Finance Ministries actions to implement the Global Biodiversity Framework and halt and reverse nature loss

Finance Ministries actions to implement the Global Biodiversity Framework and halt and reverse nature loss

During COP15 of the Convention on Biological Diversity (CBD), in December 2022 in Montreal, a message was clear: Ministries of Finance play a critical role in achieving commitments set out in the Kunming-Montreal Global Biodiversity Framework (GBF).

As a parallel to the 1.5 degree goal set out in the Paris Agreement, the GBF hinges on a vision to “live in harmony with nature by 2050”. To achieve this, the GBF sets a mission to halt and reverse biodiversity loss by 2030, underpinned by 23 action-oriented targets. These cover protecting 30 percent of land and sea, restoring 30 percent of degraded habitats, restoring ecosystem functions and services, ensuring just and equitable access and benefit-sharing to all people. The GBF also calls for aligning financial flows to support this vision and mobilizing resources for implementation.

The GBF does not only focus on nature conservation or restoration - it aims to address the causes of nature loss throughout all of the economic activities. This means the GBF targets are being directly relevant to “green financing” as well as all other “non-green” activities, in particular key productive sectors in need of transition such as agriculture, forestry, extractive industries, and infrastructure. Domestic implementation of the GBF is through national biodiversity strategies and action plans (NBSAPs) that all parties to the CBD have committed to updating by COP16 in 2024.

What do GBF targets mean for the Ministries of Finance?

