Directing social assistance payments to women – prioritizing them as the recipients – can offer them safer access to and increased control over funds. Photo: © Victor Idrogo/World Bank

Directing social assistance payments to women – prioritizing them as the recipients – can offer them safer access to and increased control over funds. Photo: © Victor Idrogo/World Bank

Bébé Agbodoglo a merchant in Avépozo, Togo, has seen her sales plummet during the COVID-19 pandemic. Bébé first heard about NOVISSI – a monthly government cash transfer of approximately 20 dollars to informal workers – on TV. She dialed the phone code seen on TV and after providing the basic information required, received a transfer to her mobile money account just a couple of days later. This money has helped Bébé in meeting the basic needs for her three children – a vital lifeline in a crisis.

The COVID-19 crisis is disproportionately affecting women like Bébé who are facing higher job losses, shrinking work hours and greater responsibilities for care. Directing social assistance payments to women – prioritizing them as the recipients – can offer them safer access to and increased control over funds. Digitizing these payments to women, especially through accounts in their name, when done well, can be a powerful tool to help them build the financial history and relationships to access savings, credit, and other financial services that contribute to their long-term economic wellbeing.

How are countries directing payments to women during the COVID-19 response?

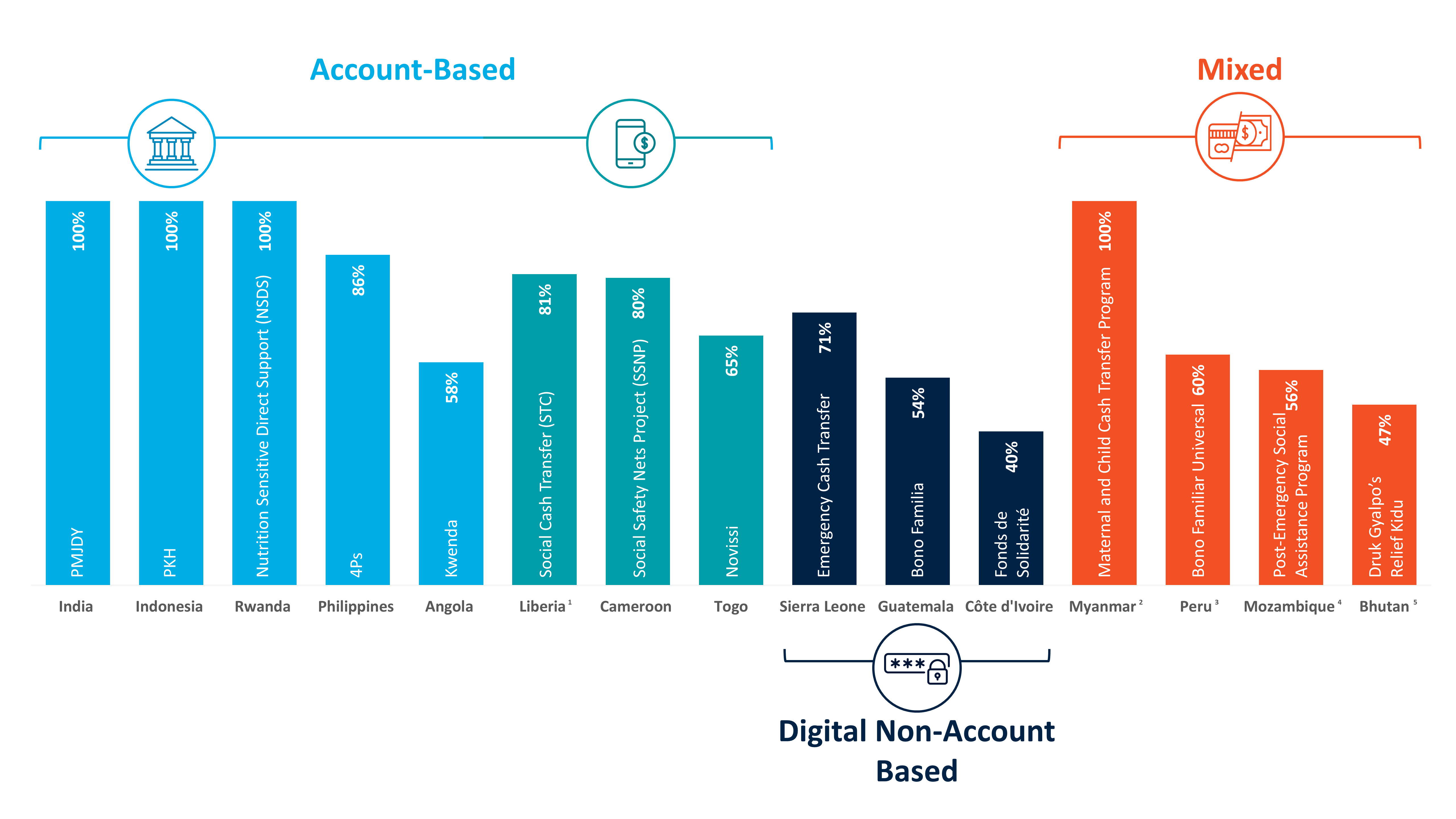

% of female recipients in select social assistance programs

Several COVID-19 social assistance programs have been directing payments to women using digital methods (see figure above). Receiving these payments into an account creates a gateway to financial inclusion and can also give women increased privacy and control over their resources.

Umu Kamara, a single mother selling cosmetics in Freetown, Sierra Leone faced a significant dwindling in sales due to COVID-19 related stay-at-home orders. An emergency cash transfer program for informal workers in urban areas has been a lifeline for Umu and others like her. However, not all beneficiaries have mobile phones or access to financial access points. Umu received her payment through an e-voucher but the program also accommodated others without phones by providing paper vouchers.

Gender gaps in ID, mobile phone and account ownership must be considered when transitioning to digital payments to avoid un-intended exclusion. While account-based payments like the one Bébé received have the greatest potential for empowerment, other methods such as one-time-passwords or the e-voucher received by Umu might be more appropriate in countries with less advanced infrastructure. Non-account based digital payments can still introduce beneficiaries to financial service providers and offer a stepping-stone to more advanced digital G2P payments.

