Ecuador debris after the Earthquake

Ecuador debris after the Earthquake

Ecuador is vulnerable to a wide range of natural hazards such as volcanic and seismic activity, landslides, floods, storms, and the effects of the El Niño and La Niña climate phenomena. It ranks thirteenth among countries most at risk for natural hazards and third in Latin America and the Caribbean (behind Peru and Haiti), according to the INFORM Global Risk Index.

The economic losses generated by these hazards are significant. Over the past 50 years, earthquakes have caused some USD 8.5 in damages while the climatic effects resulting from El Niño and La Niña have produced losses of USD 4.4 billion , according to ECLAC and Senplades. In the month of March 2021 alone, the country experienced the most intense flooding and heavy rains of the past five years, as well as a major eruption of the Sangay Volcano, which affected the activity of five provinces, led to the closure of the Guayaquil airport and damaged than 40,000 hectares of crops, all while Ecuador continues to deal with the devastating effects of the COVID-19 pandemic.

Five years ago, a major earthquake exposed the country’s physical and fiscal vulnerability to these catastrophic events. The Government of Ecuador estimated that reconstruction costs for the affected areas totaled USD 3.3 billion, mainly in the social, productive, and infrastructure sectors (by order of impact). The earthquake eliminated 21,823 jobs and led to USD 515 million in losses in the productive sector (in terms of lost economic flows).

In this context, the Government of Ecuador, with the technical team of the Ministry of Economy and Finance (MEF) and with World Bank support, developed its Disaster Risk Financing Strategy, which was launched in March 2021. The strategy was developed in workshops in which participants shared knowledge on financial management in the event of disaster risk, as well as analyzed good international practice in this area. Additionally, the team met with representatives from 20 public and private entities involved in risk management in Ecuador. Likewise, several studies were conducted on natural disasters, their historical impact, and potential future scenarios.

A holistic approach to disaster risk

This innovative strategy addresses the problem of disaster risk management from a holistic point of view. Characteristics of the strategy include:

- Identification of risks and contingent liabilities. This mechanism promotes the definition of measures to establish clear and regular processes to identify government responsibilities when disasters occur, known as contingent liabilities. In keeping with best practices, the strategy proposes including the liabilities established in laws or regulations (explicit) and those defined by a moral obligation that will generate an expectation or political pressure to pay (implicit). This component also seeks to integrate risk identification as a key element of government financial processes and of the management of public and private investments.

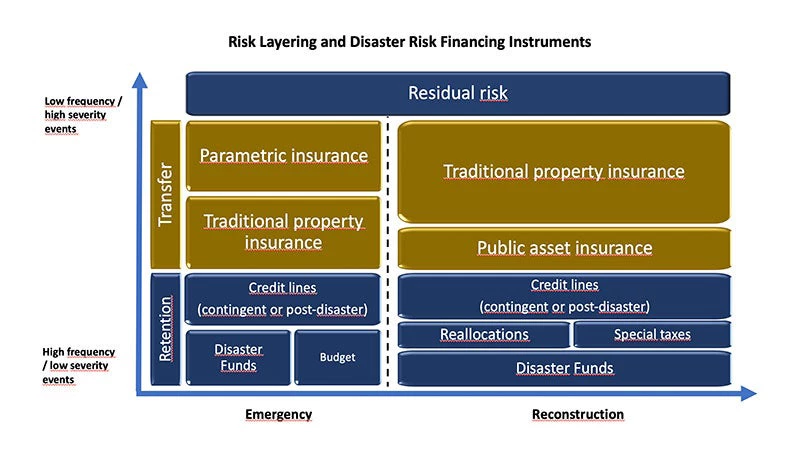

- Risk management through financial instruments. This component evaluates the application of financial instruments to ensure that Ecuador has the necessary resources to respond to an emergency and cover reconstruction costs resulting from high-impact events, either with its own or external financing. The proposed actions are based on the concept of risk layering using risk retention and risk transfer instruments, depending on the risk profile and the government’s economic capacity, as well as the timing of the need for resources.

- Strengthening of government technical capabilities, including at the subnational and sectoral levels, to manage financial instruments for disaster risk management. The strategy gives the government tools to design programs to strengthen the technical expertise of government officials, including the development of skills in the generation and use of technical information and in the design and management of financial instruments for disaster-risk management. Capacity building will focus on the long-term sustainability of the strategy, with the continuous support of multilateral organizations.

- Identification of proactive risk management as a core component of the financial strategy. Given that existing risk and the creation of new risk are the critical factors determining contingent liability, the MEF understands that promoting risk reduction actions and preventing new risks is an efficient way to reduce the contingent liability. Therefore, the MEF aims to become an active promoter of comprehensive disaster-risk management programs.

While the strategy has been developed, the challenge now is how to access its benefits. To this end, the strategy proposes an implementation plan that establishes the MEF, the governing body responsible for public finances, should coordinate the creation of an inter-institutional group of key actors from the public and private sectors to identify disaster risks, their potential impact, as well as the liabilities they imply.

Join the Conversation