Danilo Pinzon World Bank 2011 Worker at waster water treatment facility Manila Phillippines

Danilo Pinzon World Bank 2011 Worker at waster water treatment facility Manila Phillippines

Part I. Why governments support SOEs during the COVID-19 outbreak and what are the market implications?

This blog is part one of a 2-part series on state-owned enterprises and COVID-19.

Part II. Policy principles on emergency state aid to SOEs, bailouts and nationalization

During and after crises, both developing and developed economies tend to resort to state intervention measures to achieve specific public interest objectives. Governments are under pressure to keep up public services and they need to guarantee supply of critical goods and services at a time when supply chains may be disrupted. In addition, governments seek to protect national interest or jobs in strategic sectors. These are all worthy goals. But if not properly designed, emergency support to State-owned Enterprises (SOEs) can often induce distortions and undermine corporate governance and transparency.

SOE are important market players that deliver key public services.

SOE assets were valued at $45 trillion in 2018, about half of global GDP, up from around $13 trillion in 2000. Another estimate credits SOEs for 20 percent of investment, five percent of employment, and up to 40 percent of domestic output worldwide in 2018. SOEs are important players globally—their share among the world’s 2000 largest firms doubled to 20 percent over the last two decades, driven by SOEs in emerging markets (Figure 1). SOEs are common in infrastructure sectors, such as electricity, resource extraction, telecommunications, transport and water, as well as in finance. Although the presence of SOEs may be justified to address market failures in some cases, it is important to consider whether private companies could provide the same goods or services in a competitive and more efficient manner.

Figure 1. SOEs as growing market players

Support to SOEs in providing essential public services, such as water, electricity, telecommunications and transport can be crucial in the short run. Even if state ownership of these companies is sub-optimal, failure to support them during this crisis could worsen an economic downturn and hurt jobs, public services, and livelihoods. Some governments have announced support packages for utilities, in exchange for subsidized prices and deferred payments for households. Moreover, many state-owned banks around the world were asked to extend credit to ease the burden on companies.

SOEs were also called upon as producers and providers of emergency supplies. During the COVID-19 outbreak, in order to ensure delivery of emergency goods and services, Governments have involved SOEs and large private firms by leveraging their capacities and delivery platforms. Especially when supply chains are interrupted or export bans for key goods are in place, governments sometimes engage SOEs to provide medical products or services. Indonesia has asked its state-owned aircraft manufacturer to produce ventilator prototypes. China provided corporate income tax and value-added tax incentives to companies engaged in producing medical supplies while also turning its SOEs to the masks manufacturing.

In some cases, governments resort to bailouts of major SOEs for national interest or to maintain jobs. These range from national airlines, utilities, national oil companies to broadcasting and banks.

In the air transport sector, where many state-owned carriers operate, insolvencies would not only disrupt service delivery, but also involve massive job losses. As a result, many governments invoked support measures to keep the companies in business. Based on a sample of 69 subsidy and state aid schemes in 33 countries to date in the air transport, most of the schemes (72.5 percent) are supporting private firms or are open to both SOEs and private companies, while around 27.5 percent of them target SOEs only (see Subsidy and State Aid Tracker). Beyond financial support, some SOEs also benefitted from exemptions from the competition law, notably in the air transport.

