Adaptation is needed to help people adjust and enable nature to be more resilient to climate change impacts | © JoeZ, Shutterstock

Adaptation is needed to help people adjust and enable nature to be more resilient to climate change impacts | © JoeZ, Shutterstock

To address climate change we must be diligent and bold about adaptation and resilience in infrastructure development. Promoting sustainable infrastructure solutions will also be crucial in the immediate aftermath of COVID as fiscal stimulus that creates jobs and connectivity fuels economic dynamism. These may be easy words to type, but with an estimated annual infrastructure investment gap of $1 trillion, it’s hard to imagine where budget-constrained governments will find the resources.

The infrastructure sector can be a powerful conduit to mobilize private finance for adaptation. For one, the long-term effects of infrastructure and climate change mirror and mutually reinforce each other. Long-term, stable cashflows from infrastructure PPPs can attract institutional investors—especially when a country’s financial market allows the project to tap into local currency. Moreover, given the need for regulation, the infrastructure sector is at the natural nexus of public and private worlds.

How do we get more momentum on this front? A recent report by the World Bank and IFC points to barriers to attracting the significant private finance needed to advance countries’ adaptation agendas and how governments can play a key role to bring them down. These include:

- Lack of country-level climate risk and vulnerability data as well as information services to guide decision making. Solution: Make this localized data available and embed climate risks in capital investment planning undertaken by governments and their partners.

- Limited clarity on governments’ capital investment gaps to achieve adaptation goals and where private investment is needed. Solution: Setting up institutional arrangements for multi-sector adaptation planning. We need better articulation of adaptation and resilience goals at the national level—establishing policies, regulations, and standards with clear plans, including who will do what, where, when, and how.

- Low perceived or actual returns on investment. Solution: Strengthen financial incentives (or reduce risks/costs) for private participation through blended finance, credit enhancement, and other risk reduction or revenue-boosting measures.

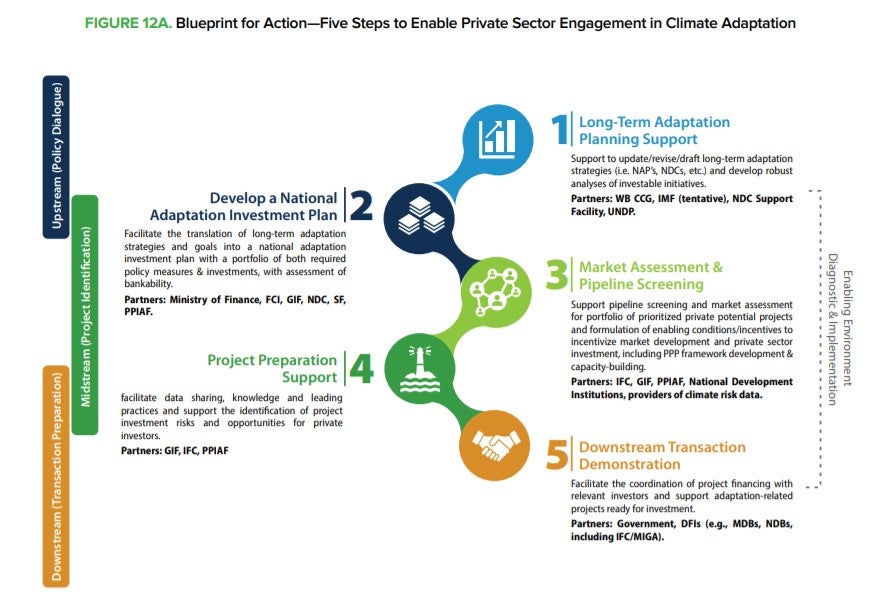

This blueprint for action highlights three areas for intervention for public sector stakeholders: policy; incentives; and standards, metrics and regulations—plus critical entry points to enable private investment in adaptation.

With these in hand, it’s time to deploy efforts in concrete projects—and governments can apply them to pilot projects currently under discussion.

The Public-Private Infrastructure Advisory Facility (PPIAF) and the Global Infrastructure Facility (GIF) are ideally positioned to address steps three and four of these five entry points:

Between countries’ planning for their pledged Nationally Determined Contributions (NDCs) and the private sector’s interest lies a key bottleneck—creating a pipeline of bankable projects. While one-off deals remain possible, best practice relies on mainstreaming climate adaptation within the enabling policy and regulatory environment for infrastructure projects more generally.

PPIAF and GIF can address this midstream phase, helping countries find the right balance between mainstreaming climate adaptation into the enabling environment framework and applying tailor-made advice to each project.

Data is king

PPIAF has new resources through its Climate Resilience and Environmental Sustainability Technical Advisory (CREST). The Philippines is benefiting from these to integrate climate change adaptation and green financing options into wastewater and sanitation PPPs. Similarly, technical assistance is being deployed in Indonesia to introduce climate resilience in guidelines for implementing PPP projects. Also, Egypt is receiving support for its climate-resilient railway infrastructure and operations. In most of these cases, PPIAF addresses the availability and disclosure of data—the first barrier listed above.

It's always about incentives

When it comes to bringing the private sector on board, it’s about creating an even playing field with the right incentives. Several means exist for projects’ structuring, such as key performance indicators; contractual clauses (better defined force majeure); risk allocation (that includes insurance), procurement requirements; and—of course—better design and technical characteristics.

GIF systematically ensures that its activities are analyzed for opportunities to generate positive climate mitigation and/or adaptation and resiliency co-benefits and alignment with governments’ NDCs. For example, GIF and the Inter-American Development Bank are working with municipalities in Sao Paulo to advance feasibility analyses and determine the project scope for an intercity train system that will significantly reduce greenhouse gases, ensuring that climate-related risks are considered as the project moves to the design and structuring phase.

GIF is also part of FAST-Infra (Finance to Accelerate the Sustainable Transition-Infrastructure), which seeks to establish a consistent, globally applicable labelling system for sustainable infrastructure assets—a “Sustainable Infrastructure” label. GIF and the Macquarie Group are co-chairing a working group focused on creating this label, which will promote infrastructure assets’ positive contribution to climate mitigation and adaptation, resilience, and nature-based solutions—among other sustainability dimensions. As it turns out, we’re launching the public consultation on the labelling system today. Please feel free to share your thoughts and expertise here.

Filling in the advisory gap

While investment and finance stakeholders have improved their exposure and capacity to integrate and measure climate considerations, advisory services for governments have lagged.

PPIAF and GIF, together with IFC, are developing toolkits to encourage private investment in low-carbon, climate-resistant infrastructure in developing countries. These toolkits will demonstrate actionable work that countries can use to complement successes in pilot countries and beyond.

Stay tuned for these and other developments on this topic as we see more and more stars align in support of sustainable, green infrastructure solutions.

Related

FEATURE STORY: Unlocking Private Investment in Climate Adaptation and Resilience

REPORT: Enabling Private Investment in Climate Adaptation and Resilience : Current Status, Barriers to Investment and Blueprint for Action

VIRTUAL EVENT: Enabling Private Sector Investment in Adaptation: Current Baseline, Barriers for Investment and Proposed Blueprint for Action

Related Posts

How do we link private sector participation and climate resilient infrastructure right now? Some ideas from PPIAF

The developing world is crying out for greater private investment in sustainable infrastructure

Bouncing back is not enough. Let’s bounce forward to infrastructure resilience

Join the Conversation