1. Almost all commodity prices are higher than before the pandemic

Nearly all commodity prices rose in the first quarter of the year, and most are now above pre-pandemic levels. The gains have been driven by the recovery in global economic activity, as well as some specific supply factors, particularly for oil, copper, and some food commodities.

2. Crude oil prices recovered in record time

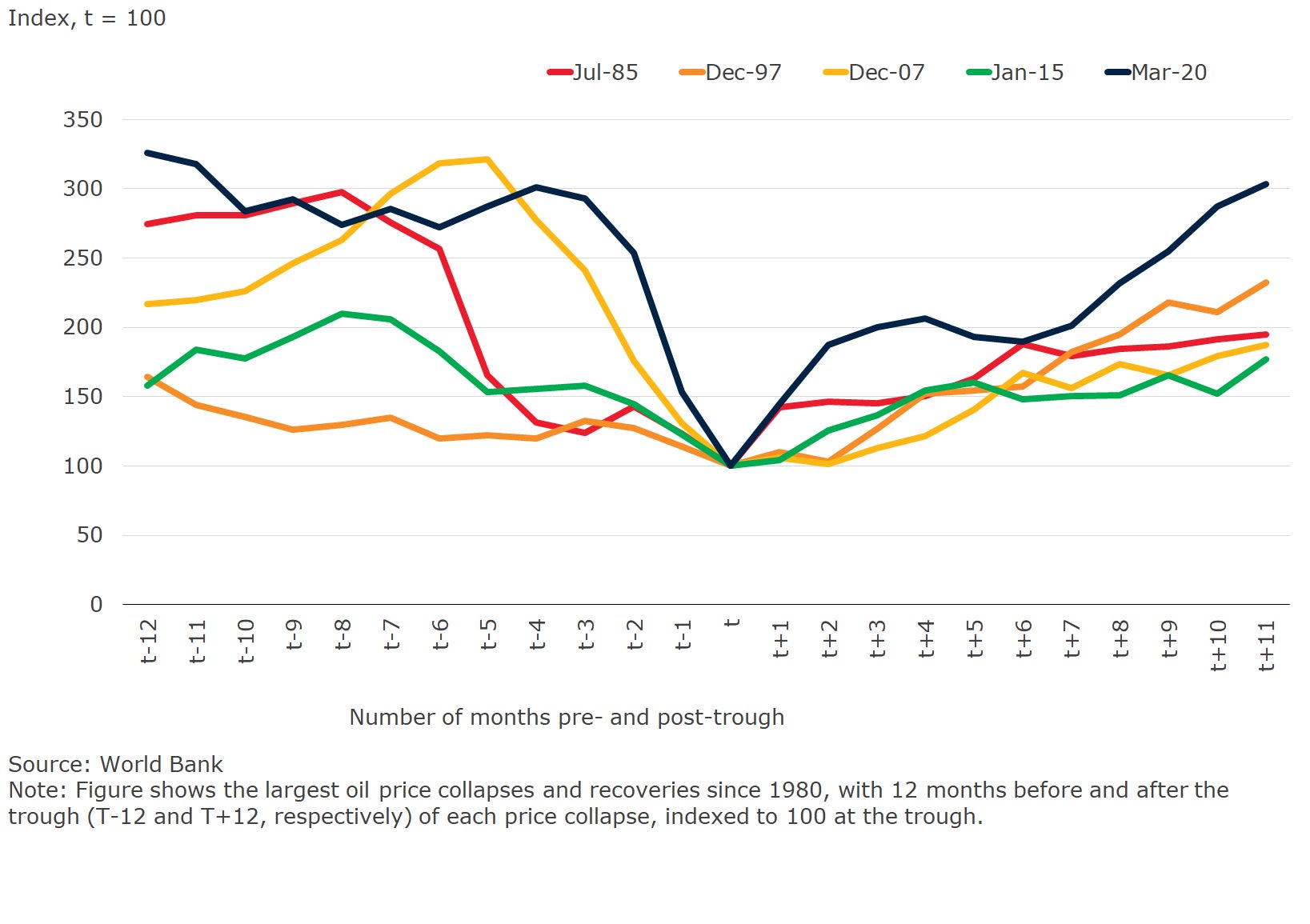

Crude oil prices underwent a record-fast recovery from lows reached during the pandemic, supported by continued production cuts by the Organization of the Petroleum Exporting Countries (OPEC) and its partners. Demand has also seen a gradual recovery, and this is expected to firm over 2021 as vaccines become widely available and travel restrictions begin to be unwound, especially in advanced economies.

Oil price collapses and recoveries

3. Spare oil production capacity is vast

While production cuts by OPEC and its partners (OPEC+) have been critical in supporting oil prices, the resulting large quantity of spare production capacity will limit price increases over the forecast horizon. In addition, if pandemic containment falters, a further weakening in demand could put pressure on the production cut agreement. A breakup of the agreement could result in markedly lower oil prices.