The G2Px Initiative, an effort pulling together teams across different sectors and areas of expertise in the WBG and in partnership with the Gates foundation, is developing knowledge and good practices on digital G2P payments. The initiative is also providing support to 35 countries where over 260 million recipients of emergency social assistance payments are women. The goal is to radically improve G2P payments globally, ensuring that all G2P programs use digitization as a powerful means to deliver life improving services to women.

3 key reasons to direct payments to women

Directing social assistance payments to a woman not only gives her greater control over resources or access to financial services, it empowers her. When a woman is empowered economically, she has greater agency and resources to control her life and make her own decisions—financial and otherwise--within and outside the home. We see three key rationales for directing payments to women:

- Promote and deepen financial inclusion for women: Globally it is estimated that 80 million women opened their first account to receive social assistance payments. Financial inclusion can create positive ripple effects for these women leading to increased savings and productive investments, higher labor market participation and higher investments in their families’ health and education. In Kenya, research has even shown that access to mobile money accounts has contributed to move households, especially women-headed households, out of poverty.

- Increase bargaining power for women leading to higher mobility and nutrition outcomes: The Benazir Income Support Program in Pakistan found that the shift in bargaining power by directing digital payments to women changed the way they are viewed in their households and communities. One positive outcome being greater mobility for both beneficiary women and other women in their community. Evidence from South Africa shows that when pensions are received by grandmothers there is a significant reduction in child deprivation rates, especially among girls. Similarly, evidence from Niger finds that households where women received digital social assistance payments, had diet diversity that was 16 percent higher than those who received benefits in cash.

- Increase female employment outside of the household: When payments are made into a women’s own account, they not only increase women’s financial inclusion but they can also impact their labor market participation. In India’s MGNREGA program , women who received their payment directly into their own account instead of the male household head’s, displayed higher levels of employment after participating in the program. The greatest impact was observed among those whose husbands disapproved of women working, suggesting that women’s control over resources improved their bargaining position to break through restrictive social norms.

Building back better starts by reaching those most adversely affected by the pandemic and empowering women. Directing digital G2P payments to women is a critical aspect of this journey, as it can impact many of the key drivers of women’s economic empowerment: deeper financial inclusion, greater bargaining power, and increased employment.

Join the Conversation