Across the world, governments are gearing up to respond to the socio-economic shock of COVID-19 (coronavirus). Early actions in countries hit hard by the pandemic range from large economic stimulus packages and the lowering of interest rates to social safety nets for millions of their citizens. From China to the United Kingdom, Morocco to South Africa, more than 130 countries worldwide have introduced various forms of social protection to compensate workers for lost income from extensive lockdowns and the broader economic downturn and mitigate adverse impacts on the poor and the vulnerable.

With some delay COVID-19 has also hit the African continent and is expected to trigger the first recession in Sub-Saharan Africa in 25 years with a shock to many households. In a region where roughly 8 out of 10 people are engaged in low-wage informal employment and often just making ends meet, the livelihoods, incomes and well-being of many households, and their human capital, are at risk. While sickness will deprive individuals of earnings and can lead to impoverishing out-of-pocket payments for treatments, the effect is already felt more widely across the population as social distancing measures curtail economic activity, supply chain disruptions affect prices and remittances from abroad dry up. Initially, informal sector workers and self-employed in cities, like market vendors, are hit hard. There are already rumblings of discontent at the additional hardship faced by the urban poor from the government-imposed lockdown in some of Africa’s mega cities.

African policymakers, too, can leverage social protection programs in response to the COVID-19 shock: to help households avoid going hungry or selling their livelihood assets, protect their human capital, while respecting stay-at-home orders to prevent the spread of COVID-19 in urban and rural areas. By putting cash into poor people’s pockets, social protection can help sustain local economic activities especially in essential sectors like food. And beyond the immediate crisis, a mix of cash and services like financial literacy, micro business development, life skills training and coaching can support households and workers in the return to livelihood activities and jobs and thereby accelerate the wider economic recovery.

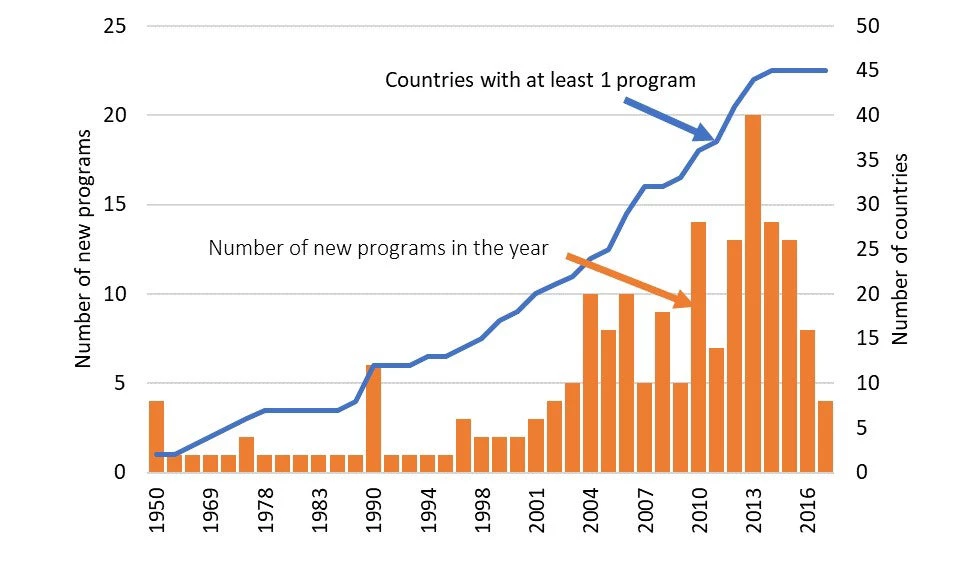

Many countries in Africa can build on solid foundations: Sub-Saharan Africa has seen a significant expansion of social protection programs over the last two decades (Figure 1). More than 45 countries now have social safety net programs in place to address chronic poverty and to help poor households diversify their livelihoods and invest in their children’s health and education. Owing to fiscal and capacity constraints, social safety net programs often cover only a small proportion of the poor and are concentrated in rural areas where chronic poverty is highest. And yet, social safety nets are a critical tool for governments across Africa to mitigate the social impact of the COVID-19 pandemic. Social safety nets can ‘flex’ in response to a shock – horizontally by reaching more households and vertically by increasing cash transfer amounts. For example, Mauritania, Kenya and Ethiopia have shock response programs that can expand when triggered by droughts. And where food markets stop functioning, governments can consider direct food support instead of cash transfers.

But with its impact on urban areas, its social distancing imperative and its scale and rapid onset, the COVID-19 shock is unlike any other African countries have seen in recent years and calls for rapid innovation in design and delivery of social safety nets. Governments need to expand coverage to those population groups who are not typically qualifying for cash transfers but are now pushed into poverty, especially in urban areas. COVID-19 shock response cash transfers can “piggy-back” on already existing beneficiary registries and payment systems, where possible, but should be designed and communicated as separate from regular safety nets, time-bound with a clear exit strategy. For example, the Togolese government is introducing Novissi, a coronavirus cash transfer program, for a limited duration for those most impacted by the COVID-19 shock and with a larger benefit for women. Reaching informal workers will often require extending beneficiary registries by enrolling households quickly through novel ways, for example, drawing on registries of mobile phone providers, trader associations, and other possible reliable databases. While the urgency of the response puts a premium on delivery speed and coverage over targeting accuracy, emergency registries can later be reassessed as countries enhance their social protection systems post-crisis and make them more responsive for future shocks.

