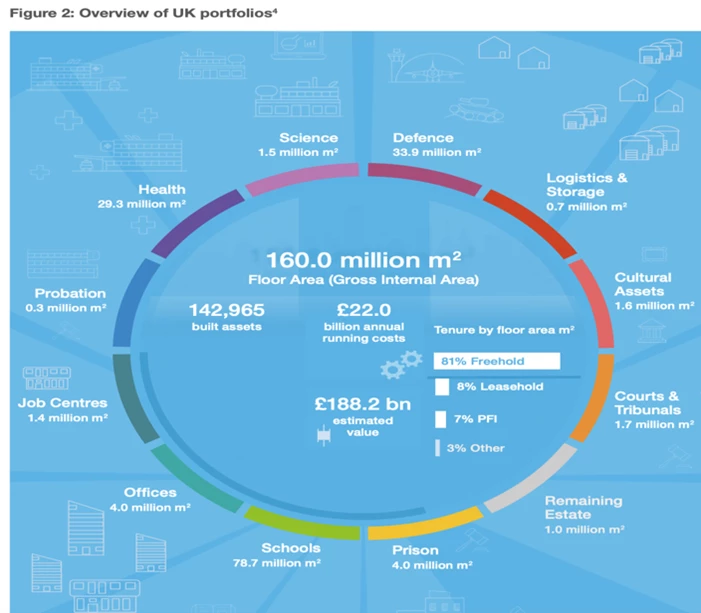

Source: State of the Estate. 2021-22

Transparency matters. The annual running costs of the UK’s £188.2 billion (USD equivalent, $257.1 billion) estate is £22 billion. The most recent report on the State of the Estate (2021-22), an annual publication since 2011, shows that emissions of the estate fell by 35% over five years. Making the UK’s public capital stock climate neutral requires improving operational efficiency but crucially hinges upon upgrading public buildings, energy and transport infrastructure. What can less developed countries learn from the UK’s experience when greening their estate?

Detailed public asset management strategies are vital. In the UK, the Government Property Strategy 2022-30 sets out four action areas to create a “smaller, better and greener” estate:

- Decarbonisation: Cutting public sector emissions plays a key role in fighting climate change. With around 300,000 properties, the UK government runs the biggest property portfolio in the country. The National Health Service (NHS) in England alone accounts for 4-5% of the country’s carbon footprint. To monitor and speed up progress, the government published a Net Zero Estate Playbook, a guide for government property professionals to decarbonise their estate. Since 2010, emissions of the estate have fallen by 57%.

- Adaptation: Adaptation to climate change impacts is a key part of greening public assets. The UK’s National Adaptation Programme (2023-28) sets out key public sector adaption actions. Separately, the Government Greening Commitments mandate government departments to conduct climate change risk assessments and develop adaptation action plans.

- Natural capital: Greening public assets requires a radical rethink of the value of nature. The UK government has pledged to increase natural capital across the estate. It has embraced the conclusions of the Dasgupta Review, a seminal overview of the economics of biodiversity, which stresses the vital role nature plays in economic activity and recognises the services provided by nature as an economic input to economic activity.

- Resource efficiency: Greening requires more efficient public investment spending. UK government plans emphasizes the need for sustainable use of resources over the entire lifecycle of a property (This involves, among others, “green” construction methods, more energy efficient buildings, sustainable procurement policies, reducing waste, and water and plastic use).

Public awareness of how government policies impact people and the planet is growing. Robust accountability mechanisms are needed to assess climate change ambition, actions and ability of governments. In the UK, the Climate Change Committee, an independent statutory body, monitors climate action and is key to transparent, independent assessment of the government’s emission reduction plans. In its most recent report to parliament, the committee warns that the UK is losing its global climate leadership role and that urgent action is needed if the government is to deliver on its net zero target by 2050.

Editor's Note: This blog is part of a series on public asset management and how governments can enhance infrastructure services and unlock revenues through better management of the non-financial assets side of their balance sheet (real estate, land, and intangible assets such as digital information), see From The Domesday Book to Cloud-based Public Asset Management and Bringing Public Assets Out of the Shadows: Optimizing Infrastructure Services, Unlocking Revenues.

Join the Conversation