4. Natural gas and coal prices also rallied

Among other energy commodities, natural gas and coal also saw sharp price increases in 2021Q1, driven by the global economic recovery, cold weather in parts of the northern hemisphere, and supply disruptions. Coal prices face long-term pressures from decarbonization trends as more coal-importing countries announce carbon neutrality targets. Coal use has been significantly curtailed by rapid penetration of renewables and low-priced natural gas, although the retirement of coal-powered electricity generation in Europe and the U.S. has been more than offset by increased capacity in China.

5. Global recovery boosted metal prices

Metal prices continued their upward trajectory during the first quarter of 2021 and have surpassed pre-pandemic levels. The rising prices reflect strong demand in China, the ongoing global recovery, and supply disruptions for some metals. Copper, tin, and iron ore prices reached 10-year highs in March. The proposed infrastructure bill in the United States and the global energy transition towards decarbonization could generate additional upward pressure on prices.

Copper prices and global manufacturing PMI

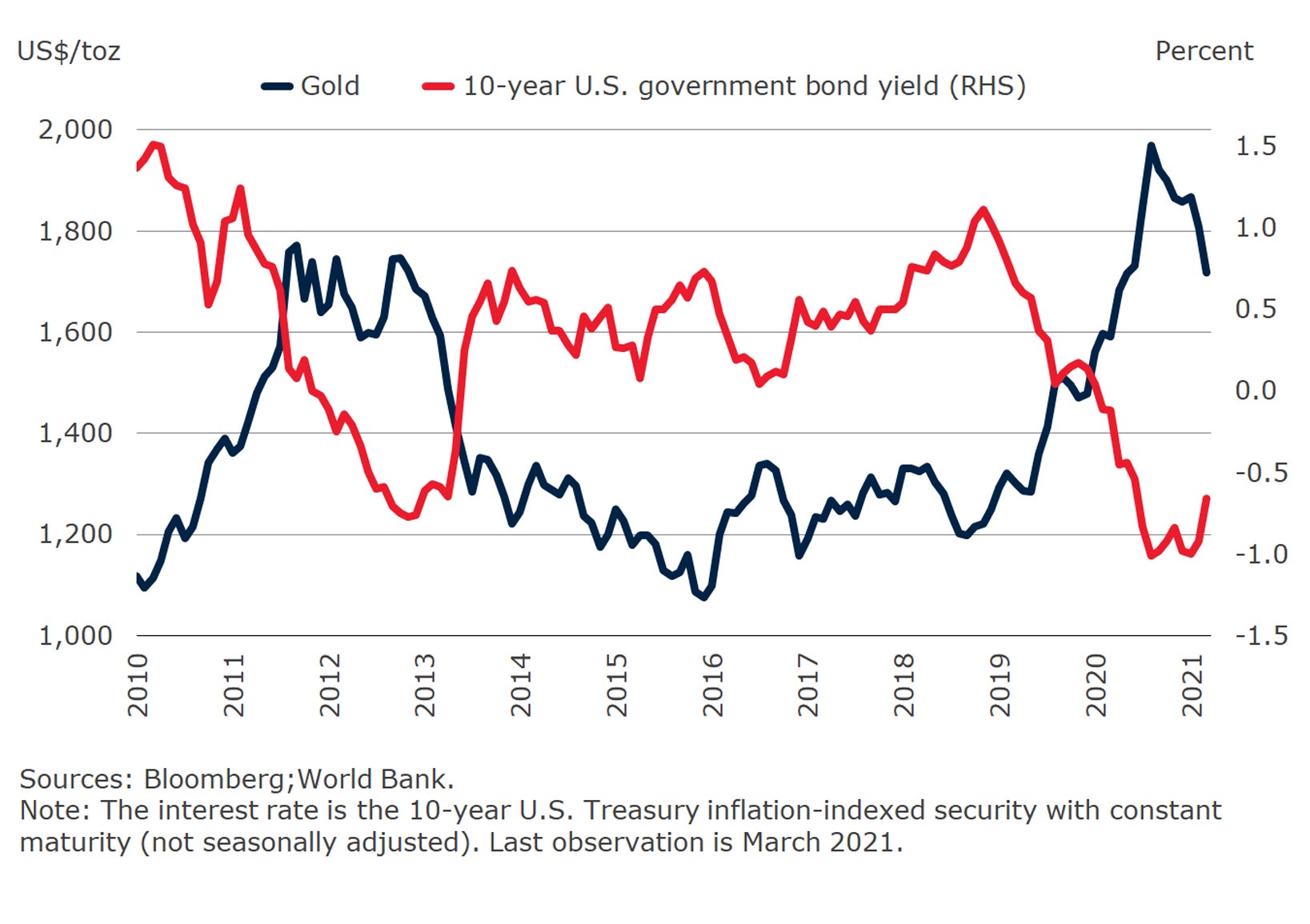

6. Rising bond yields took the shine off gold

Gold prices fell by 4 percent in 2021Q1, driven by a drop in investment demand due to rising U.S. government bond yields. The yield on 10-year Treasury Inflation-Protected Securities rose from -1 percent in January to -0.66 percent in March—the highest level since June 2020. Rising yields make gold less attractive to investors. Holdings of gold-backed exchange-traded funds have also fallen sharply in recent months, and central banks have reduced gold purchases.

