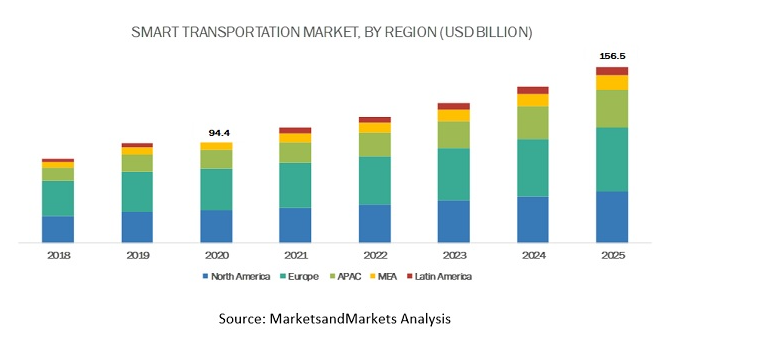

Fueled by advanced technologies and new mobility solutions, the global smart market for mobility is projected to reach $150 billion in the next five years. Private investors are pouring billions of dollars into hundreds of new mobility starts-ups every year, and stakeholders up and down the automotive value chain are pumping in billions of dollars into making autonomous, connected, shared, and electric vehicles a reality.

This optimism is largely led by expectations that the demand for transportation and mobility will continue to grow exponentially in the future—in the next 30 years, there will be one car for every three people on Earth. Equally important are pressures put on the transportation and manufacturing industry to innovate and deliver the new mobility solutions of the future—those that will be affordable, efficient, safe, and green. This pressure has become more visible as we get closer to COP26, and transport is once again targeted for slow progress on reducing its carbon footprint, and its contribution to air and noise pollution.

COP26 will make several announcements geared towards the transportation industry, including the path to phasing out the Internal Combustion Engine, and advent of EVs. But as countries around the world are debating on the best and realistic options for their own development path, an important question has been invited to this debate: where will the financing for sustainable mobility come from? In this blog, we get the discussion started on how to mobilize enough financing to truly transform the transport sector.

Note: Smart mobility includes the promotion of environmental-friendly transport modes such as electric vehicles, shared transportation services, and on-demand smart mobility services. It promotes convenient and safe multimodal travel, accessibility, and efficient use of roads and resources through a strong circulation network management.

Innovative finance that work

The transport sector will require $50 trillion of investment by 2040, and the investment gap is estimated at $10 trillion, according to the estimate by Global Infrastructure Outlook. Several innovative financing mechanisms could be used to fill that gap. For example, green bonds are increasingly important even as we leverage traditional funding sources including public funding via borrowing and taxes. The good news is that investors have an appetite in “sustainable investing” and the potential in the transport sector is yet unmet. The volume of assets under management that incorporate elements of sustainable investing is large and rapidly growing. In 2020, global flows in terms of environment, social, and governance ESG-driven assets tripled to 40.5 trillion dollars. In addition, in the low yield environment, infrastructure assets are becoming attractive to more investors as they offer predictable cash flows and reasonable returns.

A green bond is a debt instrument that can help raise awareness for and support the financing of climate change mitigation and adaptation activities, which proceeds are allocated to projects designed to deliver environmental benefits, according to pre-defined criteria. The World Bank’s issuance of the first green bond of about $290 million in 2008 catalyzed the market for sustainable investing—a market that has since grown exponentially with a diverse set of issuers and investors. Today, the green bond issuance reached $260 billion with 20 percent of the proceeds going to the transport sector. Although multilateral development banks mostly use project loans as a financial instrument, an innovative example of financing is the World Bank green bond for the Bus Rapid System project in Colombia.

The transport community and wider global development community could also think creatively about creating an organization to mobilize funds for sustainable projects in the transport sector. A good example of such an organization is the International Finance Facility for Immunization (IFFIm), of which the World Bank is the treasurer. It was founded to mobilize funds for providing vaccines for the poorest nation in the world. Pledges that are over 25 years were made by governments and to date, IFFIm has raised more than $5.7 billion that has helped GAVI immunize over 820 million children, saving over 13 million lives in the long term. This structure can be replicated for transport decarbonization, although this would require significant capital commitments to make a difference in the sector.

Climate Investment Funds

Another financing mechanism at scale that has and continues to deliver significant results is the Climate Investment Funds with its unique business model that delivers transformative investment programs through predictable, at scale, flexible and highly concessional climate finance for investment in key sectors including energy and transport. To date, CIF has supported over $350 million in climate-smart transport projects, including innovative hybrid bus investments in Colombia and climate resilience road standards and investments in Mozambique. And while these projects and CIF investments in the transport sector were pioneering and have led to important results, they represent a very small fraction compared to CIF investment levels in renewable energy, for example.

Constraints to investment have included limited demand; high investment levels and upfront capital costs; the need for close multi-sectoral collaboration and alignment; weak metrics around climate mitigation potential and results as well as sectoral inertia. But the time has now come to catalyze and accelerate a transition in the transport sector similar to what we have observed in the last decade in the energy sector. And the investments made in clean energy power supply will support this process of transformational change. And that is why moving forward, CIF is planning to finance the transport transition agenda including through innovative financing structures, such as ‘pay-as-you-save’ models to finance battery and charging stations, to drive low-carbon mobility in fast-growing cities.

An important lesson learnt by CIF from energy projects is that upstream investment in analytical work is critical to package investments and persuade donors to invest. This is the reason why global instruments, such as the new World Bank-led Global Facility to Decarbonize Transport are urgently needed to create, test, nurture, coordinate, and scale-up solutions.

Public financing, Public-private partnerships, and the role of development banks

Public financing alone will not be sufficient. Scaling up of transport decarbonization has huge resource requirements and will therefore need to mobilize resources through other sources. Public-Private Partnerships (PPP) can help close the financing gap, with multilateral development banks involved to guarantee a greater emphasis on sustainability.

New national and regional development banks, such as the Africa Finance Corporation, the New Development Bank, the Asian Infrastructure and Investment Bank, and the Canada Infrastructure bank, will also be needed to provide patient capital and medium to long-term funding to support the mobility transition.

Finally, there will be a critical role to play for global multi-stakeholder platforms, such as Sustainable Mobility for All, in bringing together coherence in vision, programs and projects in countries.

Join the Conversation