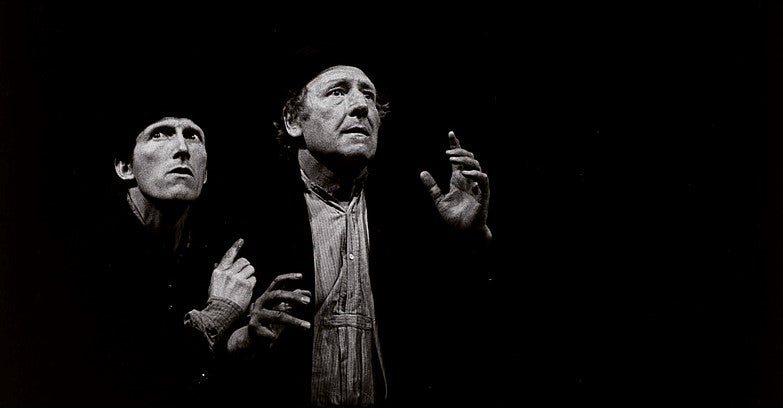

Waiting for Godot, Avignon Festival, 1978 © Gallica Library.

Waiting for Godot, Avignon Festival, 1978 © Gallica Library.

This post was originally published on Project Syndicate

To ensure that anticipated foreign investment actually arrives, governments need organizational capabilities that go beyond Adam Smith’s maxim that they must do no more than ensure “peace, easy taxes, and a tolerable administration of justice.” They need to do at least three additional things.

The scenario is all too familiar. A reformist government wants to boost economic growth and employment by implementing market-friendly reforms designed to make the country more attractive to (often foreign) investors. Policymakers understand that these investors possess the technological prowess, organizational capability, and market reach that the country desperately needs. Committees are created to improve the country’s performance in the World Bank’s Doing Business index, the World Economic Forum’s Global Competitiveness Report, or other beauty contests promoted by a sprawling array of international rankings.

The reformist government overcomes grueling fights with legislators and civil society, who accuse it of putting investors’ interest ahead of those of its own people. But with perseverance, it successfully adopts reforms that improve the country’s rankings and gets glowing coverage in the international press. The learned world’s impression of the country (and even that of money managers) changes significantly for the better. And then the government waits for foreign investment to arrive. And waits. And, as in Samuel Beckett’s famous play, the anticipated inflows, like Godot, never show up.

This problem stems in part from assuming that what needs fixing is captured in international rankings. Too often it is not: worldwide, there is zero correlation between improvements in the Doing Business and Competitiveness indexes and growth or investment performance.

Often, the focus of such rankings is on reducing red tape, which assumes that investors stay away because of some sin of commission, which, if stopped, would release the floodgates. But the world is more complicated than that. Most people who could potentially do well by investing in your country know a lot about their business but probably know very little about your country—particularly the things about your country that matter for their business, including the ones you just reformed. More important, their business usually depends on things you should be doing but aren’t—your sins of omission.

For example, manufacturing requires industrial zones with power, water, security, logistics, and access to a labor force that can get to the worksite. Fresh produce requires cold chain logistics, certifications, a green lane at customs, and government-negotiated phytosanitary permits. Eliminating burdensome regulations and cumbersome controls is far easier than establishing these systems. Given your limited resources, you cannot do it all, which means that you are doomed to choose the areas where you will devote special attention to create the required ecosystem.

Moreover, you need to be deeply knowledgeable about these areas. You need to understand what potential activities require and what about your country makes them more or less likely to succeed. But assuming you do this for some chosen area, how do you avoid waiting for Godot once again, especially after all that costly effort? And will you ever recoup those costs?

To avoid this predicament, governments need organizational capabilities that go beyond Adam Smith’s maxim that they must do no more than ensure “peace, easy taxes, and a tolerable administration of justice.” They need to do at least three additional things.

First, the government needs to engage with existing economic activities to identify what it can do to improve their productivity, whether by changing rules, infrastructure, or other publicly provided goods and services. These engagements need to be narrowly focused, typically along value chains, to enable the identification of sufficiently detailed problems. For this reason, economy ministries must organize quite a few of them, as with the deliberation councils that started over a century ago in Japan and have been emulated elsewhere. There are more than 200 such councils in Japan, including for Sumo wrestling.

Second, the government should mobilize society and domestic and foreign firms to explore the “adjacent possible”: activities that do not exist but for which the requisite ecosystem is almost in place. This requires people in and out of government to imagine what is not yet there, figure out what is needed to establish it, and determine whether it would be both feasible and valuable to society. This exploratory process is both costly and risky, although recent advances such as the Atlas of Economic Complexity make it less of a crapshoot, by revealing relevant information for assessing the feasibility and the attractiveness of potential new industries. To implement these strategies, governments need to reform their current “investment bureaus,” which often do little more than authorize or handhold investors. Instead, these entities should help promote the government’s diversification strategy by identifying foreign firms that are in a desired industry, but not yet in the country, articulate the business case for investment, and lead the negotiations.

Third, and most controversially, governments often need a corporation to facilitate investment in new strategic areas and manage the activities generated by previous strategic investments. These corporations may be set up as holding companies for already existing state-owned enterprises that currently report to their respective line ministries. The ministries should focus on their regulatory functions, leaving the holding company to provide close financial and operational oversight and exercise shareholder rights on behalf of society. The holding company can also be capitalized with assets that the government already owns.

These corporations should use part of their proceeds for pre-investment activities in new potential areas and use their knowledge of the country to create joint ventures with firms that have knowledge of targeted industries. In fact, by being an equity partner, the corporation can capture the upside of government efforts to fix the ecosystem. The corporation should also explore opportunities for divestment of existing holdings in order to free up capital needed to advance the economic diversification strategy.

Conventional wisdom discourages governments from creating such corporations on the grounds that the risks of poor governance and bad performance are too large. A more useful approach would be to develop the tools and mechanisms to ensure good and improving governance. Published audited financial statements, high technical capacity (facilitated by salaries and career paths that are competitive with the private sector), powerful advisory boards with foreign participation, and partnerships with institutions such as the International Finance Corporation (the World Bank’s private-sector lending arm) could create the right environment for excellence.

Once governments have taken these steps, they may no longer have to wait for Godot. They may simply go fetch him.

Disclaimer: The content of this blog does not necessarily reflect the views of the World Bank Group, its Board of Executive Directors, staff or the governments it represents. The World Bank Group does not guarantee the accuracy of the data, findings, or analysis in this post.

Related Posts

Private sector infrastructure financing brings well-being and equity: Can we prove it?

PPIAF’s recipe for enabling PPP finance: Good infrastructure governance

More and better infrastructure services: Let’s look at governance; financing will follow

This blog is managed by the Infrastructure Finance, PPPs & Guarantees Group of the World Bank. Learn more about our work here.

Join the Conversation