Photo: Ruwan Muhandiramge

Photo: Ruwan Muhandiramge

Exports drive economic growth, create better jobs, and generate foreign exchange earnings. One determinant of export competitiveness is the real effective exchange rate (REER), which measures the value of a currency relative to a basket of other major currencies, adjusted for the effects of domestic inflation. When it depreciates, production costs for domestic firms fall relative to those of foreign competitors, making the country’s exports more competitive in foreign markets. Conversely, when it appreciates, exports become less competitive and tend to contract.

A currency can depreciate for many reasons. For example, it may result from a deliberate devaluation aimed at correcting a misaligned exchange rate, or from market pressure if the exchange rate is floating; or it could stem from an appreciation of the US dollar or other foreign currencies. Since 2020, over 30 low- and middle-income countries have seen their currencies depreciate by at least 10 percent.

Although exports tend to react to exchange-rate fluctuations, the response is not symmetric: Depreciations bring about smaller and slower export responses than appreciations do.

This blog post showcases examples of two countries, Malawi and Pakistan, where exports were often seen as only responding weakly and slowly to currency depreciations. And when their currencies appreciated, exports fell more and faster.

As a result, a critical question arises: Why don’t exports react to a depreciation as much as and as fast as they do to an appreciation, and what is holding them back? The answer is important for policymakers in low- and middle-income countries, who want to ensure that exports increase and contribute to economic growth in the face of strong currency fluctuations.

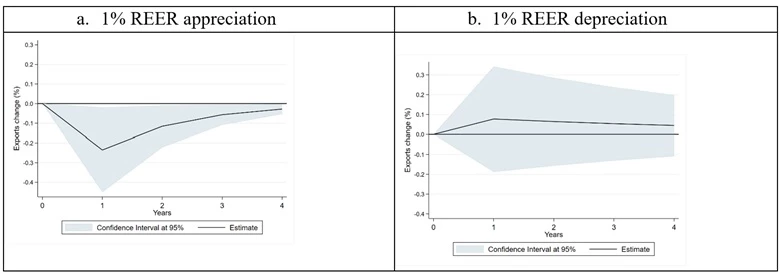

Let’s start with Malawi. Between 2010 and 2022, Malawi alternated between a pegged and floating exchange rate, though over time its currency gradually depreciated. World Bank analysis in the new Malawi Country Economic Memorandum, “A Narrow Path to Prosperity,” yielded surprising results: One year after a 10 percent depreciation, exports increased by only about 7.7 percent, whereas they decreased by 23.5 percent after a similar currency appreciation. It also took much longer for exports to adjust to a depreciation than appreciation (Figure 1). This suggests an asymmetric response to a variation in the exchange rate, depending on its direction, up or down.

Figure 1: Malawian exports reacted twice as strongly and quickly to an appreciation of the currency as they did to a depreciation.

Note: The graph shows the estimated export changes due to a reaction in REER appreciation (a) and to a REER depreciation (b).

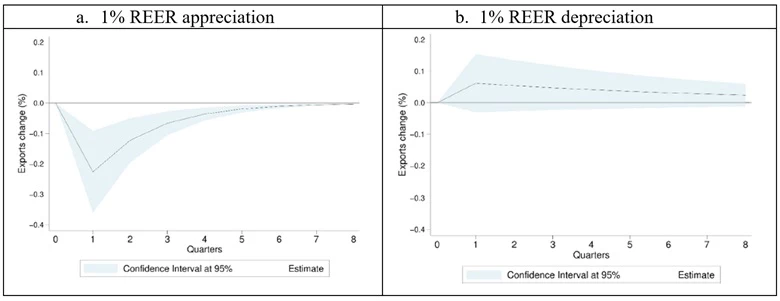

In Pakistan, the difference was even more pronounced. The rupee has been on a downward trend since the early 2000s, with a significant depreciation occurring in 2018-19. Our study found that exports increased by 6.2 percent one year after a 10 percent depreciation and decreased by 22.6 percent one year after an appreciation, and that the reaction of exports to a depreciation was much slower.

Figure 2: The difference in the response to a swing in the exchange rate was even bigger in Pakistan, and the adjustment was much slower for exports.

Note: the graph shows the estimated export changes due to a reaction in REER appreciation (a) and to a REER depreciation (b).

What accounts for this asymmetric pattern?

We focus on two possible explanations. One concerns the information that firms have about destination markets. Establishing new trade relationships, finding shipments, and acquiring new clients takes more time than losing them. Foreign buyers won’t suddenly appear just because the goods become cheaper.

Exports of homogenous goods that are traded in standardized markets, such as soybeans, mangoes, and wheat, show similar responses to currency appreciations and depreciations—in other words, there is no asymmetry. The reason: Exporters can more easily find new markets once a depreciation renders the price competitive.

By contrast, exports of differentiated products—such as electronics or apparel—show a weaker response to depreciations than to appreciations. Why? Exporting such products requires a stronger buyer-seller relationship, more familiarity with market demand, and pricing that reflects the quality and features of the product. As a result, it’s more difficult for a seller to find a new client once a depreciation turns its product internationally competitive.

The second explanation has to do with supply constraints. The capacity of a firm to ramp up production by hiring more workers or procuring additional capital and inputs is crucial to reap the benefits of improved export competitiveness. Our study finds that:

- Labor-intensive sectors such as agriculture and apparel are more responsive to depreciations because it is easier to hire workers to ramp up production after a depreciation than it is to invest in physical capital.

- Access to credit is crucial. Sectors that are more dependent on finance exhibit a slower export response to depreciations because exporters in developing countries often have trouble securing the financing needed to expand export supply.

Policymakers in low and middle-income countries should take stock of these results. First, public policy has a role to play in reducing informational costs associated with finding new clients. Here export promotion is key. Particularly for differentiated, complex, or specialized exports, export promotion agencies should ensure that firms have enough information on their destination markets to find new buyers.

Second, deep financial markets are key for exporters to gain from better price competitiveness; it is also important, during macroeconomic adjustment episodes, to consider the impact of monetary policy on export supply response. Reducing other supply constraints that increase export costs will also help, such as investing in improved connectivity infrastructure and removing barriers to investment.

Join the Conversation