As Finance Ministers and central bank governors from around the world arrive in Washington next week for the Annual Meetings of the World Bank-International Monetary Fund, there will be many critical development challenges that will be the focus of discussions at open events and in closed-door meetings. The challenges in emerging market and developing economies (EMDEs) are many and they are complex --- for example, how do we create more and better jobs, how do we address climate change, and how do we provide citizens with good public services, such as education, health, electricity, water, sanitation and much more.

These are enormous needs and they come with an enormous price tag - $640 billion to $2.7 trillion per year, according to World Bank estimates. Debt financing is, therefore, crucial for development. However, debt levels are already at record highs in EMDEs, which may restrict their ability to borrow further. As past financial crises have shown, debt needs to be used prudently and it has to be transparent.

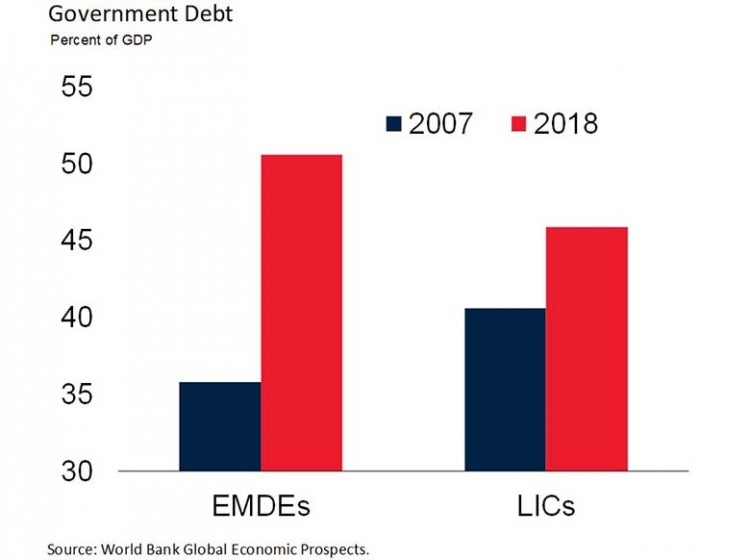

Government debt has risen substantially in emerging market and developing economies , by an average of 15 percentage points of GDP since 2007 to 50 percent of GDP in 2018. The external debt stock of the world’s poorest countries stood at $387 billion at the end of 2018, more than double the level of a decade earlier. In fact, over half of the countries in Sub-Saharan Africa have doubled their debt stocks. The increase is more pronounced for some countries: 885 percent for Ethiopia, 521 percent for Zambia, 437 percent for Uganda, and 395 percent for Ghana.

The government debt accumulated in recent years has increasingly come at higher interest rates and from a more diversified creditor base, outside of existing international monitoring mechanisms. Lack of transparency surrounding some debt transactions create additional uncertainty and risk. Many of the countries which have taken on debt from new sources are at high risk of debt distress or in debt distress.

In addition, there has been a sharp increase in private sector debt. Total debt in EMDEs is at a record high of 168 percent of GDP, on average, in 2018, from 96 percent of GDP in 2007.

The consequences of excessive debt, particularly external debt, can be dire. It both increases vulnerability to financial crises and constrains governments’ ability to respond to crises when they happen. It can also result in slower investment and growth.

Debt management and debt transparency have, thus, once again become critical development challenges. Greater debt transparency and good debt management can mitigate some of the costs associated with debt buildups and some of the political-economy pressures for rapid debt accumulation.

The advantages of transparency are many. It helps policymakers make informed borrowing decisions; it helps creditors and rating agencies assess sovereign creditworthiness and, thus, appropriately price debt instruments; and it keeps citizens informed about how governments spend public money. Transparency also underpins prosperity—more transparent countries enjoy higher credit ratings, lower borrowing costs, and a stronger ability to attract foreign direct investment (FDI), studies show.

Transparency, unfortunately, remains woefully inadequate. World Bank assessments of 62 low-income countries have found that less than half of them meet the minimum requirements for debt recording, monitoring, and reporting. We are stepping up our efforts to encourage debt transparency as a critical part of the joint World Bank/IMF Multi-Pronged Approach. This is being done through technical assistance and dialogue to advance a reform agenda that will strengthen macro-fiscal policies, unleash growth, and reduce fiscal risks. The World Bank is also working on establishing a database of debt held by state-owned enterprises (SOEs) and on piloting debt transparency reforms in several countries.

I look forward to discussions with senior policymakers in Washington next week on good debt management and transparency as an urgent priority in the current development environment. We are also organizing a public event, Decoding Debt: Getting Transparency Right, which will delve into critical questions around why debt transparency is lacking in so many countries and what we can do, collectively, to create the incentives for it. The event will be live web streamed. I urge everyone with an interest in the role of debt in public finance to watch the discussion and join the conversation.

Join the Conversation