The global economy will likely contract by over 5 percent in 2020 due to the impact of COVID-19, according to the recently released Global Economic Prospects. The deepest global recession in eight decades is sending hundreds of millions into poverty, and recovery appears to be far off. Still, the crisis has encouraged incentives for economic transformation and adoption of digital business models, including increased use of digital financial services (DFS).

Digital financial inclusion was a development priority before the COVID-19 emergency; now, it is indispensable for both short-term relief and as a central element of broad-based, sustainable recovery efforts. There are challenges to accelerating digital finance, but also, increasingly, an understanding of how to overcome these obstacles and reduce risks.

This year, the Global Partnership for Financial Inclusion (GPFI) developed High-Level Policy Guidelines (HLPGs) on Digital Financial Inclusion for Youth, Women and SMEs, which were recently endorsed at the meeting of G20 Finance Ministers. The World Bank Group produced background reports that informed these guidelines—for women’s financial inclusion with the Better Than Cash Alliance and Women’s World Banking, and innovations in small- and medium-enterprise (SME) finance with the SME Finance Forum—leveraging insights from country advice and operations as well as from extensive empirical research. Two issues raised in these documents are: the importance of access to digital technology and infrastructure, and the opportunity to accelerate digital financial inclusion through large volume payments. Both are highly relevant today as the world copes with COVID-19.

