在巴西圣保罗市中心一辆公共汽车上,一名妇女戴着口罩保护自己免受COVID-19感染。 图片:©Nelson Antoine / Shutterstock

在巴西圣保罗市中心一辆公共汽车上,一名妇女戴着口罩保护自己免受COVID-19感染。 图片:©Nelson Antoine / Shutterstock

The coronavirus (COVID-19) pandemic has dealt a severe blow to an already fragile global economy. Although the full scope of the human and economic impact of the pandemic will not be known for some time, the toll in both respects will be high. Pre-existing macroeconomic vulnerabilities make emerging market and developing economies (EMDEs) susceptible to economic and financial stress and this may limit the capacity and effectiveness of policy support at a time it is needed most. Even with policy support, the economic repercussions of the coronavirus pandemic are expected to be long-lasting , as we find in our latest analysis.

Widespread lockdowns

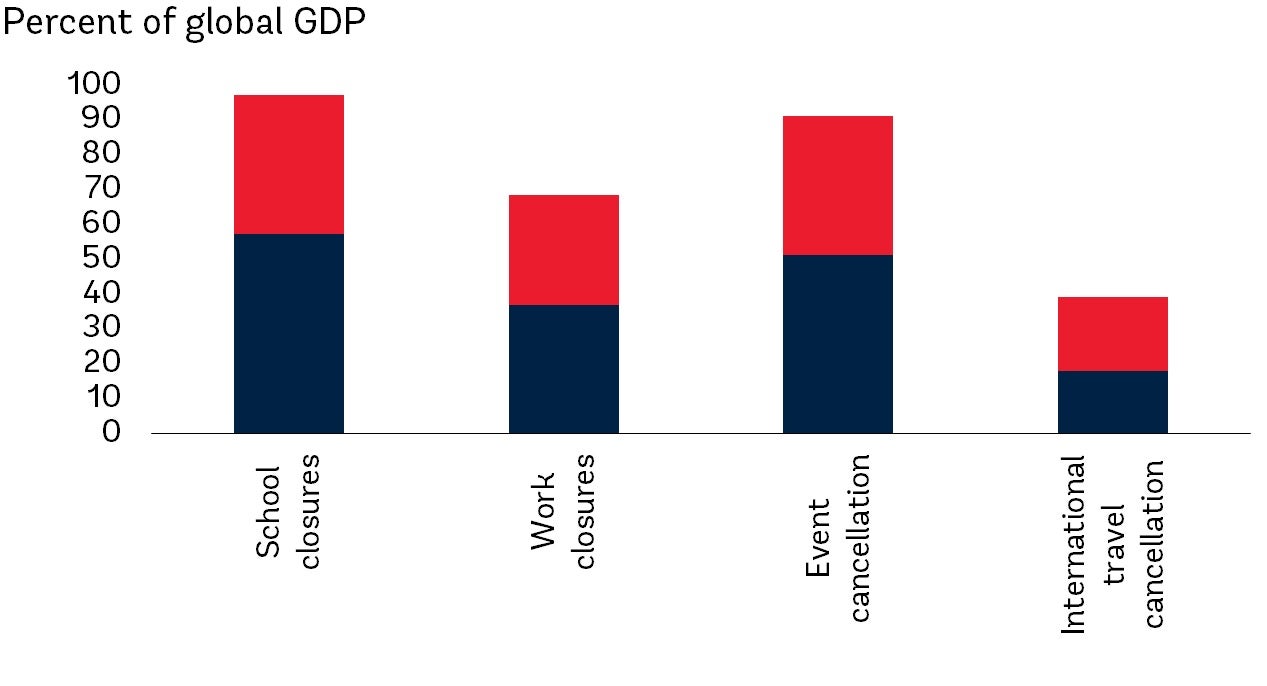

By early April, nearly 150 countries had closed all schools and mandated cancellation of events, and more than 80 had closed all workplaces in order to control the spread of the virus. Travel restrictions were widespread. The mandatory lockdowns, together with spontaneous social distancing by consumers and producers, have wreaked havoc on global activity and trade , and have been accompanied by gyrations in financial markets and sharp declines in oil and industrial metals prices.

Share of global GDP represented by countries with mandatory closures and cancellations

Note: Travel restrictions are counted if they entail a ban on arrivals from all regions or a total border closure. Data is for April 1, 2020.

