As a practitioner with several years of government experience, and later as a public debt management advisor at the World Bank Treasury, I am often faced with these questions from our client countries: “Which Public Debt Management IT System is best for our needs?”, “Shall we build a software from scratch, or purchase an off-the-shelf system?”. With the increased focus on public debt transparency[1], having accurate and reliable debt data has a critical role in ensuring effective risk assessment to support sustainable borrowing and lending practices.

A debt management IT system is the backbone of any sovereign debt management office. A robust, well-functioning and user-friendly system allows governments to support their debt related operations. This in turn strengthens the public financial management environment of the country. In a recent Policy Research Working Paper, “Study on Public Debt Management Systems and Results of a Survey on Solutions Used by Debt Management Offices,” we tried to find the answers to these questions.

Starting with an extensive review of the essential requirements of a debt management system, we explored the selection criteria for software that fits the system modernization and integration needs of a debt management office. We also assessed the pros and cons of “in-house” versus “off-the-shelf” systems.

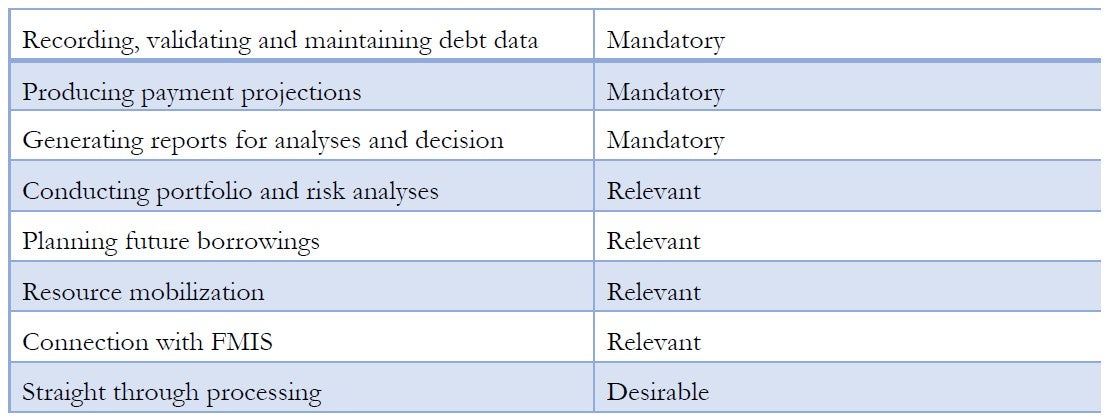

Functions of a Debt Management System – what is mandatory?

The main reason for having a debt management system is to make sure that the records of all debt related transactions are maintained systematically and accurately, allowing governments to meet its debt obligations timely, a major source of reputational risk for the governments.

Given this, such a system at a minimum should be able to (i) securely record and maintain all debt-related transactions such as commitments, disbursements and debt service payments; (ii) produce payment projections of principal, interest, and other fees; and (iii) generate reports at individual instrument and portfolio levels. These functions are mandatory for any debt management system.

Further, a highly desired function by debt managers is the ability to conduct straight through processing of debt transactions, allowing for automatic settlement, payment and registry of debt related transactions. This function is highly-recommended to reduce the operational risk involved in debt management.

To further investigate the landscape of current solutions, we analyzed the survey results of a sample of debt management offices from 31 countries.

The survey results suggest that current off-the-shelf systems can handle the critical functions and instruments of most debt management offices of emerging and developing countries. However, if the nature of respondents’ debt portfolios evolves over time, system limitations may present challenges.

Key survey findings:

1. Almost all countries (94%) use a software, either developed internally or purchased off-the-shelf, as a solution to capture debt management operations and functions. More than half of them use a public debt management system (DMS). Public DMS is composed of the two information systems currently available for governments, DMFAS and CS-DRMS.

4. The most common debts instruments (bills, bonds, floaters, fees and project-finance loans) are captured by all systems. However, the more evolved instruments, which are used less frequently (interest and cross-currency swaps, inflation-linked instruments, guarantees, on-lent debt, and receivables) seem to be less covered. This is partly due to governments’ reluctance in using the available systems and partly due to the limitations of software.

The question of “in-house vs. off-the-shelf” will be faced by many debt managers as the needs of the Debt Management Office (DMO)’s needs evolve, and their current system ceases to cannot capture the additional needs. The answer will depend on the differentiation between functions and coverage that are mandatory, relevant and desirable. Further considerations will be the DMO’s ability to professionally lead the IT project, staff expertise, the time constraints, and the financial resources available to it.

Strengthening the public financial management environment through improving IT systems not only reduces the operational and reputational risk of the government in liability practices but provides one more step towards achieving economic resiliency – essential for the development work in our client countries.

Join the Conversation