The private sector has long been a major player in infrastructure projects around the globe. Its contribution is important on many levels: besides making financial, technical and managerial resources available for infrastructure projects, its participation has policy implications that impact investment and development.

The World Bank’s Public Private Partnership Group and the Public-Private Infrastructure Advisory Facility (PPIAF) support public discussion on the role of private participation in infrastructure, or PPI. To provide relevant information on this topic, they maintain a PPI database that includes information on over 6,000 infrastructure projects implemented from 1984 through 2013 in 92 emerging economies. The information is useful for analysts, policymakers, private sector firms involved in infrastructure, donors, NGOs and other stakeholders.

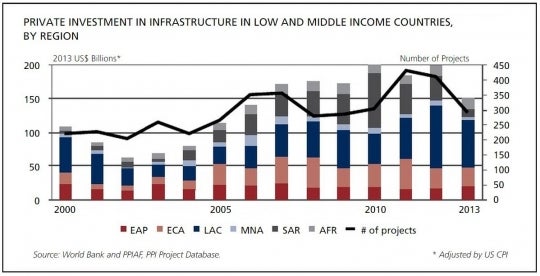

The data can be used to identify regional or sectoral trends. The recently-released 2013 Global PPI Update, for example, shows that PPI in 2013 in emerging markets fell by 24 percent in comparison with 2012, with decreases in Brazil and India accounting for much of the change. The data also show that investments in telecom and energy top the list, each accounting for 38 percent of global PPI.

Updates on PPI trends by sector, including transportation, energy, water and telecoms are also available on the PPI website. Site visitors can obtain project-level or summary data directly from the database and perform their own analyses.

The World Bank’s Public Private Partnership Group and the Public-Private Infrastructure Advisory Facility (PPIAF) support public discussion on the role of private participation in infrastructure, or PPI. To provide relevant information on this topic, they maintain a PPI database that includes information on over 6,000 infrastructure projects implemented from 1984 through 2013 in 92 emerging economies. The information is useful for analysts, policymakers, private sector firms involved in infrastructure, donors, NGOs and other stakeholders.

The data can be used to identify regional or sectoral trends. The recently-released 2013 Global PPI Update, for example, shows that PPI in 2013 in emerging markets fell by 24 percent in comparison with 2012, with decreases in Brazil and India accounting for much of the change. The data also show that investments in telecom and energy top the list, each accounting for 38 percent of global PPI.

From a regional perspective, Latin America and the Caribbean accounted for nearly half of PPI, at 46 percent of the total. Europe and Central Asia (ECA) came in at a distant second at 19 percent. Africa, however, saw an increase of 8.4 percent, reaching $14.9 billion, the highest for the region since 2008.

Updates on PPI trends by sector, including transportation, energy, water and telecoms are also available on the PPI website. Site visitors can obtain project-level or summary data directly from the database and perform their own analyses.

- Have you used data from the PPI database? Tell us your story in the comment section below.

- Read the 2013 Global PPI Update on Scribd

- Visit the PPI website.

Join the Conversation