Photo: Grzegorz Zdanowski / Pexels Creative Commons

Some regard institutional investors—with their deep pockets—as the white knights filling the huge investment gaps in infrastructure development in emerging markets and developing economies (EMDEs). The IMF estimates that some 100 trillion dollars are held by pension funds, sovereign wealth funds, mutual funds, and other institutional investors. Unquestionably, the long-term nature of their liabilities matches the long-term financing requirements of infrastructure projects. So, it’s no surprise that institutional investors are seen as the white knights of infrastructure finance.

While the potential is enormous the reality is different

A new report, Contribution of Institutional Investors to Private Investment in Infrastructure, finds that the current level of institutional investor activity in new infrastructure deals is abysmally low and constitutes a mere 0.7% of total private participation in infrastructure investment in EMDEs at financial close.

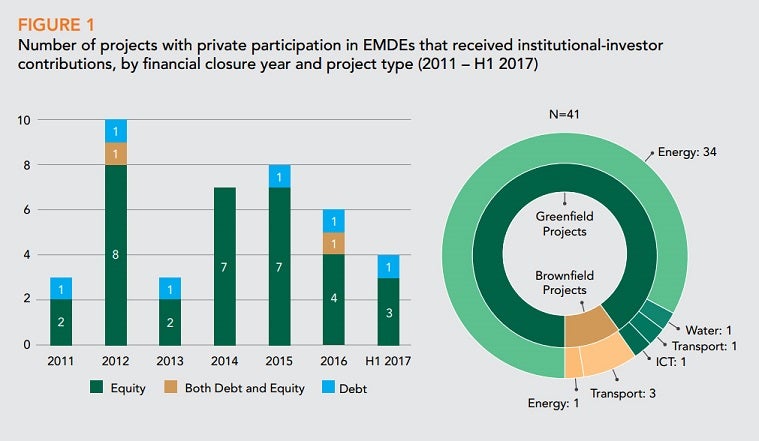

From 2011 to the first half of 2017, 41 projects benefitted from institutional investor contributions. This constitutes equity-investments in 35 projects and debt in 8 projects, with two projects receiving both equity and debt. Twenty-five different institutional investors were involved, of which 15 contributed equity and the remaining nine contributed debt. One investor contributed both debt and equity in two separate projects. Sub-Saharan Africa and Latin America and the Caribbean saw the most institutional investor transactions, 21 and 12 respectively , while the other regions recorded less than five transactions each.

Why this huge mismatch?

The hard truth is that very few institutional investors have the appetite to invest in infrastructure assets in EMDEs . A mere two percent of fund managers can identify attractive opportunities for investing in EMDE infrastructure.

Several reasons exist for this mismatch:

- The lack of a significant pipeline of well-prepared and well-structured infrastructure projects. As the number of bankable projects in EMDEs is low, it does not make up a significant enough asset class to attract institutional investors.

- Differing mandates and lower risk appetite of institutional investors. Simply put, they prefer mature markets with an established track record.

- The yield on many EMDE infrastructure investments are relatively low compared to the risks, and do not compensate institutional investors at par with the high levels of risk involved.

- Infrastructure projects have long construction periods. They typically don’t yield returns during the construction phase and have relatively restrictive/unclear investment exit strategies.

- Institutional investors often have limited resources to set up the specialized infrastructure teams that are essential to assess and track investments in EMDEs.

What does work for institutional investors?

Even in this limited role, institutional investors clearly show preferences. The report finds that institutional investors prefer energy projects over transport projects, due to shorter gestation periods coupled with lower construction risk. Within the transport sector there is a strong preference for brownfield projects, which typically have an established performance track record and no construction and operational delay risks. In the energy sector, where institutional investors have been most active, there is a clear preference for contracted revenues over uncontracted revenues. This clearly indicates that revenue visibility and certainty is one of the key considerations for institutional investors.

While the bulk of the institutional investor projects were in investment-grade countries, they do not seem to have inhibitions investing in speculative-grade countries if there is adequate multilateral, bilateral, or government support. With almost two-thirds of all institutional projects relying on DFI and government support, it is clear that institutional investors also count on reliable policy regimes to protect their revenue streams.

How can institutional infrastructure investment in EMDEs achieve its true potential?

To stimulate the flow of financing from institutional investors into the infrastructure sector, interventions over the entire spectrum of “policy to projects” are needed .

At project level, improving preparation by carrying out robust feasibility studies and structuring projects with appropriate risk allocation can help, as can credit enhancements in the form of guarantees by multilateral and other financial institutions. The World Bank Group has a host of guarantee products (including through MIGA), as do other MDBs, such as the Asian Development Bank, the Inter-American Development Bank, and the African Development Bank (among others). Facilities like the Global Infrastructure Facility (GIF) help build robust project pipelines and bring in critical partnerships.

On the policy side, governments and multilaterals can help provide the institutional environment to encourage the securitization of infrastructure assets, allowing for risk pooling and subsequent sale of future cashflows arising from a group of similar infrastructure assets. We also need to understand the regulatory constraints and fiduciary responsibilities of institutional investors to build the right climate for their participation. Developing fixed-income infrastructure indices could also address some of the constraints.

If one were to be optimistic, with a number of these issues addressed, in the coming years, participation by institutional investors in infrastructure will no longer be the holy grail—but an ordinary cup filled to the brim. But for this to happen, and to unlock the trillions of dollars held by institutional investors to finance critically needed infrastructure in emerging markets, governments will need to put in place reliable regulatory environments, build strong institutions, invest in capacity, and commit to robust governance.

You can download the full report here.

The PPI Database is a product of the Infrastructure, PPPs & Guarantees (IPG) Group and is managed by the World Bank Group Singapore Hub for Infrastructure and Urban Development. It the most comprehensive database of private investments in infrastructure in the developing world. This endeavor on Contribution of Institutional Investors was carried out by the PPI Database team led by Deblina Saha under the guidance of Cledan Mandri-Perrott. The core team comprises Seong Ho Hong, Akhilesh Modi, and Yuliya Zemlytska.

Related Posts:

Slight bump in half-year private investment in infrastructure: a sign of recovery?

PPI Database users leave their mark on the new resources section

Declining private investment in infrastructure – a trend or an outlier?

PPI and the poorest: New private participation in infrastructure results highlight critical role of MDBs in IDA countries

Join the Conversation