Multiple vulnerabilities

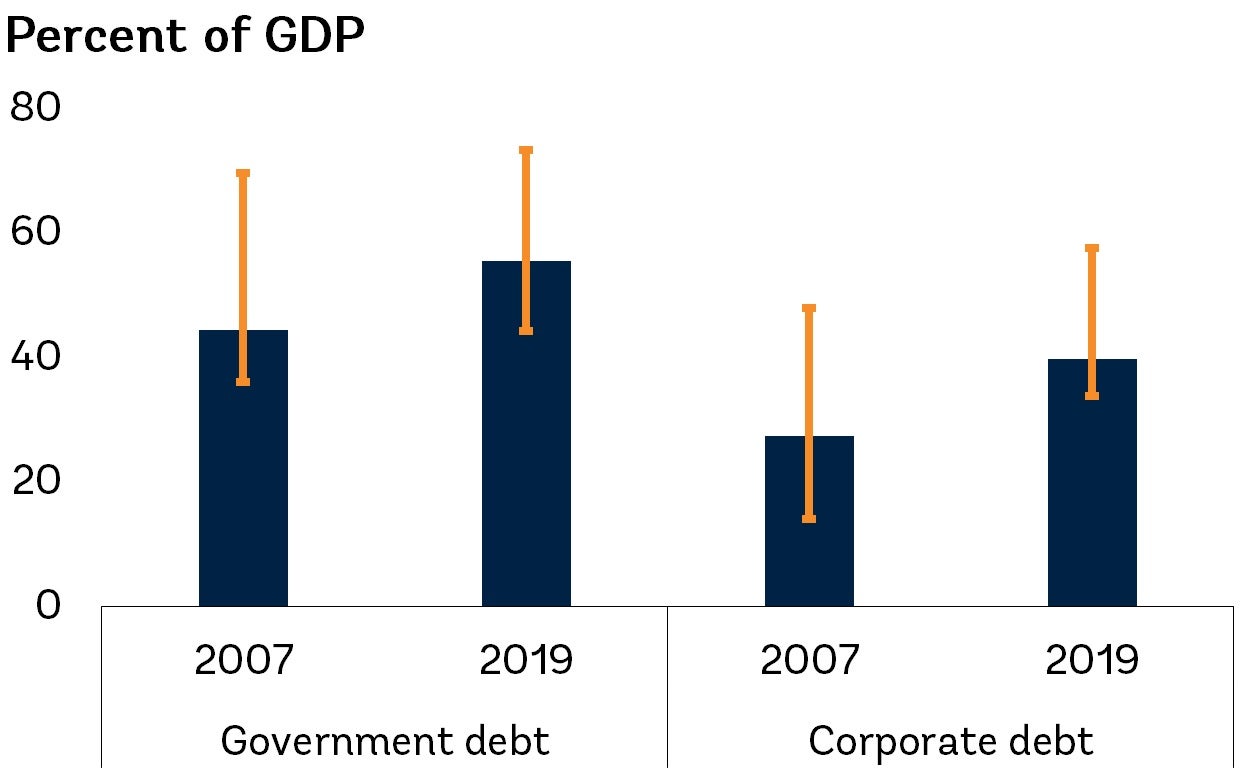

In the short term, EMDEs likely to be hardest hit economically are those that have weak health systems; rely heavily on trade, tourism, or remittances from abroad; depend on commodity exports; or have financial vulnerabilities. On average, EMDEs have higher debt than prior to the global financial crisis, making them more susceptible to financial stress.

Government and corporate debt

Note: Bars show unweighted averages. Whiskers show interquartile range. Based on data for up to 152 EMDEs.

