The global financial landscape is composed of nearly $500 trillion in financial assets. Yet, development financing needs, including for climate action, are confronted by an ever rising, financing gap. This is especially true in low and middle-income countries.

An underlying reason for this gap is a mismatch between investors’ risk-return appetites and the risk profile of investment offerings. Market failures, demand-side weaknesses, institutional capacity, policy shortcomings and inadequate risk-sharing mechanisms compound this challenge. The result: private capital flows remain woefully short of what they could be. With rising fiscal constraints across many of our client countries and increased climate finance needs, we must find a way to attract more private capital.

The Bank is uniquely positioned to address this challenge. We provide policy, knowledge, and technical support to our clients, build institutions and markets, address market failures, and support macroeconomic fundamentals that facilitate the flow of private capital. We must continue this work, even as we strengthen the private-sector enabling lens. But we must do more to narrow the risk-return gap that inhibits private capital from flowing.

Our typical approach has been to finance development expenses and assets such as roads, bridges, small and medium enterprises (SMEs), social and urban infrastructure, among others. This continues to be important and the Bank has established a good track record. However, a ‘financing assets’ approach has limitations when it comes to scaling up private financing. One promising way to bridge the risk-return gap is to finance risk capital. Covering for “risks” that private investors cannot accept alone would encourage them to invest. This approach could increase our development outcomes per dollar invested and, if done well, could crowd in tens of billions worth of private capital per annum into development via our projects.

Financing risk capital does not eliminate the risk itself. The question remains as to who de-risks. The World Bank, through its financing, already absorbs some of these risks. Absorbing too much risk would be counterproductive to our clients and adversely impact our rating, which is vital to maintaining the competitive, concessional, and long-term financing we offer to our clients.

This can be a win-win for countries on several counts. Investments, even in risk-absorbing capital can yield returns and are clearly better relative to simply expensing development activities, as is the case in the typical ‘financing assets’ approach. Market perceptions of project risk tend to overstate actual risk, which for World Bank projects is mitigated by its technical knowledge and project preparation. Risk-capital provision crowds in multiples of private capital, thereby ‘stretching’ World Bank project dollars more efficiently. Being a joint venture of sorts, brings efficiency gains and returns , even if government returns are pegged at levels lower than for the private sector, to crowd them in. This approach aligns with the Bank’s objective of bringing in private capital while maintaining financial sustainability.

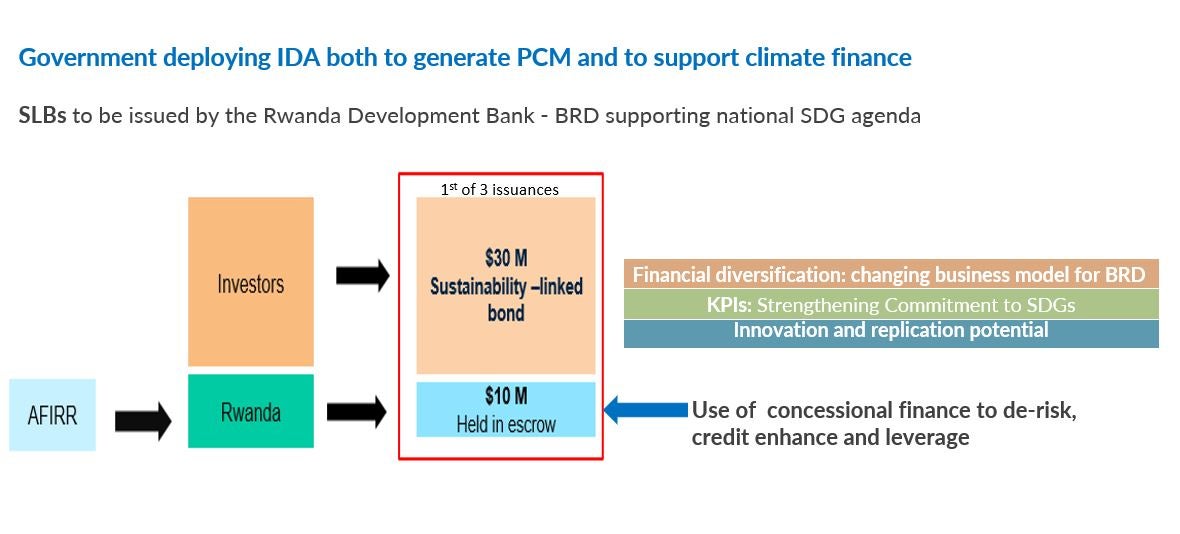

There are several World Bank project examples that underscore the viability of this strategy. In Rwanda, under Access to Finance for Recovery and Resilience Project, the Bank channeled part of its resources through the government to provide a collateralized first-loss credit enhancement for a development bank’s bond issuance (just closed), to leverage capital from financial markets to ultimately finance SMEs. Here, instead of doing what we would typically do – offer a line of credit for $40 million - we worked with the government in Rwanda to deploy roughly a third of that amount as credit enhancement and raise the balance from capital markets. While the amounts here are small, the idea itself is not about this project alone, but is about leveraging capital and outcomes that is fully scalable for wider application. Another example is an upcoming project in Turkiye, which is proposing for IBRD to lend to a domestic financial institution, who will set up an SPV-based PE fund for helping firms adopt more climate-friendly practices, thereby transforming IBRD funding into equity capital for a green-oriented SPV, and in turn attracting multiples in additional equity and via leveraging debt from financial markets. Other examples from Kenya, Mozambique, Angola are of financing the equity capital of funded risk sharing facilities for leveraging multiples from private financial institutions for SME financing.

Some countries are also independently applying this approach. For example, Malawi’s infrastructure facility, seeded by government capital, is professionally managed and leverages both equity and debt capital from the private sector. India’s National Investment and Infrastructure Fund initiated by government equity, successfully mobilized international and domestic private capital.

It is also critical for the public sector not to over-absorb risks. The private sector should continue to bear manageable risks. Equally, such an approach should not be used for activities that are otherwise feasible without public funding. Not every kind of engagement we support will be amenable to this approach, but it could apply to potentially a much larger part of our work.

Broadening financial and capital market development, enabling policy reforms, supporting strong pipeline development and knowledge-sharing, staff training and sensitization—all aimed at attracting private capital—will be critical for sustaining these endeavors. Financing risk capital – risk sharing, first loss, credit enhancement – via our lending projects, is yielding results and holds promise of leveraging more private capital into development and better optimize our public funding.

Join the Conversation