Reunión con pobladores para hablar sobre catastro

Reunión con pobladores para hablar sobre catastro

When we think about the COVID‑19 pandemic, we often think about its implications on people’s livelihoods and health. However, an often-overlooked aspect is its consequences on local governments’ finances.

Cities around the world experienced 5 percent increase in expenditures and 10 percent decrease in revenues during 2020, on average, according to a study by the United Cities and Local Governments (UCLG) encompassing 22 countries. Local governments were faced simultaneously with an increase in expenditure due to the growing demand for health services and social assistance programs, and a decrease in revenues due to movement restrictions. Globally, this emergency highlighted the importance of strengthening subnational governments’ generation of local own-source revenues.

Land and physical properties are one of the biggest sources of untapped revenue for local governments; low taxation on them often relies on outdated cadastral bases not reflecting the reality of fast urbanization and growing population thus depriving municipalities of potentially greater incomes that correspond to the overall economic growth and wealth generation. Updated cadastral bases allow for better planning and monitoring of the real estate taxable base and its dynamics over time, helping municipalities to enhance their financial position and capabilities to manage taxes while increasing substantially their own revenues.

The case of Pereira, Colombia

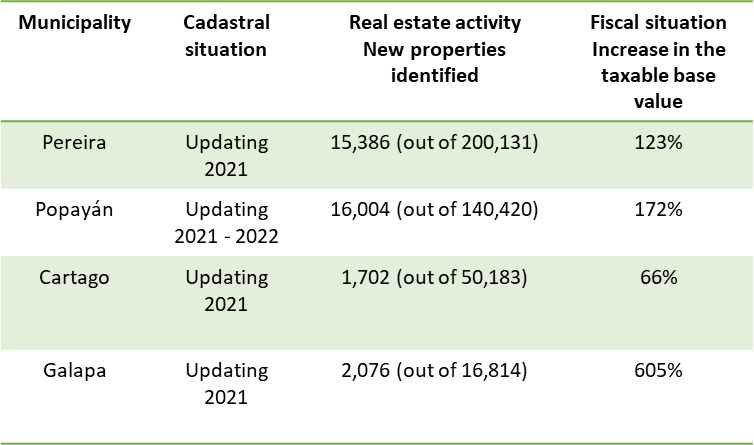

In 2021, the city of Pereira in Colombia embarked on a modernization and updating project of the urban and rural cadastral system. It adopted a new legal framework that fosters cadaster decentralization and allows cities to perform their own cadastral management, reverting historical dependence on national institutions. The city went from registering an estimated 185,000 properties in 2020 to 200,100 in 2021. With this, property valuation increased by more than 200 percent, and in 2021 taxation increased by 123 percent.

Main results from Ciudata+ in fiscal strengthening in Colombia

"In 2021, before initiating the update, the situation [of the cadaster] was critical. There was a 10-year delay in information registration in both rural and urban areas. The updating of the cadastral base was around 3 percent per year, leading to a huge lag in processing land transactions." expressed Dora Patricia Ospina, Pereira's Treasury Secretary.

With the new multipurpose cadaster, local administration and citizens will benefit in the medium and long term. "The population expects the local government to allocate revenues derived from property taxes to meet their needs in health, education, care for vulnerable groups, infrastructure, sports and culture, among others. This will improve the socioeconomic indicators and the level of well-being of the population." affirms the mayor of Pereira, Carlos Maya.

For the city, the ability to respond to the community's needs through a modern, efficient, and effective cadaster and taxation is the result of prioritizing policies directed towards citizens' satisfaction and strong political will to implement changes and adopt decentralization.

In Colombia, between 35 and 45 percent of municipal financing, depending on the size population, comes from local revenues, including property taxation. The example of Pereira cadastral modernization in such a short timeframe is remarkable, considering that approximately 65 percent of the territory has outdated cadastral information and that, in Colombia, the Multipurpose Cadaster is part of the 2016 Peace Accords.

The city of Pereira has been focalized by the CiuData+ Program, financed by the Swiss Government through the State Secretariat for Economic Affairs (SECO) and implemented by the World Bank. The program builds capacity at the municipal level through:

- Cadastral data management and maintenance,

- Land-based instruments (i.e., tools, guidelines, procedures) that leverage fiscality and the key role of land as a productive factor and financing source for urban development, and

- Tax administration

The program is piloting these types of interventions in six prioritized municipalities of Colombia, representing the country's differential subnational capacities and typologies aiming to strengthen the governance of local administration by enhancing the municipal government's capacity to manage land valuation and cadaster information, land value capture instruments, revenue collection, and tax administration.

Ciudata+ Program is one of the three country programs currently financed through the Land 2030 Global Partnership Umbrella Program. The development objective of this Partnership, launched in January 2021 by the World Bank, is to assist developing countries in achieving land tenure Security for all. Structured as a programmatic Multi-Donor Trust Fund (MDTF), the program is supported by the Government of Canada’s Department of Foreign Affairs, Trade and Development and the Government of Switzerland’s State Secretariat for Economic Affairs (SECO).

There is still a long way to go with regards to efficient land administration. Yet, the example of Pereira demonstrates that progress can be made, and that stronger land management is a key piece for laying the foundations for future solutions to improve local revenues, fight poverty, and foster prosperity, equity, and peace.

Read the Spanish version here.

Join the Conversation