(Photo: Getty Images)

There is a huge need for new and upgraded infrastructure around the world, particularly in emerging markets. Policy makers like to talk about raising trillions of dollars to fund infrastructure, but the truth is that capital for good projects exists. Regulation and lack of policy clarity are inhibitors.

What lacks is a strong pipeline of projects that meet societal needs and are financeable. If we can increase the quality of projects, and encourage smart and efficient regulations, the money to fund them will follow.

As an investor and infrastructure technology provider in 180 markets, GE surveyed its global investment, sales and policy teams for their insights on what is holding up progress.

We identified several areas that should be prioritized by the international community and local governments.

Write the Right Rules

1. “One-Stop Shops” for Approvals

GE’s experience is that a major decelerator of projects are slow or unclear permitting and approvals systems. The World Bank and other International Finance Institutions (IFIs) have teams working on permitting simplification and training; they are unsung heroes. Even more focus and funding should be channeled to programs that streamline processes, and promote best practices — such as in Chile, which has successfully centralized permitting and approvals.

2. Tendering

GE is fully committed to and supportive of competitive tendering. However, we have seen it slow down or derail critical projects with short timelines. We believe that in some cases, such as the need for critical power, sole sourcing can greatly accelerate projects without sacrificing price or quality. The development finance community should apply cost-benefit analysis to consider when unsolicited bids and direct negotiations can offer efficiencies.

Recognize and Reduce Risks

3. Risk guarantees

IFIs have developed innovative products such as Partial Risk Guarantees and Partial Credit Guarantees, to mitigate political, off-taker, and sovereign risk. We have found that these guarantees are not utilized to their full potential. IFI’s should do more to promote their programs and make them easier for project developers to use by standardizing terms and qualification criteria. Countries and their procurement authorities should work with developers to engage IFIs regarding these programs, early and often in the development process.

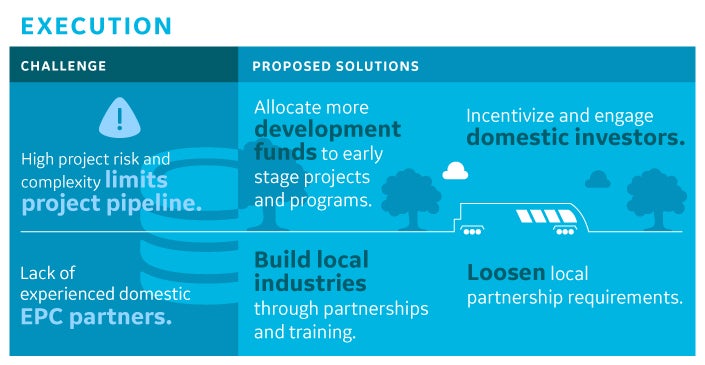

Execute Faster and Better

4. Early stage funding

The GE team, along with most others in the infrastructure space, agree that to move projects forward, more funding for early project development is needed. Groups like IFC have made strides in sourcing and allocating funds and risk for early stage development. Continued patience, capital and political support is needed from IFI member countries to stand up and execute development programs that can tackle the early stage funding gap.

5. Building local EPCs

It remains important for countries to encourage local engineering, procurement, and construction (EPC) sector involvement. However, GE has, on several occasions, seen projects get stalled or discontinued due to forced collaborations between global and local developers that yield diminishing returns from a time, quality and cost standpoint. In some cases, countries should loosen joint venture or equity risk participation mandates for local EPCs. At the same time, there is a great opportunity to use the strong knowledge sharing capacity of global development organizations to increase training for local EPCs so they can compete for projects more effectively, and build a track record of bringing them to fruition.

Unlocking a stronger and more financeable pipeline of infrastructure projects is critically important. It is getting a lot of attention, but progress is slow. GE will continue to build relationships, advocate and share experiences that will inform policy makers and drive industry to deliver infrastructure solutions in the countries that need it the most.

Unlocking Infrastructure Investment in Emerging Markets

This post by David Nason originally appeared in GE Reports on April 10, 2017.

Disclaimer: The content of this blog does not necessarily reflect the views of the World Bank Group, its Board of Executive Directors, staff or the governments it represents. The World Bank Group does not guarantee the accuracy of the data, findings, or analysis in this post.

Join the Conversation

Very apt article and I agree with the panacea recommended. However, there is the political side to issues such as this. Lots of sentiment rules when decisions are made. There are instances where procurement procedures are pushed aside due to the need to score (selfish) political point. Investors have to be supported by their government of origin in maintaining transparency.

Actually , infrastructure projects through the World by PPPS which is achieved primarily by the World Bank are appreciated by the developing countries because they need them very urgently. The World Bank among other international institutions are not only supporting funds , but also giving beneficial advice , high quality training and consultation to these countries in order to accelerate projects... and trying to minimize potential risks . Actually , it is clear that all these projects whether PPPS or any other future projects that the World Bank and the other concerned international institutions are doing , are considered a steady successful steps towards the development of the globe with very high quality These world financial institutions actually care. Yours Very Respectfully, Dr. Mohamed Taher Abdelrazik Hamada,Ph.D Retired Professor at Strayer University, USA Address [redacted]

Read more Read lessInterestingly sub Sahara projects development market Witnessed so many international conniving with d local in turning at terrible Risk in and resulted in abandoned projects or lost time N values becoming moribunds in all aspects of development of d needed infrastructure

In Nigeria we have shortage of PPP experts. As a matter of fact most policy makers define PPP to include every venture in which the government has a stake alongside private investor. Some sub national entities venture into PPP transactions without any framework and preparedness in terms of making information available to the investing community. For these reasons, amongst others we have experienced... serious investor reluctance to participate in PPP transactions. The political system in Nigeria does not support serious investment in infrastructure through PPP. Fluctuation in government policies depending on who or which party is in power affect PPP arrangements no matter how sound the contractual documentations are drawn. A new government can frustrate a PPP arrangement entered into by the previous government without violating the existing agreement. World Bank support had been tremendous and more is needed really bridge the infrastructure gap in the EMDEs. Thank you. Nufi Barnabas Yohanna Legal Adviser, Kaduna Investment Promotion Agency (KADIPA), Kaduna State, Nigeria.

Read more Read less