Access to digital technology and infrastructure for DFS

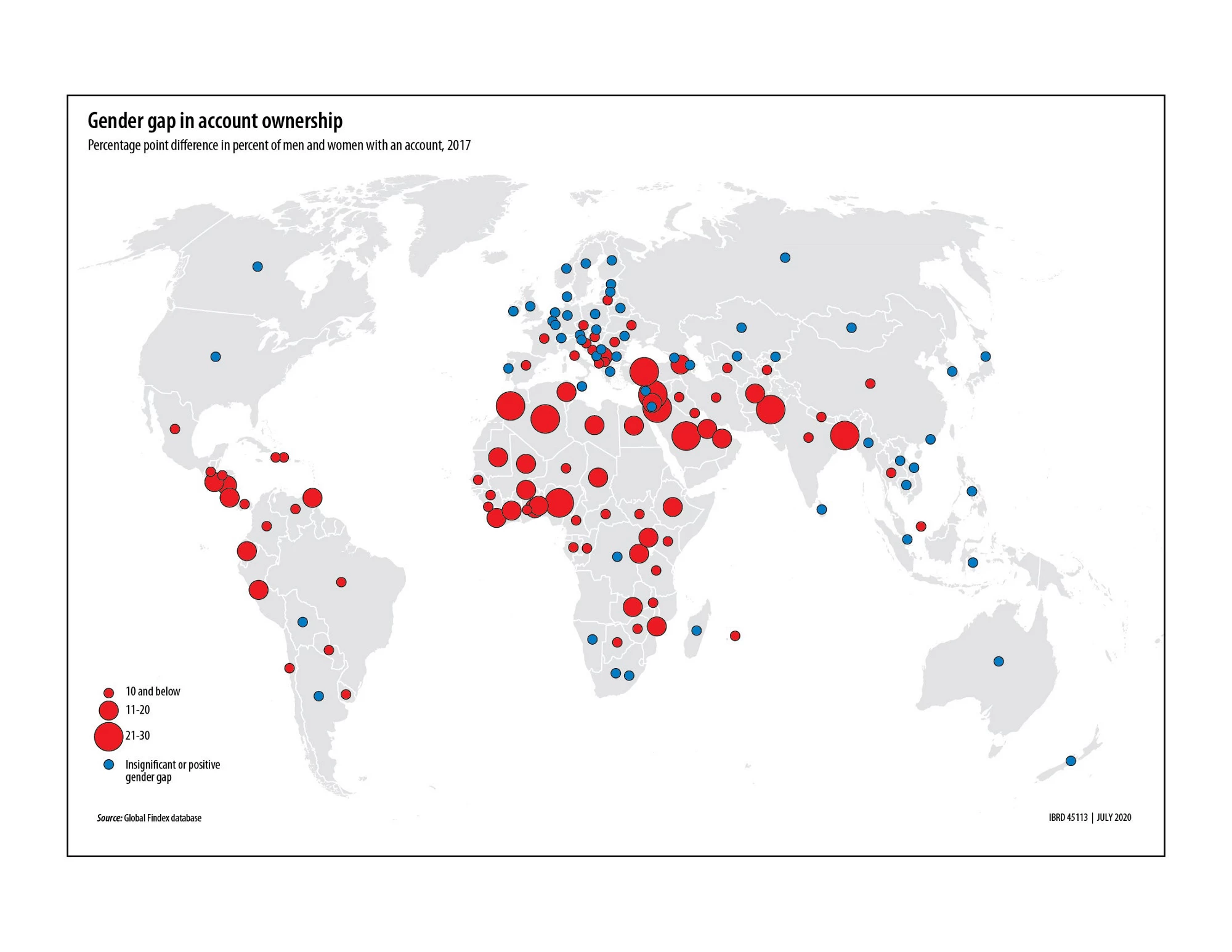

Women in low- and middle-income countries are much less likely than men to use financial services (9 percentage points) or own mobile phones (8 percentage points). Experience in the Africa region suggests that mobile money services, such as M-Pesa in Kenya or MTN Mobile Money in West Africa, can close the gender gap in financial inclusion more rapidly than traditional banking products. In the Middle East and North Africa, an estimated 65 million women who don’t have bank accounts have mobile phones—a ready-made opportunity for deployment of DFS. Proactive government policies to support women’s ownership of mobile phones can help close both the technology and financial inclusion gap.

Other elements of digital infrastructure and policy essential for achieving financial inclusion involve digital identification and electronic Know Your Customer (eKYC) technologies. The COVID-19 health emergency has spurred more countries to building this infrastructure, deploying online tools to create digital IDs to speed access to health care and relief services. Low-income countries, especially, are simplifying eKYC regulations.

Digitalization of small businesses strengthens productivity and improves their access to finance and markets. A study conducted by International Data Corporation (IDC) covering more than 3,200 SME CEOs from 11 different countries found that 49 percent of the CEOs believe that technology levels the playing field for small businesses versus larger corporations. From a macroeconomic perspective, the digitalization of SMEs can also enhance a country’s economic activity. It is estimated that the digitalization of SMEs in the countries comprising the Association of Southeast Asian Nations (ASEAN) could add $1.1 trillion of GDP value across the region by 2025.

Digital payments

For SMEs, one of the most valuable consequences of digitalization is improved access to information—both within the firm, to increase efficiency and profit maximization, and to create data for external partners including financial institutions. Digitizing payments generates massive amounts of detailed transactional data which can be used as a basis to estimate income, evaluate risk, and extend financial services. In Kenya, for instance, Kopo Kopo is a Fintech company that offers digital payment access to merchants through M-PESA, and then applies Big Data analytics to merchant payment transaction data to offer SMEs a range of value-added services, such as unsecured, short-term loans. Accelerating the development of digital payments for SMEs also strengthens the ecosystem for financial inclusion for consumers, allowing them to pay electronically, particularly important during this time of social distancing. Digital payments help formalize SMEs in emerging markets, which in turn can lead to the increase of overall economic output and expansion of the tax base.

Digital payments also provide a path toward financial inclusion for women—with strong evidence on the impact of government payments for women. Even before COVID-19, government payments (such as public sector wages, pensions, and safety net transfers) were the reason vast numbers of women—140 million, globally—opened their first bank account. In Argentina, for example, according to the 2017 Global Findex, approximately 20 percent of women who have an account opened their first account specifically to receive digital government payments.

The COVID-19 crisis is propelling a massive shift toward digital markets and digital finance. Handled responsibly, the digitalization of finance, for both individuals and firms, can reduce costs and open up new market and livelihood opportunities—helping countries rebuild better after COVID-19.

Join the Conversation