Group of farmers working the land in Escuintla, Guatemala. Source: The World Bank

Group of farmers working the land in Escuintla, Guatemala. Source: The World Bank

The approximately two million family farmers that live across northern Central America are among the most vulnerable populations in the region. These family farmers typically cultivate staples like beans or maize on 1-2 hectares of land, operating on the edge of subsistence. Crop yields are low and variable as most family farmers rely on rain-fed cropping and have limited access to seed and fertilizer technologies. Many supplement their income with off-farm labor and remittances.

Extreme weather events and climate risks further threaten their livelihoods. Guatemala, for example, is the 16th most exposed country globally to extreme weather events. Hydrometeorological hazards (such as excessive rainfall and droughts) are increasing in severity and frequency across the subregion. Family farmers in the Dry Corridor (which spans parts of El Salvador, Guatemala, Honduras, and Nicaragua) are particularly vulnerable to severe El Niño droughts every three to five years. In 2018, drought resulted in the loss of several hundred thousand hectares of beans and maize across these countries, with significant adverse implications on rural communities’ incomes and food security.

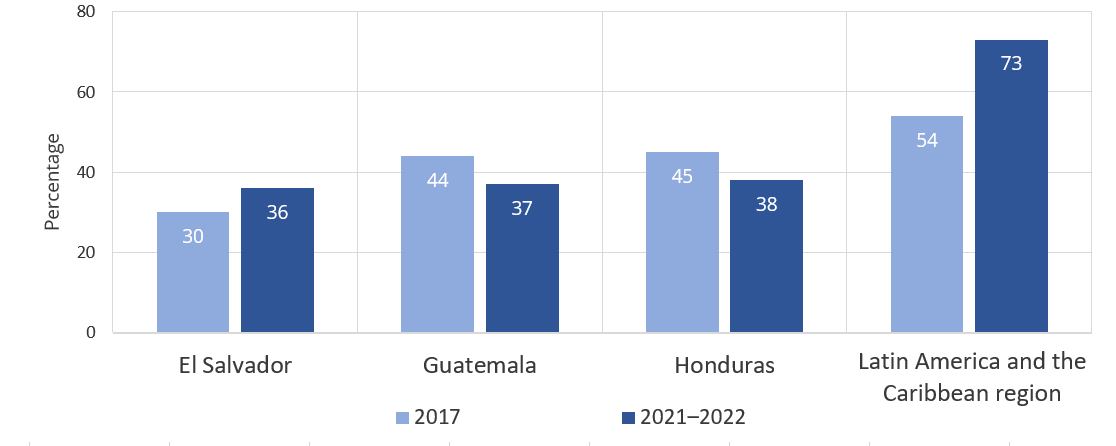

Family farmers in northern Central America also lack access to basic financial tools like insurance, credit, and savings that could help boost their financial resilience in the face of climate risks . Fewer than 4 in 10 adults living in rural areas of Honduras have basic transaction accounts. Efforts to promote microinsurance among family farmers have yet to achieve scale due to high operational costs and low levels of financial literacy. Existing social safety net programs provide inadequate financial protection for family farmers.

Financial inclusion in the northern Central American countries

Guatemala’s approach – a potential model?