Gold prices and interest rates

7. Agricultural prices hit 7-year high

The World Bank’s Agricultural Price Index increased more than 9 percent in 2021Q1 (q/q), building on the previous quarter’s momentum. Prices are 20 percent higher than a year ago, an almost seven-year high. The price gains have been driven by supply shortfalls for some food commodities, especially maize and soybeans, strong demand for feed commodities by China, and depreciation of the U.S. dollar.

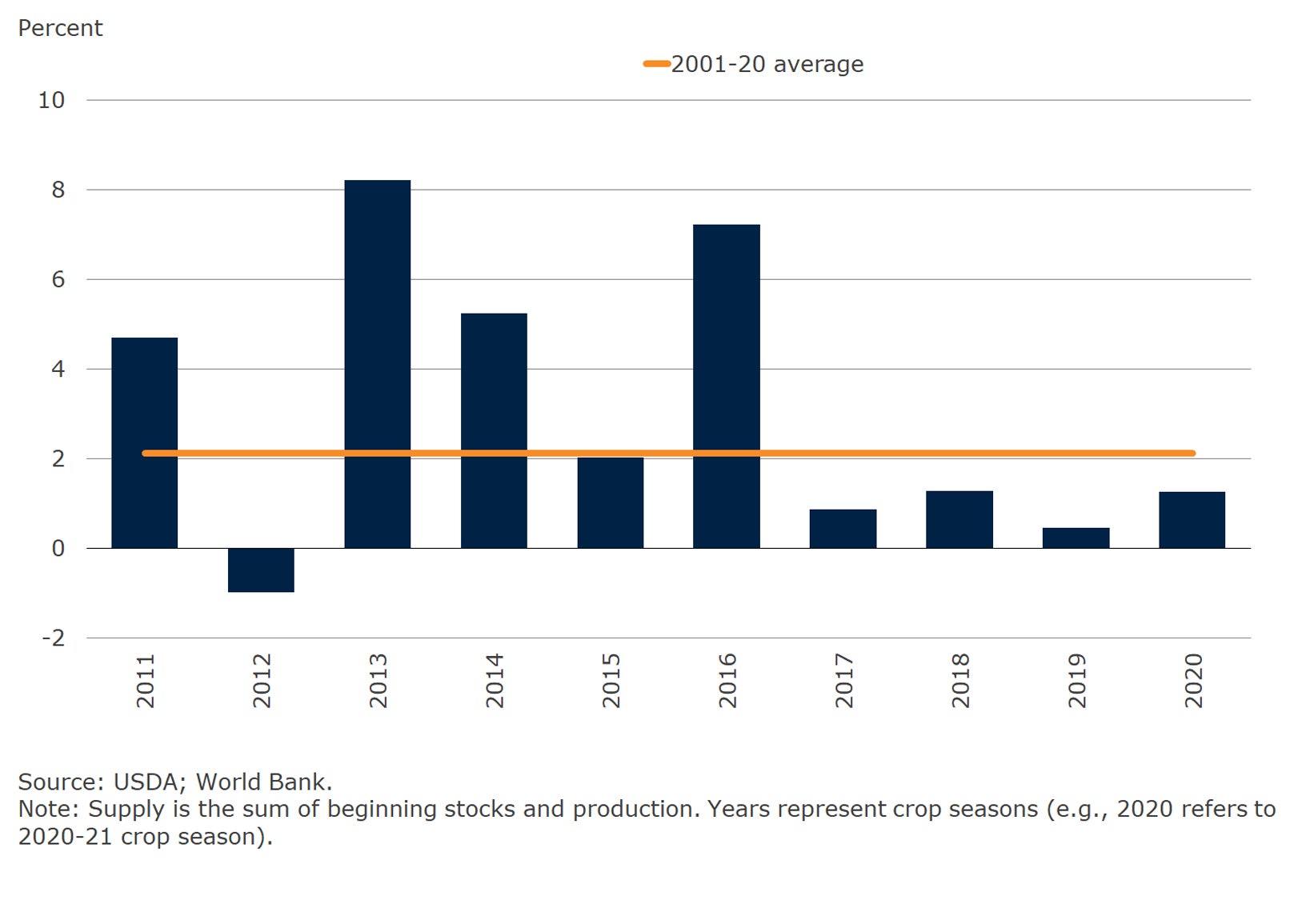

8. Food commodity markets seen stabilizing

Based on the U.S. Department of Agriculture’s planting intentions survey, land allocated to maize, soybean, and wheat in the U.S. is expected to increase by 0.4, 5.4, and 4.5 percent, respectively, next season. This follows supply growth below long-term trends during the past few crop seasons. Given the outsized role of the U.S. in these commodities, should the assessment materialize it will help stabilize global food commodity markets. Agricultural prices are expected to stabilize in 2022 following a 13 percent increase this year. Risks to the forecasts emanate from the path of energy costs, in the short term, and biofuel policies in response to energy transition in the longer term.

Global grain supply growth

Join the Conversation