Countries in Latin America and the Caribbean suffer from low productivity: the region’s workers produce on average just a fifth of the output of a US worker.

Productivity is the outcome of the functioning of an economy – both at the micro and macro levels. Therefore, we need to focus on the drivers of productivity if we want to shrink the efficiency gap.

As discussed in a previous blog post, a fundamental cause for this efficiency gap is what economists call resource misallocation.

In this post, I dig deeper on what can be done to address this problem, drawing on the results from our recent study Understanding the Income and Efficiency Gap in Latin America and the Caribbean

Microeconomic Reforms

At the microeconomic level, the drivers of productivity can be classified as external or internal to the firm.

External Factors

In many Latin American countries, external factors (factors mostly outside firms’ control or influence) became barriers to productivity growth.

External factors can include the overall regulatory framework (including in labor and capital markets), access to finance, the degree of trade openness, availability of public infrastructure (such as access to electricity, paved roads, ports and airports) and tax policy.

These can often become barriers to adequate resource allocation – thereby blocking the flow of labor and capital to the most productive enterprises and reducing aggregate productivity.

For example, product market regulations (the red diamonds in Figure 1 below) are among the most restrictive in the region’s countries.

Figure 1. Overly Restrictive Product Market Regulations

Internal Factors

Then there are also internal factors that work as barriers to productivity growth.

Internal factors include managerial capacity and ability to innovate within firms. Surveys of management practices suggest that managerial efficiency varies significantly across firms in different countries. In addition , incentives to invest in managerial skills also vary by country.

Innovation is a key internal driver of firm-level productivity growth, but external factors prevent firms from absorbing technology that is readily available. In fact, institutional variables, such as poor rule of law and weak protection of property rights, have greater force in Latin America than elsewhere in reducing firms’ incentives to innovate. This means that even internal factors can be influenced by external factors such as policy reforms.

Macroeconomic Policy Environment

The region’s relatively high poverty rates have hindered convergence to higher income levels. Why? If poverty is widespread, the poor might have no means to invest – including in education – despite their potentially high payoff.

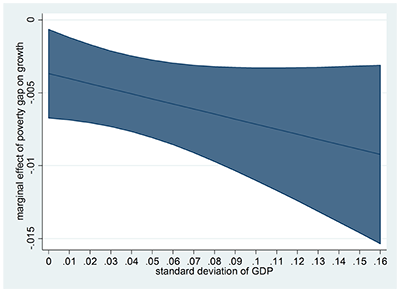

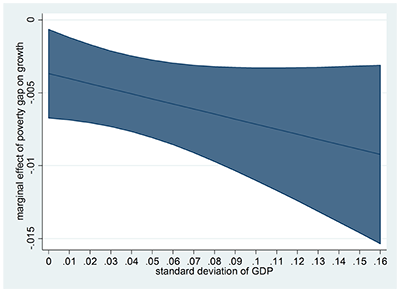

A novel finding of our study is that this effect is magnified by macroeconomic volatility. This potentially creates a vicious cycle: Macroeconomic volatility and uncertainty further increases the negative effect of poverty on growth, because under such conditions the poor will refrain even more from investing. In addition, volatility discourages poorer workers from moving to sectors that are more profitable and productive. Figure 2 shows that the adverse effect of poverty on growth becomes more pronounced as GDP volatility increases.

Policies that reduce macroeconomic volatility – such as, for example, fiscal rules when appropriate – will help thwart the vicious cycle of high poverty and low growth. Conversely, countries should steer clear from policies that amplify macroeconomic volatility – such as pro-cyclical fiscal policy – as longer-term harmful effects may result.

Productivity is the outcome of the functioning of an economy – both at the micro and macro levels. Therefore, we need to focus on the drivers of productivity if we want to shrink the efficiency gap.

As discussed in a previous blog post, a fundamental cause for this efficiency gap is what economists call resource misallocation.

In this post, I dig deeper on what can be done to address this problem, drawing on the results from our recent study Understanding the Income and Efficiency Gap in Latin America and the Caribbean

Microeconomic Reforms

At the microeconomic level, the drivers of productivity can be classified as external or internal to the firm.

External Factors

In many Latin American countries, external factors (factors mostly outside firms’ control or influence) became barriers to productivity growth.

External factors can include the overall regulatory framework (including in labor and capital markets), access to finance, the degree of trade openness, availability of public infrastructure (such as access to electricity, paved roads, ports and airports) and tax policy.

These can often become barriers to adequate resource allocation – thereby blocking the flow of labor and capital to the most productive enterprises and reducing aggregate productivity.

For example, product market regulations (the red diamonds in Figure 1 below) are among the most restrictive in the region’s countries.

Figure 1. Overly Restrictive Product Market Regulations

Source: OCDE

What can be done to turn these external factors from negative to positive drivers of productivity growth? Here are some of the most important reform areas:

- Improve competition in key industries such as transport, financial, telecommunications, logistics, communications, and distribution

- Increase labor market flexibility, for example by addressing skill mismatches and social barriers that block qualified workers from certain employment based on gender, age, or ethnic group

- Simplify and rationalize tax regimes and regulatory frameworks

- Increase the level and efficiency of infrastructure investments

Internal Factors

Then there are also internal factors that work as barriers to productivity growth.

Internal factors include managerial capacity and ability to innovate within firms. Surveys of management practices suggest that managerial efficiency varies significantly across firms in different countries. In addition , incentives to invest in managerial skills also vary by country.

Innovation is a key internal driver of firm-level productivity growth, but external factors prevent firms from absorbing technology that is readily available. In fact, institutional variables, such as poor rule of law and weak protection of property rights, have greater force in Latin America than elsewhere in reducing firms’ incentives to innovate. This means that even internal factors can be influenced by external factors such as policy reforms.

Macroeconomic Policy Environment

The region’s relatively high poverty rates have hindered convergence to higher income levels. Why? If poverty is widespread, the poor might have no means to invest – including in education – despite their potentially high payoff.

A novel finding of our study is that this effect is magnified by macroeconomic volatility. This potentially creates a vicious cycle: Macroeconomic volatility and uncertainty further increases the negative effect of poverty on growth, because under such conditions the poor will refrain even more from investing. In addition, volatility discourages poorer workers from moving to sectors that are more profitable and productive. Figure 2 shows that the adverse effect of poverty on growth becomes more pronounced as GDP volatility increases.

Figure 2. Impact of Poverty on Growth Increases with Volatility

Source: Wacker (2016).

Source: Wacker (2016).

Policies that reduce macroeconomic volatility – such as, for example, fiscal rules when appropriate – will help thwart the vicious cycle of high poverty and low growth. Conversely, countries should steer clear from policies that amplify macroeconomic volatility – such as pro-cyclical fiscal policy – as longer-term harmful effects may result.

What now?

Our study confirms the importance of microeconomic reforms for reducing the efficiency gap in Latin America and the Caribbean. But it also shows that governments can facilitate growth at the micro level by fostering a stable and predictable macroeconomic policy environment – since the macro and micro dimensions are inextricably linked.

Join the Conversation