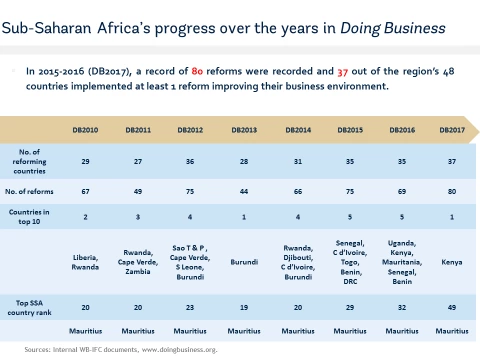

"Doing Business 2017: Equal Opportunity For All" was released on October 25, and it marked record progress for the business environment reform agenda in Sub-Saharan Africa. Implementing 80 of the 283 reforms recorded globally, Sub-Saharan Africa once again claims the status of the world's top reforming region. Beyond the record reform count, this year is also marked as the year with the highest number of countries in the region having passed reforms (37 out of 48), confirming that more and more economies in Africa are putting private-sector-led growth at the heart of their development agendas.

There is actual transformation tied to those rankings. For example: It now takes 156 days to build a warehouse in Mauritius, compared to 183 days in France and 222 days in Austria. Rwanda ranks second globally on the Getting Credit indicator, not to mention that, years ago, it used to take 370 days to transfer a property in Kigali, while today it takes only 12 days.

But, beyond the figures, a few additional thoughts come to mind.

How has Africa become not only better at reforming, but also become home to some good practice that inspires many to reform?

First, one should mention the unique momentum for reform. Most African countries’ development strategies place the private sector as the engine of their growth, and recognize that creating enabling business environments is a key pre-requisite to attract investments and encourages business expansion. That is a timely move from African governments, especially in the context of the present commodity-price fall, which calls on African countries notably to move away from an exclusive dependence on minerals and to diversify their growth models.

Then, Africa countries are simply getting better at reforming. A good sign of this is that reforming today costs less in Sub-Saharan Africa. Recent analysis shows that it costs on average of $310,000 to implement a reform today, versus $730,000 merely four years ago. That is a clear sign of increased efficiency. The capacity-building and hands-on assistance of World Bank Group teams to governments and implementing agencies throughout the region is beginning to bear fruit.

With that having been said, a lot more needs to be done. Many of the Sub-Saharan Africa countries still are in the lowest quartile of the ranking in Doing Business. The region today notably underperforms in such areas as Getting Electricity, Trading Across Borders, and Dealing With Construction Permits.

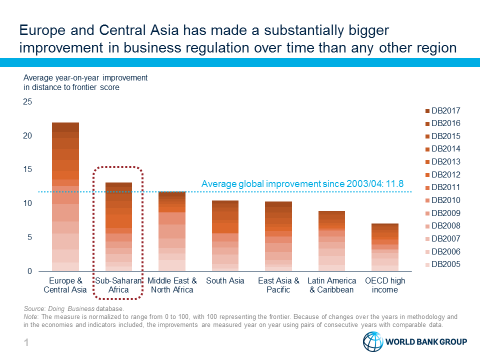

On Getting Electricity, the region’s economies rank on average 151st in this area, and it takes an average of 120 days to obtain a permanent electricity connection to the grid in Sub-Saharan Africa, compared to the global average of 93 days. Other areas where the region needs to perform better include Trading across Borders, and Dealing with Construction Permits, where sub-Saharan African countries rank on average 137th and 133rd globally. For countries in the region to continue improving the quality of their business environment, they will also need to increase their scores on the Distance To The Frontier – the gap separating a country from global best practice. Presently, African countries score on average 49.35 on this metric, and they reform consistently above the global averages, at a pace second only to that of the Eastern Europe and Central Asian region.

That said, the region shows a great variety in its performance and stands out as the region that has the biggest difference (52 points) between its best performer (Mauritius) and its worst performer (Somalia). To compare, the OECD group of high-income countries has the smallest difference of 18 points between the best and worst scores.

What all this means is that, while Africa is reforming, there is still quite some room for economies in the region to improve their competitiveness if they want to rival top global standards.

The World Bank Group can help Africa'sd economies accomplish that.

One way is for our programs to support African countries as they tackle the second-generation, deeper level of reforms that target infrastructural and institutional issues. The second-generation reforms should aim for further simplification of government-to-business (G2B) service delivery processes through the increased use of electronic solutions, making access to electricity more efficient and reliable, improving the quality of land administration, strengthening access to credit, or again strengthening legal frameworks to improve the efficiency of bankruptcy regimes and the protection of minority shareholders.

Evidence suggests that the successful DB reforming countries consequently expand business reforms beyond the DB indicators. Such countries as Rwanda, Kenya and Cote d'Ivoire, for exanple, have been implementing critical sector-specific and sub-national-level investment climate reforms.

Another way is to further enhance knowledge-sharing and peer-to-peer learning. WBG is already supporting this through the Ease of Doing Business Initiative (EDBI), which was launched six years ago at the request of African countries. EDBI initially gathered six countries to discuss successes and challenges in reforming. The last edition of the conference, in May in Nairobi, gathered reformers from 27 African countries and allowed for rich and very fruitful exchanges, inspiring more of the newcomers to reform. This year’s record number of reforming economies also has its source in the “reform buzz” taking over the region.

There is no silver bullet that leads to successful reform. But the Trace & Competitiveness Global Practice’s combination of technical guidance to governments to deepen and sustain the reform effort, along witrh exposure to best practice from the region, is proving quite effective. The momentum continues to build, and the reform count continues to increase, and that progress will surely pay off, over the long term, in positve human impact.

Join the Conversation