A construction tool sales representative wears a helmet and mask while on the job during the COVID-19 pandemic. © Daniel Catrihual/Shutterstock

A construction tool sales representative wears a helmet and mask while on the job during the COVID-19 pandemic. © Daniel Catrihual/Shutterstock

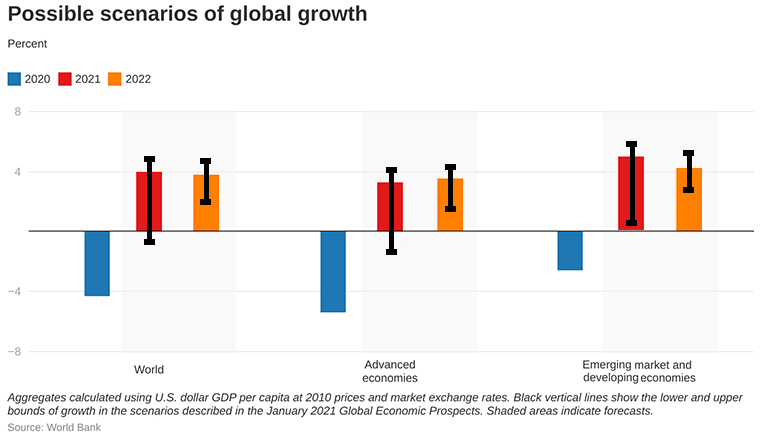

The global economy is expected to recover slowly from the collapse caused by the COVID-19 pandemic. Output is expected to expand 4% in 2021 but will remain more than 5% below pre-pandemic projections. The pandemic likely caused lasting damage to potential growth. In particular, the shock to investment and human capital is eroding growth prospects in emerging market and developing economies (EMDEs) and setting back key development goals. The global recovery, which has been dampened in the near term by a resurgence of COVID-19 cases, is expected to strengthen as vaccination proceeds and the pandemic is brought under control, and as confidence, consumption, and trade gradually improve.

1. Recovery has moderated amid a resurgence of COVID-19

COVID-19 has continued to spread around the world. Some areas have experienced a sharp resurgence of infections, and daily new cases remain high. As a result, an incipient recovery in global economic activity has moderated. That said, there has been substantial progress in the development of effective vaccines.

2. A range of growth scenarios in 2021

The 2020 global recession was somewhat less pronounced than previously expected due to shallower contractions in advanced economies and a more robust recovery in China; in contrast, most other EMDEs experienced deeper recessions. Prospects for the global economy are uncertain, and several growth outcomes are possible.

3. Lingering damage from the pandemic

By 2022, global GDP is still expected to be 4.4 percent below pre-pandemic projections, with the gap in EMDEs nearly twice as large as in advanced economies. The recovery will be dampened by the effects of diminished physical and human capital accumulation on labor productivity.

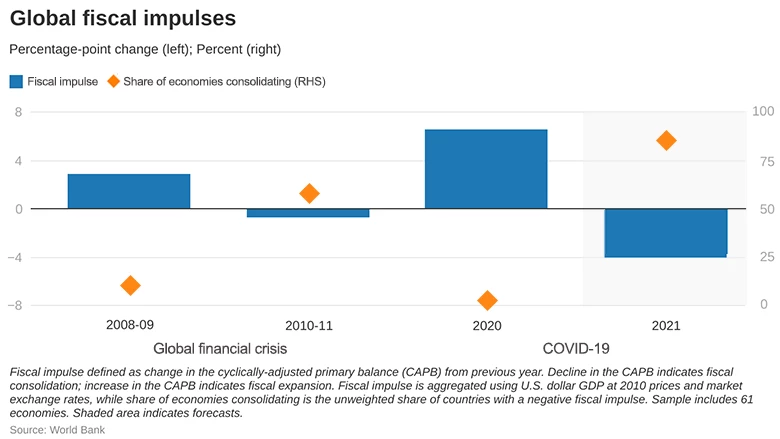

4. Diminishing fiscal support

Fiscal support played a significant role in cushioning the economic blow from the pandemic. As the crisis abates, policy makers need to balance the risks from large and growing debt loads with those from slowing the economy through premature fiscal tightening. In most countries, much of the fiscal support provided last year is expected to be withdrawn, weighing on growth. Whereas deficits are generally expected to shrink over the forecast, they will nonetheless contribute to rising debt, potentially planting the seeds for future problems—particularly if borrowing is not used efficiently.

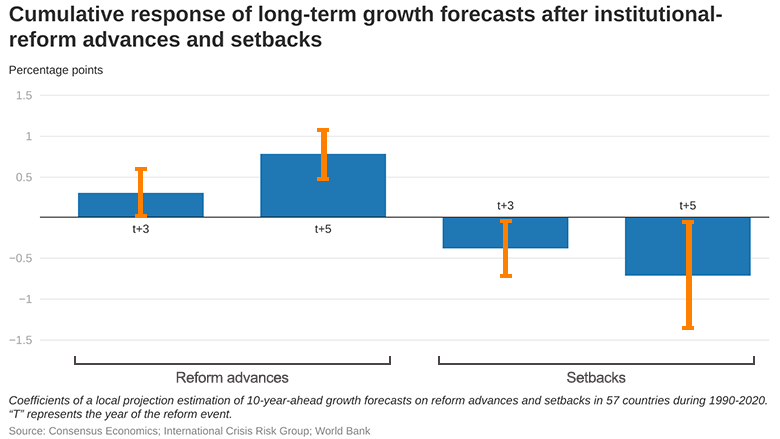

5. Structural reforms can mitigate the pandemic’s long-term damage

A slow recovery is not an inevitability and can be avoided through productivity-enhancing structural reforms. Promoting education, effective public investment, sectoral reallocation, and improved governance can offset the pandemic’s scarring effects and lay the foundations for higher long-run growth. Investment in green infrastructure projects can provide further support to sustainable long-run growth while also contributing to climate change mitigation.

Join the Conversation