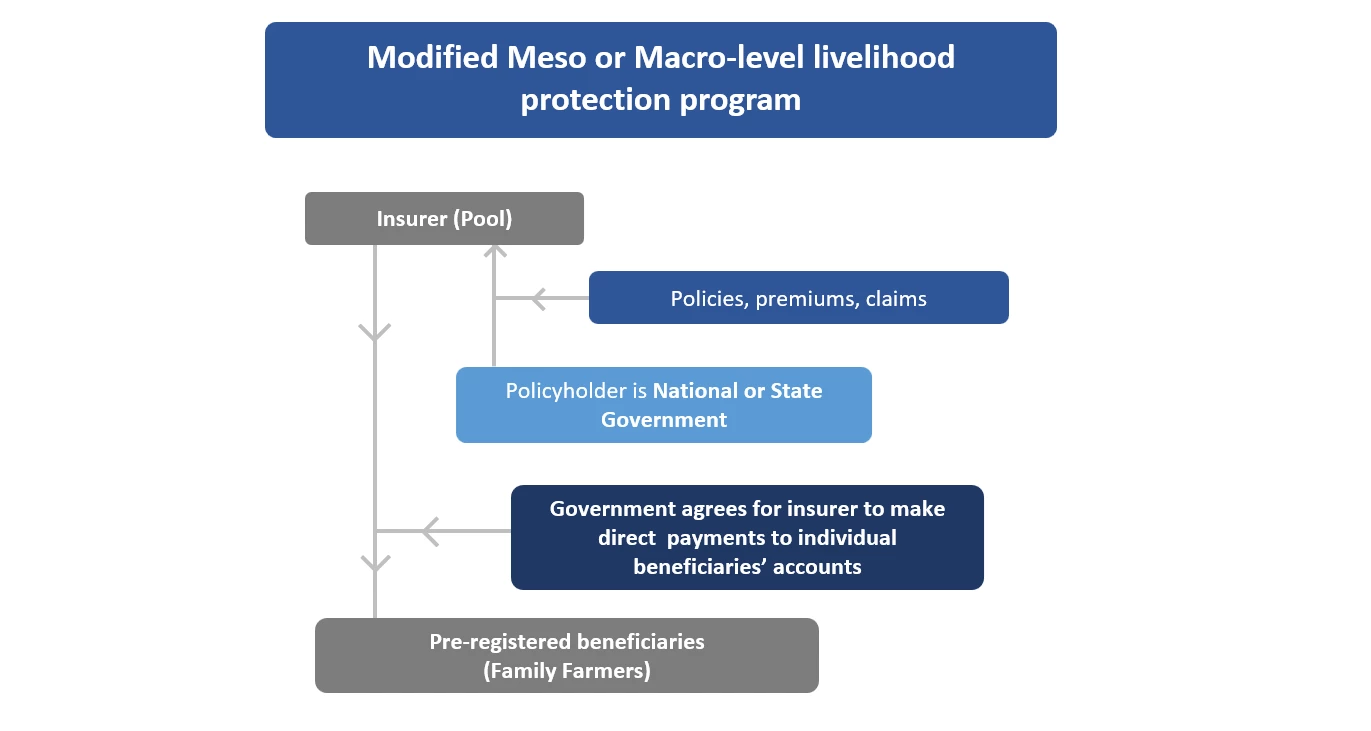

What can we do to improve the financial resilience of family farmers in the face of extreme weather events and climate risks? Our recently published feasibility study identifies potential disaster risk finance and insurance solutions that could provide basic financial protection at scale for family farmers in northern Central America. One promising approach has already taken root in Guatemala. Starting in 2021, the Ministry of Agriculture and Livestock initiated an innovative program to protect the livelihoods of family farmers against severe climatic risks under a program called Catastrophic Parametric Insurance.

Under this program, the Ministry purchases a single insurance policy that includes large numbers of family farmers as the primary beneficiaries. In recognition of the severe financial constraints facing these farmers, it fully funds the costs of the insurance premiums. The insurance is parametric or index-based, meaning that it pays out on the occurrence of a triggering event -for example, a specific volume of rainfall as measured by a satellite- rather than indemnifying actual loss incurred.

Once the policy is triggered for a particular geographic area, the insurance payouts are distributed directly by the insurer to the family farmers. The farmers receive a text message with a token or code and use that token to retrieve their payments from a nearby ATM or bank branch. As of 2023, the program protects 100,000 family farmers in Guatemala against excess rain and drought events, which could severely impact their livelihoods.

Benefits and preconditions for scaling

This approach – which we refer to as “modified macro index-based disaster risk insurance” – has several benefits:

- It avoids the high operational costs associated with traditional agricultural insurance and microinsurance models, for example, selling insurance door-to-door, managing thousands of individual policies, and measuring actual losses. Instead, farmers can be registered en masse as beneficiaries of a single policy.

- The policy can be designed to consider off-farm income sources that may also be affected by extreme weather events, thus enabling a livelihood-protection approach.

- This approach can achieve scale fairly quickly, as demonstrated by global experiences over the past decade— for example, in Ethiopia under the Satellite Index Insurance Program for Pastoralists (SIIPE) supported by the World Food Programme.

- Experience shows this approach can be more cost-effective than traditional humanitarian assistance approaches.

However, the approach also requires several building blocks, including effective targeting and registration of family farmers, quick and reliable payment mechanisms, rigorous parametric insurance product design that minimizes basis risk, and financial education, as this Kenyan example showcases. Given the poverty levels of the target population, the model also implies significant premium financing (subsidies).

To achieve meaningful impacts on financial resilience, complementary interventions that provide farmers with access to a broader range of financial services and risk mitigation tools should also accompany the insurance cover.

We see an exciting opportunity to improve and further scale this approach in Guatemala and introduce the model in Honduras or El Salvador. The World Bank, together with national authorities and our partners in the Disaster Risk Insurance and Finance in Central America Consortium (DRIFCA), will continue to advance disaster risk finance and insurance solutions to protect the livelihoods and strengthen the financial resilience of family farmers in northern Central America.

Download the full report here.

Subscribe and receive a weekly article

Related articles

Join the Conversation