Construction site

Construction site

When the 1966 earthquake hit Uzbekistan, the entire capital city of Tashkent trembled. This powerful earthquake leveled hundreds of buildings to the ground. Many countries–former fellow Soviet republics—rushed to help save people, clean debris, and reconstruct houses and infrastructure. In 3-5 years, the city was completely rebuilt. Today, Tashkent is a "Pearl of Central Asia" with rapid new construction, economic development, and population growth. Over the past decade, these three factors have completely changed the city's face.

The growth of Tashkent is happening in one of the most seismic areas of the region. There are other Central Asian cities whose development confronts seismic risk: Bishkek, Dushanbe, and Almaty, to name a few.

Countries in Central Asia are simply not prepared to face disasters. Besides earthquakes, they face floods, landslides, mudflows, wildfires, or avalanches every year. Since 2000, natural disasters in the region affected almost 10 million people and caused economic damages that exceeded US$ 2 billion according to EM-DAT. Climate change will make disasters worse and more frequent.

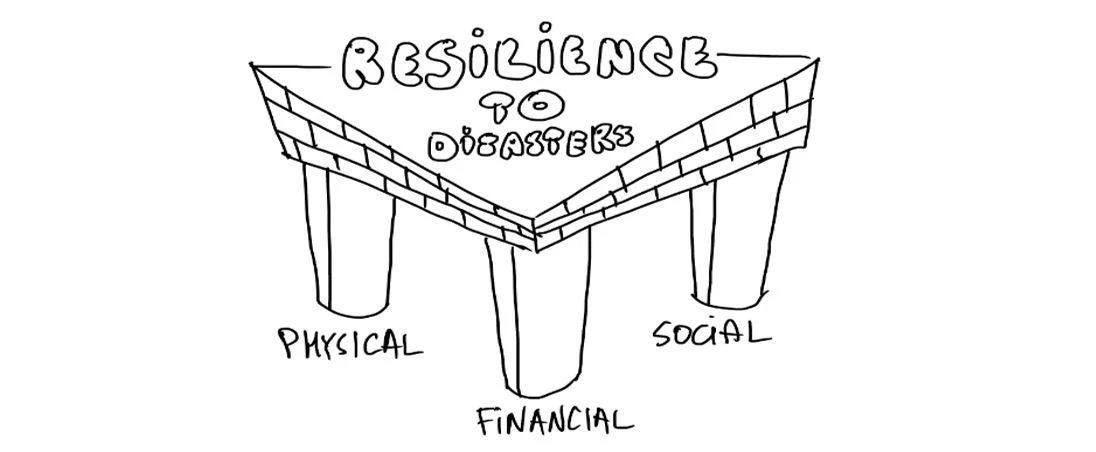

Resilience to disaster shocks is critical. Being more resilient means governments can manage risks as opposed to tackling them as they come and hoping for the better. Resilience has three pillars: physical, social, and financial (figure 1). Financial resilience or disaster risk financing is a preparedness approach to achieve financial management of post-disaster costs that is cost-effective and timely.

Figure 1: Pillars of Resilience to Disasters

Source: Authors based on World Bank (2019).

In Central Asia, governments mainly rely on their budgets: when disasters come, ministries of finance tap their reserve funds, reallocate the budget, borrow to the full capacity, and hope for fast solidarity funds to come from abroad. However, the public sector cannot deal with major shocks alone.

The private sector is largely not involved in financing disaster costs in the region. Insurance penetration is low in the single digits, and capital markets are underdeveloped. The Kyrgyz Republic is a pioneer in Central Asia. In 2015, the government established a mandatory disaster insurance program. Initially, they put in place the State Insurance Organization to implement it. Now, the government is building a public-private pool. This program still requires a lot of support to reach its potential, including because it still creates a large contingent liability for the government and covers less than 10 percent of people.

Other countries in Central Asia are just starting to explore financial preparedness. Tajikistan has adopted a Disaster Risk Finance (DRF) Strategy and is now exploring the creation of a disaster reserve fund. Uzbekistan is preparing to develop its first DRF Strategy. International finance institutions are helping these countries with analysis and capacity building, but much remains to be done.

What type of solutions can Central Asian countries explore? In the past blogs, we talked about risk layering and Cat bonds. Risk layering is important to cost-effectively combine different sources of financing.

Private-public partnership in disaster risk finance is another solution to examine. PPP could be a risk pool or first-loss fund (such as in the Kyrgyz Republic) that mobilizes both public and private capacities to provide speedy and adequate payouts for disaster-affected households. It can help reduce the country’s reliance on the state budget for major systemic events (such as the 1966 Tashkent earthquake).

For Central Asian countries, Türkiye is one good example to learn from. About 23 years ago, the country’s government created the Turkish Catastrophe Insurance Pool (TCIP), which by 2023 insured some 50 percent of all houses. Following the devastating 2023 earthquake, most payouts were provided within months.

Note that 10 years ago, following the Christchurch earthquake, it took New Zealand’s Earthquake Commission years to adjust and pay out all claims- many lessons have been learned since then. Besides reducing over-reliance on a public budget after disasters, PPP solutions can also help make payouts faster, more transparent, and better targeted.

PPPs are critical for robust disaster risk financing. For a major shock, experience shows that neither the public nor the private sector can deal with the financial repercussions alone. With sustained economic growth and rapid urbanization, PPPs are at the heart of solutions to manage post disaster impact in Central Asia.

Join the Conversation