Long-term damage

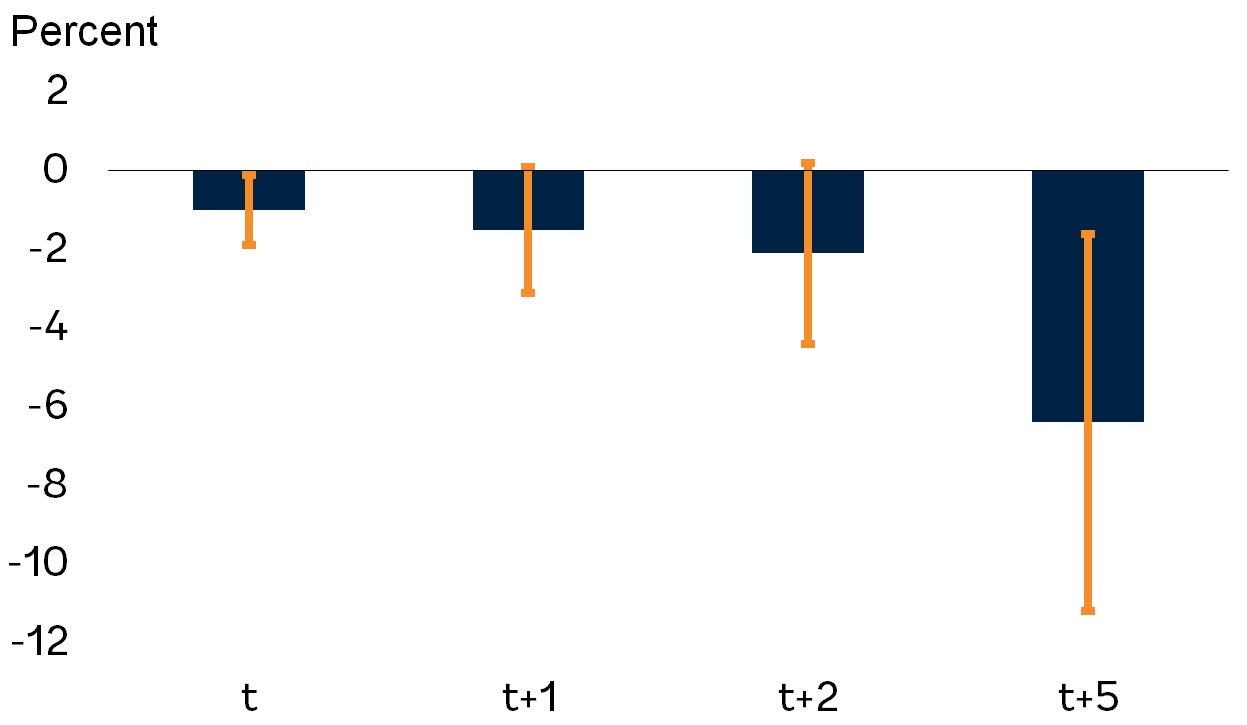

Deep recessions inflict lasting scars on potential output through lower investment and innovation; erosion of the human capital of the unemployed; and a retreat from global trade and supply linkages. The long-term damage of COVID-19 will be particularly severe in economies that suffer financial crises and, in energy exporters, because of the collapse in oil prices. In the average EMDE, over a five-year horizon, a recession combined with a financial crisis could lower potential output by almost 8 percent while, in the average EMDE energy exporter, a recession combined with an oil price plunge could lower potential output by 11 percent.

Cumulative EMDE potential output response after recessions and financial crises

Note: Vertical lines show 90 percent confidence bands. Sample includes 75 EMDEs during 1982-2018.

Hit to productivity

The pandemic can also be expected to stifle productivity growth, which has been anemic during the past decade. Past epidemics were associated with 6 percent lower labor productivity and 11 percent lower investment five years later in affected countries.

Cumulative labor productivity response after epidemics

Note: Bars show the estimated impacts of SARS (2002-03), MERS (2012), Ebola (2014-15), and Zika (2015-16). Vertical lines show the range of the estimates with 90 percent significance. Sample includes 30 advanced economies and 86 EMDEs.

Groundwork for long-term growth

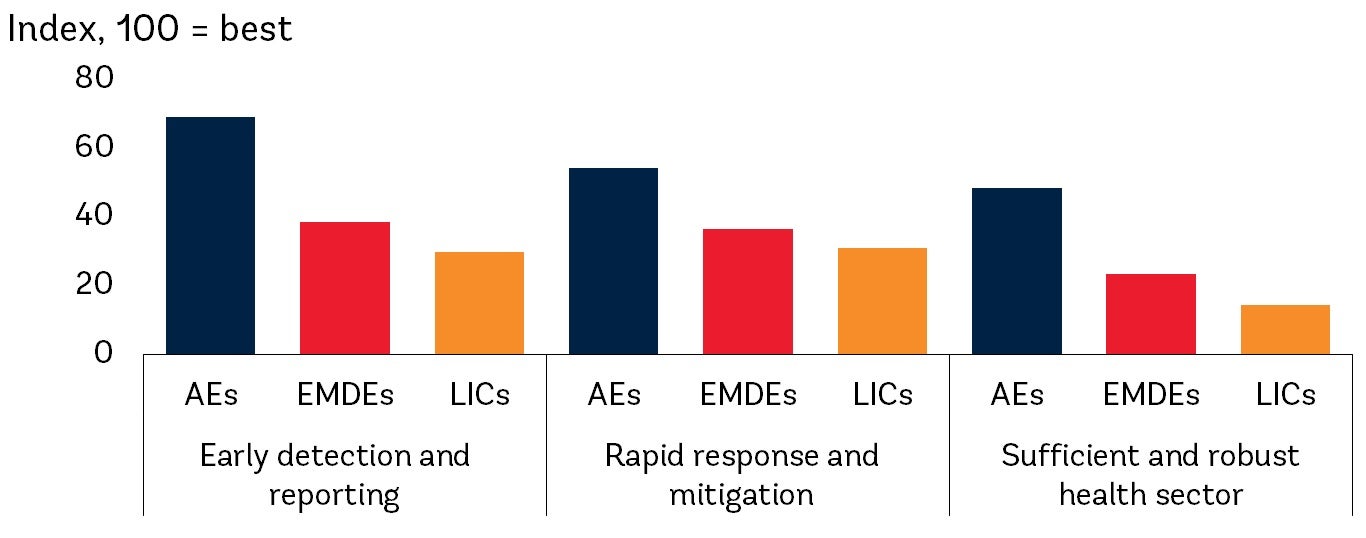

Policymakers must undertake comprehensive reform programs to improve institutions and frameworks that can ensure an eventual return to robust growth after the COVID-19 pandemic while setting the stage for stronger long-term prospects. As the world emerges from the pandemic, it will also be critical to strengthen the mechanisms to prepare for, prevent, and respond to epidemics before the next one strikes. Less than 5 percent of countries around the world entered this pandemic scoring in the highest tier for their ability to respond to and mitigate the spread of an epidemic. Improving health sector capacity will require international policy cooperation and coordination, especially given the pandemic’s global reach.

Health sector preparedness

Note: Data for 2019. Sample includes 31 LICs, 123 EMDEs, and 35 advanced economies. EMDEs exclude LICs.

Join the Conversation