Global competition to attract foreign and domestic direct investment is so high that nearly all countries offer incentives (such as tax holidays, customs duty exemptions and subsidized loans) to lure in investors. In the European Union, the 28 member states spent 93.5 billion euros on non-crisis State Aid to businesses in 2014. In the United States, local governments provided and average of US$80.4 billion in incentives each year from 2007 to 2012.

In order to better understand the prevalence of incentives worldwide, the Investment Climate team in the Trade & Competitiveness Global Practice of the World Bank Group reviewed the incentives policy of 137 countries. Results showed that all of the countries that were surveyed provide incentives, either as tax or customs-duty exemptions or in other forms. Table 1 (below) shows the rate at which these instruments are used across advanced and emerging economies. For instance, tax holidays are least common in OECD countries and are most prevalent in developing economies. In some regions they are the most-used incentive.[1]

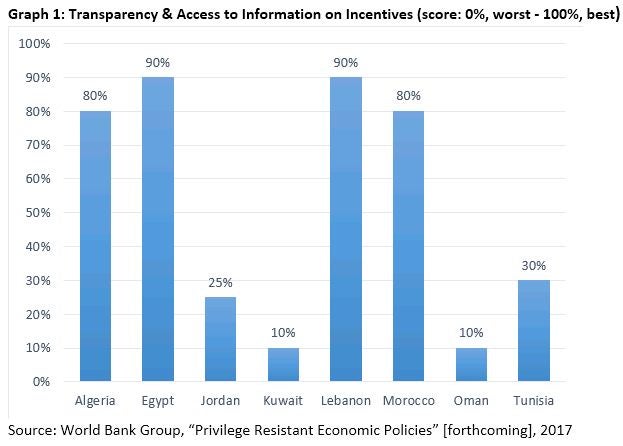

However, despite offering incentives, few countries meet all the requirements of a fully transparent incentives policy. These include: mandating by law, and maintaining in practice, a database and inventory of incentives available to investors; listing in the inventory all aspects of key relevance to stakeholders (such as the specific incentive provided, the eligibility criteria, the awarding and administration process, the legal reference and the awarded amounts); making the inventory publicly available in a user-friendly format; requiring by law the publication of all formal references of incentives; and making the incentives easily accessible to stakeholders in practice. A T&C study now under way on incentives transparency in the Middle East and North Africa (MENA) region showed that none of the eight countries analyzed has a fully transparent incentives policy. (See Graph 1, below.)

Five reasons why governments should care about incentives transparency

Boosting incentives transparency should be a key item in a government’s reform agenda for (at least) five reasons:

- Achieve higher benefits: Incentives transparency can help attract a larger pool of qualified applicants that can result in much higher socioeconomic benefits. For example, companies with high growth or social-impact potential that would meet the eligibility criteria often don’t apply for incentives because they are not aware of them. This can lead to under-investment or, in the worst of cases, a lack of investment. Especially in sectors where incentives can make a difference in an investor’s location decision, the country is deprived not only of the "lost" investment, but also of such benefits as more and better jobs and productivity. On the contrary, a lack of transparency can protect the interests of incumbents. When existing beneficiaries are not the most competitive to achieve government objectives, this can lead to suboptimal results. In the worst-case scenario, it can distort competition and facilitate unethical behavior.

- Reduce time and cost: Incentives transparency can help reduce the time and cost that companies spend trying to find information about incentives, making it easier to gain access to them. Investors often have to hire consultants to assist them in the process, which can be a costly undertaking, particularly in middle-income and high-income countries. This ultimately discourages businesses, especially small and medium-sized enterprises (SMEs), from applying. In addition, information about processes and procedures for obtaining incentives can help governments identify areas for streamlining, thus minimizing the administrative costs of granting incentives.

- Promote investment: Investment policy and promotion institutions have to compete in the global arena to attract and retain investors. They can leverage incentives information particularly in those sectors where incentives can make a difference for investors.

- Assess public expenditure: Most governments, especially in developing countries, are resource-constrained. Therefore, it is important for them to understand how their money is spent. Public finance authorities can use incentives information to assess fiscal expenditures and to make accurate budgets.

- Improve policy coordination: Incentives transparency can also help improve coordination among government bodies. In many countries, not all agencies are (fully) aware of the incentives provided by other entities. This can result in duplication, or even contradiction, ultimately wasting public resources.

How do we help clients increase incentives’ transparency?

In the last five years, T&C has helped the governments of over 20 countries reform their incentives policy. More than half of these interventions [1] were focused on improving transparency by creating an inventory of all the tax, customs-duty and financial incentives provided to investors by different agencies. With T&C’s help, Bosnia and Herzegovina, Kosovo, Kyrgyzstan, Jordan and Tajikistan have made their inventories public, increasing incentives transparency for stakeholders.

In the case of Jordan, before the inventory reform, only 13 percent of investors interviewed by T&C rated the information publicly available on incentives as "excellent." [2] Based on the transparency score from T&C’s forthcoming "Privilege Resistant Economic Policies" (PREP) study, [3] Jordan has also been one of the worst performers in the MENA region. With T&C’s help, Jordan developed a world-class inventory that is publicly available on the Jordan Investment Commission (JIC)’s e-portal. The inventory is underpinned by an internal IT solution administered by a dedicated team. In addition, in order to make the reform sustainable, the government adopted a notification that mandates its staff to update the inventory on a yearly basis. This reform will make Jordan one of the top performers for incentives transparency calculated using the PREP study’s methodology. (See Graph 2, below).

In the words of Husam Saleh, the chairman of the Jordan Garments, Accessories, & Textiles Exporters' Association (JGATE) and the CEO of Fashion Way Company: "The new e-portal and information presented [at the launch event recently held in Amman] will help the private sector to better understand service requirements and available incentives and regulations, which will reflect positively on Jordan's image and readiness as an investment destination."

Join the Conversation