Editor's Note: Join us April 22nd at 10AM ET for the 2017 Global Infrastructure Forum when the Multilateral Development Banks (MDBs), the United Nations, the G-20, and development partners from around the world meet to discuss opportunities to harness public and private resources to improve infrastructure worldwide, and to ensure that investments are environmentally, social and economically sustainable. Check out the event site to view the livestream on April 22.

This post was originally published on the International Finance Corporation's Medium channel.

Infrastructure projects should be a natural fit for large private investors.

Institutional investors — particularly pension funds and insurance companies that together manage more than $70 trillion in assets — need long-term instruments with stable cash flows to help them meet their long-term commitments.

At the same time, developing countries are searching for vast amounts of investment to build the transport links, power systems, and telecommunications networks they need to modernize their economies and lift millions out of poverty.

The $1 trillion that’s currently invested annually in infrastructure will need to triple over the next decade if we are to meet the UN Sustainable Development Goals.

Yet despite the potential match, institutional investors have been slow to invest in infrastructure in developing countries. Risks — both real and perceived — are often cited as the main obstacle to long-term investments.

The result: many poor countries remain unconnected to global markets and funding sources. In the long run, this may prove to be a major obstacle to achieving the Sustainable Development Goals.

To help match institutional capital with emerging market infrastructure investment, IFC recently launched the Managed Co-Lending Portfolio Program (MCPP) for Infrastructure initiative.

In a nutshell, MCPP Infrastructure adapts IFC’s existing co-lending model to the needs of institutional investors looking for long maturities and stable cash flows.

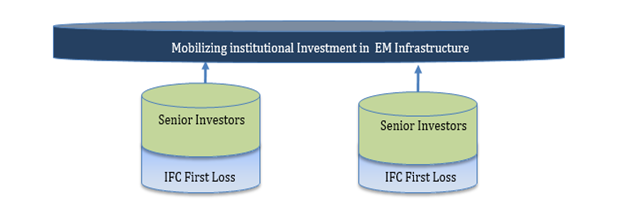

Investors commit capital in advance, to be invested alongside IFC funds, within certain country and sector limits. To match the risk appetite of institutional investors, IFC provides credit enhancement in the form of a first-loss tranche.

In setting up the first phase of the initiative, IFC has benefitted from the partnership and support of the Swedish International Development Cooperation Agency, which provides a guarantee on a portion of the first loss position in exchange for a guarantee premium.

Importantly, MCPP Infrastructure will add value in terms of development impact — by enabling projects to access new pools of capital in order to reach closure, while also demonstrating that it is possible to mobilize private investors to go outside of their comfort zone. The initiative also allows institutional investors to generate predictable revenue streams and achieve greater portfolio diversification.

The process is designed to be transparent and objective, and to maximize efficiency. Eligible infrastructure projects will be in the power, water, transportation, and telecoms sectors, all of which provide the stable, long-term cash flows that investors demand.

The first phase of the MCPP infrastructure initiative will involve partnerships with two to four investors, with a goal of raising between $1.5 billion and $2 billion. The program will later be scaled up to mobilize additional volumes — up to $5 billion is expected over the next three to five years.

Scaling up private capital for sustainable infrastructure will be a key issue when the Multilateral Development Banks meet for their Second Global Infrastructure Forum in Washington DC on April 22. By developing an innovative way to engage private institutional investors, MCPP Infrastructure should be a source of inspiration.

We look forward to hear from you: Flagging a new World Bank Group consultation on the Guidelines for the Development of a Policy for Managing Unsolicited Proposals in Infrastructure Projects. Submit your feedback here - Now open through May 7, 2017.

Join the Conversation