sunset with carbon fumes over tree canopy

sunset with carbon fumes over tree canopy

Choosing the right discount rates matters for selecting good projects. The authors of this blog provide strong reasons why a rate of zero is appropriate for discounting costs and benefits of most investment projects - and especially climate-sensitive ones.

Estimating future benefits and costs is fundamental to appraising a project. The discount rate is used to express future monetary value in today’s terms. Using a higher discount rate reduces the value of the future stream of net benefits or costs compared with a lower rate. Therefore, a higher discount rate implies that we value benefits less the further they are in the future.

Doing cost-benefit analyses of projects is a difficult but important exercise for selecting the best investments. At a recent World Bank event, Professor Bent Flyvbjerg highlighted the problem of underestimation of costs and overestimation of benefits due to optimism bias and suggested some behavioral responses. Below, we spell out four reasons for adopting a zero-discount rate.

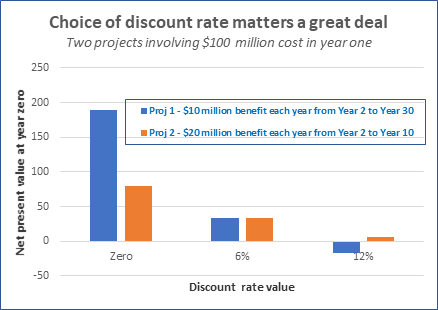

Getting discount rates right matters for selecting the best projects rather than wasting scarce public investment funds on inferior ones. A quick review of the relative outcomes for projects 1 and 2 shown in the figure below demonstrates this. The two projects have a similar net present value at a 6% discount rate. However, project 1, which has a long tail of benefits, comes out poorly with higher discount rates. Project 2, which has a shorter period of benefits, comes out relatively worse with lower discount rates. In recent years, research has pointed out the need to move to zero or close to zero for projects with long tails of benefits or costs (see Arrow et al 2013 and Weitzman 2013).

The figure compares two projects that cost $100 million in year 1, but with project A yielding an annual return of $10 million between years 2 to 30 and for project B an annual return of $20 million between years 2-10. Discount rates impact the net present value of projects and can thereby also change the relative ordering between projects.

Here are the reasons for a discount rate of zero. Three of them general and one specific to climate projects:

Consumption/wealth might not continue to increase:

A sustained increase of consumption due to continued growth is one of the fundamental assumptions of a positive social discount rate. The past few years have shown that sustained growth cannot be assumed. Recent research suggests that about half the children born in the U.S. in the 1980s are likely to have income that is at best equal to their parents’, and this was before the dislocation of COVID. Climate change is both exacerbated by consumption and constitutes a rapidly aggravating negative supply shock. With a declining number of workers in many countries, it is hard to see output growth topping 1 percent in many places. If incomes do not increase, then marginal gains from consumption do not necessarily reduce with time and discounting the value of future consumption does not necessarily hold.

Discounting basic rights is philosophically questionable:

A social discount rate based on marginal utility of consumption should not be applied to the value of life or human suffering. When estimating the present value of losses from future extreme weather events or slow-onset disasters, let’s be mindful that these measures of loss can be a matter of life or death for vulnerable people. This type of consumption does not match well with the optimal growth model from which social discount rates are derived. The mathematician Frank Ramsey and others have argued that while discounting made sense on behalf of an individual it was ethically indefensible for society as a whole – the lives of all generations should be treated equally. While accounting for these social costs might be a necessary exercise for decision making, reducing their weight through discounting is ethically questionable.

Climate change is an existential rather than a marginal threat:

Discounted cash flow analysis is generally conducted on the premise that the project itself is marginal and doesn’t generally affect relative prices. But this might not apply when it comes to climate change massive projects in small places (like Nam Theun II in the Lao People’s Democratic Republic). Climate change is a massive change for (very finite) Planet Earth and has the potential to dramatically affect prices and growth. While individual projects cannot significantly impact climate change, the sum of all climate-sensitive projects could significantly help mitigate or have a snowball effect. From that perspective, global guidance on social discount rates can shape investment decisions similarly to the way monetary policy does with interest rates. Lower social discount rates would promote projects with long-term benefits for the climate and be complementary to other methods such as setting carbon prices. Retaining coal would look worse.

A zero-discount rate limits the risks of moral hazard:

Problems of systematic bias and strong incentives for project teams and decision makers to arrive at positive present values make it necessary to set strict institutional guidelines. Cost-benefit analysis results are often driven by parameters – such as discount rates -- on which there is no scientific agreement or consensus. Swedish reviewers have noted an unsystematic range of discount rates applied for environmental projects. The review found that justifications were weak and non-transparent, which reduced accountability. If discount rates are in play, there is an incentive for project sponsors to think of planning cash flows in terms of the discounted outcome, which could incite opportunistic discretion over the timing of planned cash flows. An institutional commitment to set discount rates at a fixed number would remove one opportunity to massage the numbers.

The zero response

Zero makes for a simply communicated attention grabber. A zero-discount rate also takes a neutral stance on whether consumption growth will remain positive or dip because of climate change. Zero ensures ethical treatment between generations and of losses in human life. Finally, zero is lower than the current guidance and would level the playing field for environmentally friendly projects with long-term benefits. It has commitment value.

Zero may not be a perfect number in the strict technical sense, but it may be a very good number to improve project selection.

Join the Conversation