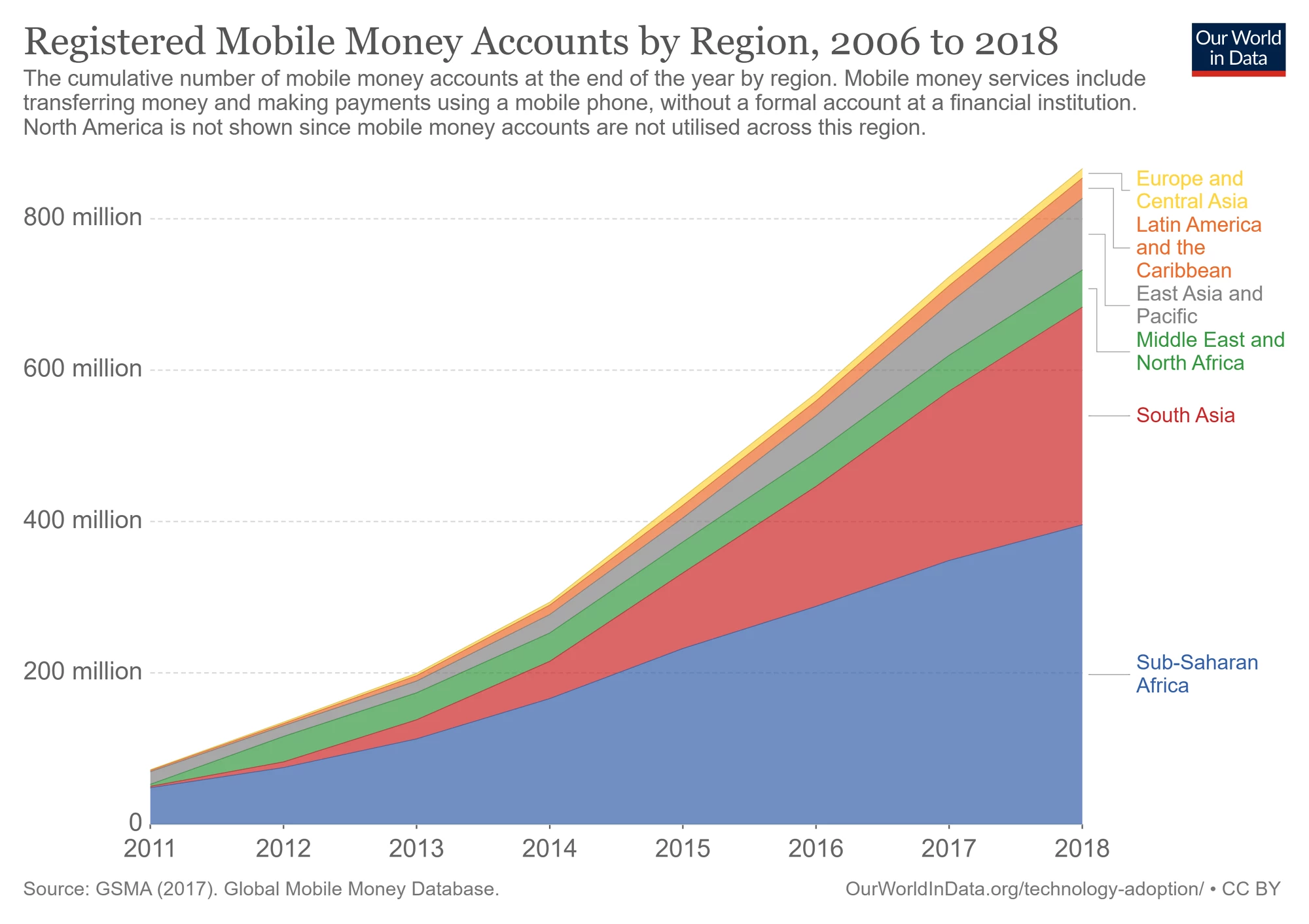

Digital technologies can help governments expand coverage of social safety nets and safeguard beneficiaries in line with social distancing requirements. The COVID-19 crisis can be the driver of innovation in service delivery by promoting electronic government-person rather than in-person payments, by leveraging big data for targeting and expanding communications through radio and short-message service including on behavior change like handwashing. At around 400 million, Africa has the highest number of registered mobile accounts in the world, and about 160 million unbanked adults own a mobile phone. In many countries, governments can already transfer cash to their citizens’ mobile account quickly and effectively. And where digital payments are not possible in the short term, administrators of cash transfer programs can stagger physical payments and adjust frequencies to reduce crowds and provide handwashing facilities where payments take place.

Realizing the potential of social safety nets to cushion the economic and social impacts of COVID-19 will require reprioritizing public expenditures towards social protection, which has often been underfunded relative to other activities across Africa. Development financing can also help, including efforts underway for debt relief for the poorest countries during this pandemic to help create fiscal space for increased public spending for safety nets. Using social safety nets to help save lives and protect livelihoods from the COVID-19 shock is a good investment.

Join the Conversation