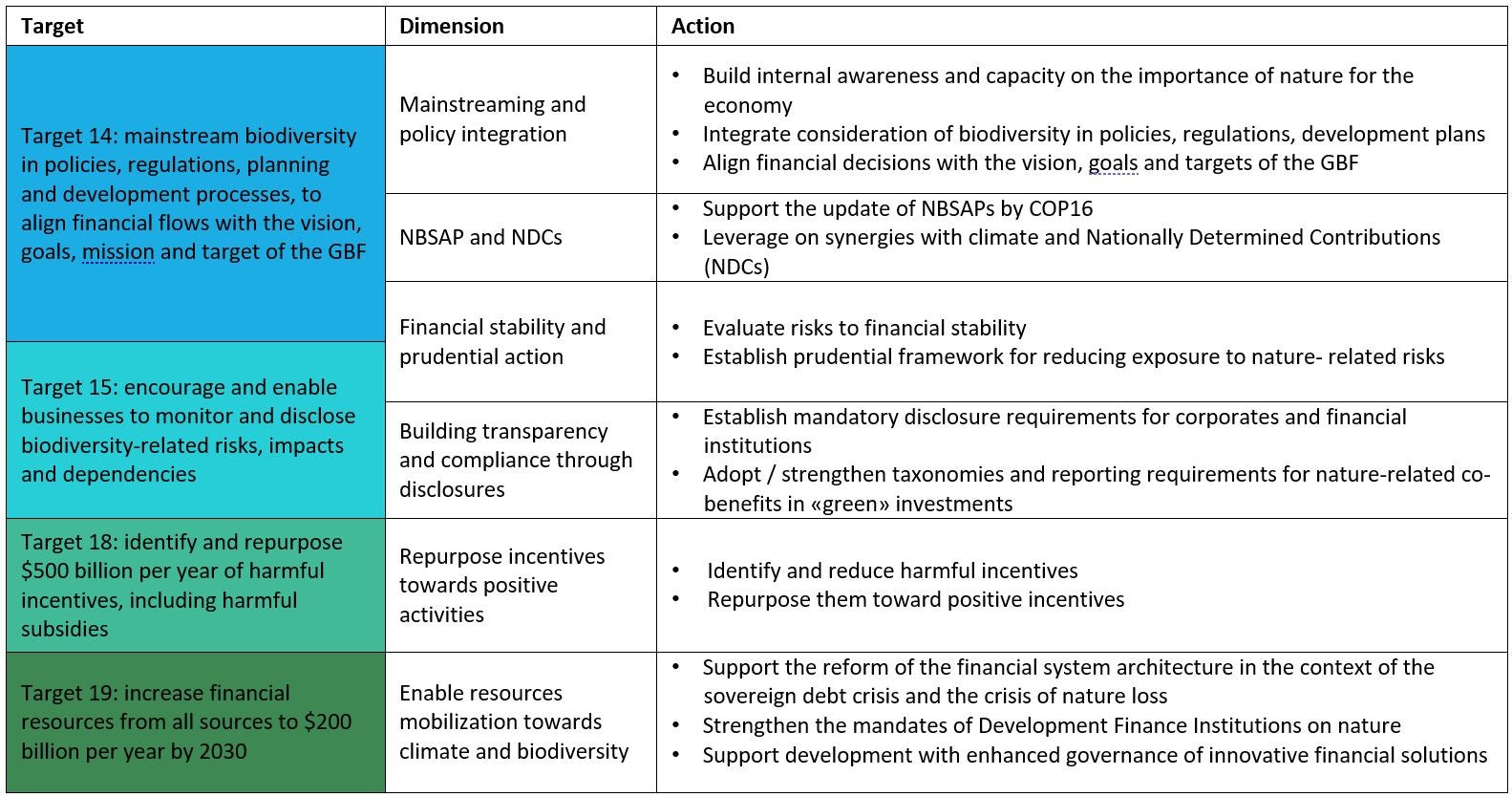

A high-level roadmap for aligning financial flows with the GBF, released in July, provides a plan of action for the financial industry. The roadmap draws upon various publications and other guidance from financial sector initiatives and coalitions, including the reports on Climate- and Nature-related Financial Risks by the Coalition of Finance Ministers for Climate Action (Coalition). The following table highlights those actions particularly relevant for the Ministries of Finance.

Aligning financial sector flows with the GBF: Actions relevant to the Ministries of Finance

Source: Adapted from High-level Roadmap for Aligning Financial Flows with the Kunming-Montreal Global Biodiversity Framework, published by UNEP FI and partners on 13 July.

Coalition members are working towards meeting the GBF targets.

In Chile, the establishment of a Natural Capital Committee consisting of representatives from various government bodies – including the MoF - offers policy advice by measuring and preserving the country's natural capital, making it a central consideration in public policy and decision-making. The MoF will be reviewing its financial strategy for climate change, along with the development of a financial strategy for biodiversity, which will be merged as the next step. Additionally, Chile intends to identify nature-based investment solutions through Biodiversity, Ecosystems, and Landscape Assessment (BELA) initiative.

In France, the MoF is actively working on mainstreaming biodiversity through green budgeting. The MoF is evaluating with the Ministry of Environment the environmental impact of state budget expenditures, including biodiversity. The Energy and Climate Law enacted in 2019 encourages nature-related risk disclosure in the private sector. The country also aims to reduce harmful incentives by 2030, and with an independent report estimated estimating nearly $10 billion in harmful incentives in 2022.

In Mexico, the federal budget is aligned with the SDGs and includes 18 programs linked to SDG 14 (Conserve and sustainably use the oceans, seas, and marine resources) and 17 programs linked to SDG 15 (Life on Land). In March 2023 the MoF published Mexican Sustainable Taxonomy, which includes objectives on climate change mitigation and adaptation, and gender equality, and it is on track to include biodiversity as its objective as well. In addition, the MoF participated in the GBF Fund negotiations and is working with other line ministries on updating the National Biodiversity Strategy to incorporate the GBF’s targets.

In Uganda, the The Ministry of Finance, Planning and Economic Development (MoFPED) is integrating biodiversity in long-term public sector strategies. The MoFPED also fiscally decentralizes funding for biodiversity policy goals: for example, allowing Uganda Wildlife Authority, an agency responsible for managing important biodiversity areas - to deploy revenues as they come in based on the urgency of actions. The MoFPED, in cooperation with other ministries, is working on implementing a budget tagging tool, to allocate funds specifically for nature and biodiversity-related initiatives. Additionally, to inform policy makers an ecosystem services account in addition to other natural capital accounts have been prepared. The MoFPED is also working with Bank of Uganda and development partners to mobilize private sector resources for nature, and work is underway to establish nature-related disclosure requirements.

In the UK, significant progress has been made in natural capital accounting, especially to inform spending reviews and fiscal events. The UK’s supplementary Green Book guidance on “’Enabling a Natural Capital Approach’ to Policy and Decision-Making" provides guidance on evaluating and monetising natural capital impacts. The UK has set a goal to mobilise £500 million of private finance per year into nature’s recovery in England by 2027. The UK has also launched: the Green Financing Programme, launched in 2021, has raised £29 billion to support projects with clear climate and environmental benefits; The Big Nature Impact Fund, launched at COP 27, combines £30 million public and private investment to finance high-integrity nature projects, such as carbon sequestration. The UK also supports the Taskforce on Nature-Related Financial Disclosures (TNFD) and looks forward to the upcoming publication of their framework.

While there is still work to do, the high-level roadmap and the experiences of implementing it as presented by the six countries, offer the insights into the practical steps necessary for the aligning the financial sector flows with the GBF. What is clear is that an environmentally sustainable future will require increasing MoF involvement - and understanding of its role is a first important step for achieving global biodiversity goals.

Join the Conversation