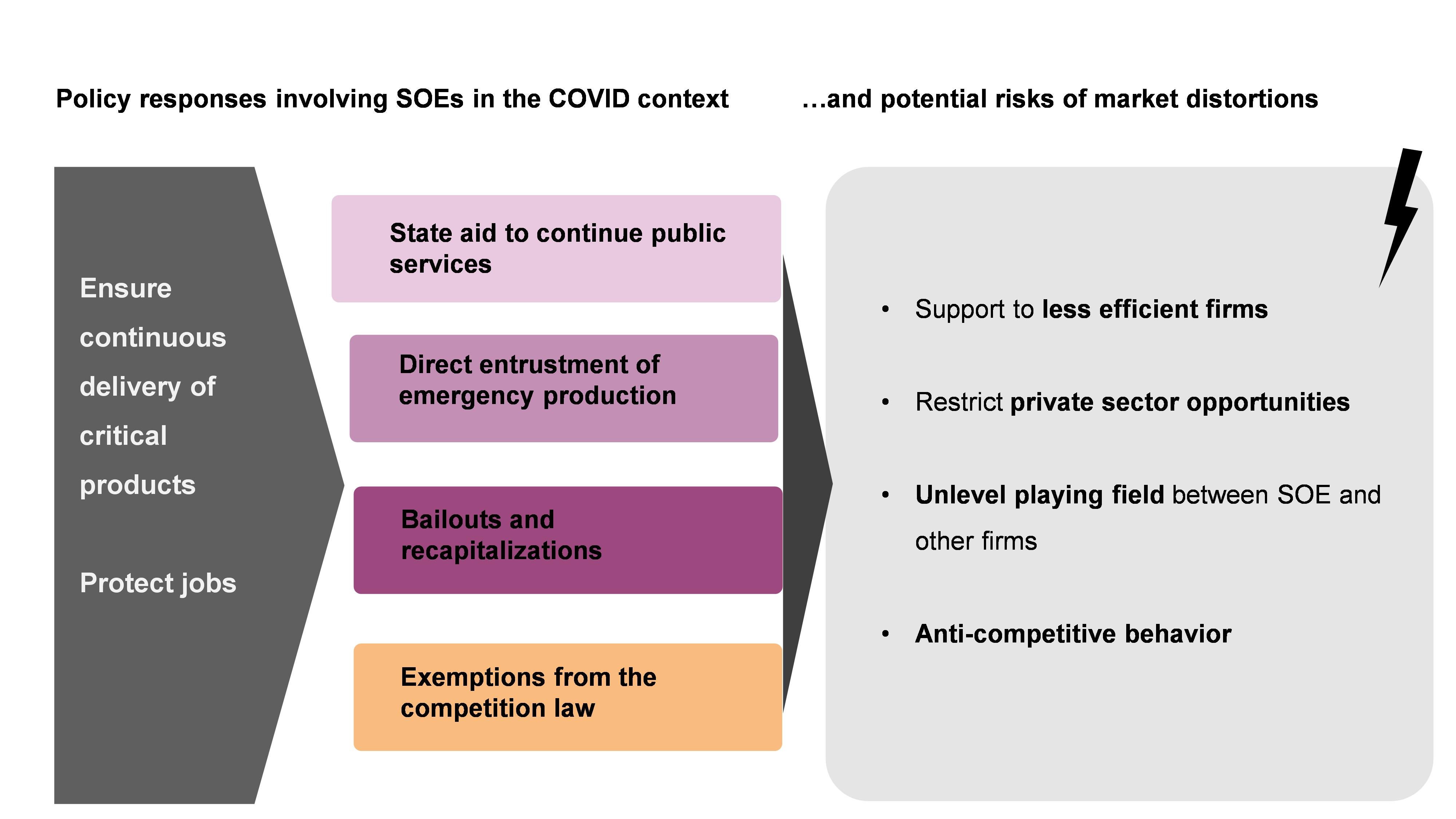

While emergency situations may require extraordinary measures, governments should to consider the impact of their SOE support measures on market dynamics. Now, protecting public interest and maintaining the economic stability are a priority. However, in the mid- to long-term, firm competitiveness and consumer welfare require preserving competitive and contestable markets. This requires vigilance regarding the risks of crowding out viable private firms, keeping zombie SOEs alive, and anticompetitive behavior (Figure 2).

Figure 2. Selected SOE-related Policy Responses and Potential Risks of Distortions

As credit becomes scarce, channeling state resources to SOEs can increase the risk of a subsequent financial crisis and delay the process of recovery from a recession. It is also critical to clarify that state aid should not be made available to firms that were failing or had structural issues before the crisis. That is why it is important to draw a distinction between firms whose difficulties stem exclusively from general market conditions caused by the crisis and those that are in distress because of endogenous reasons linked to their business models or practices, notably in competitive sectors.

In Part II, we will look at policy principles for guiding emergency state aid to SOEs to ensure markets are not distorted.

Join the Conversation