Singkham/ Shutterstock

Singkham/ Shutterstock

Climate change effects are on the radar of central banks, financial regulators, and supervisors. Climate-related and environmental risks can affect financial stability, but they also provide new green finance opportunities: the financial sector can become a major driver in mobilizing trillions of the highly needed climate finance. As successful climate action requires a whole-of-economy approach, so too does ‘greening’ the financial sector demand a ‘whole-of-financial sector’ approach.

The World Bank (WB) has been spear-heading support to developing countries in greening their financial sectors in a wide range of areas: conducting climate risk assessments; supporting central banks and financial regulators in integrating climate-related considerations into supervisory and regulatory frameworks; developing climate-responsive capital market instruments; and supporting green taxonomies, voluntary carbon markets, and other areas, all based on global expertise and knowledge.

A recent achievement of the cooperation between the WB and Central Bank of Jordan (CBJ) has yielded a blueprint for how central banks and financial regulators around the world can move toward a greener financial sector, and this experience can inform a green finance agenda across the MENA region and beyond.

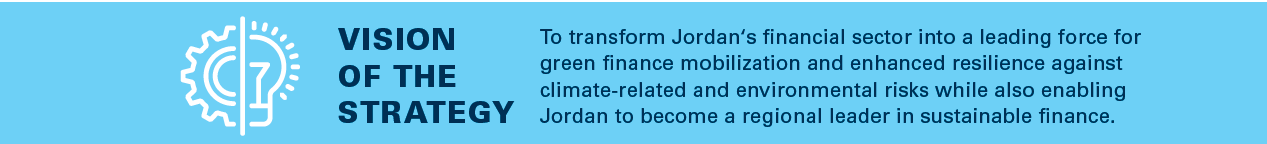

Last November 2023, the CBJ began their journey towards greening the financial sector by launching the Green Finance Strategy 2023 – 2028. The World Bank is proud to have provided technical assistance in developing this strategy, and we hope that it will inspire other countries. Our support for developing similar strategies spans from inception to fruition: advice on the scope and level of granularity; bringing in good international practices and latest developments in climate risk management and green finance; assistance in selecting targets and setting up action plans to achieve those targets; facilitating stakeholder engagement, including support in conducting baseline surveys; etc.

Jordan has been an early mover in the MENA region on climate action having submitted ambitious climate change commitments eight years ago. Yet, meeting these commitments largely depends on securing as-yet-unidentified financing. Simple calculations show that if, hypothetically, 20% of Jordan’s banking sector’s credit portfolio is made green, it would more than cover the expected private sector share of Jordan’s US$10 billion climate investment needs by 2030.

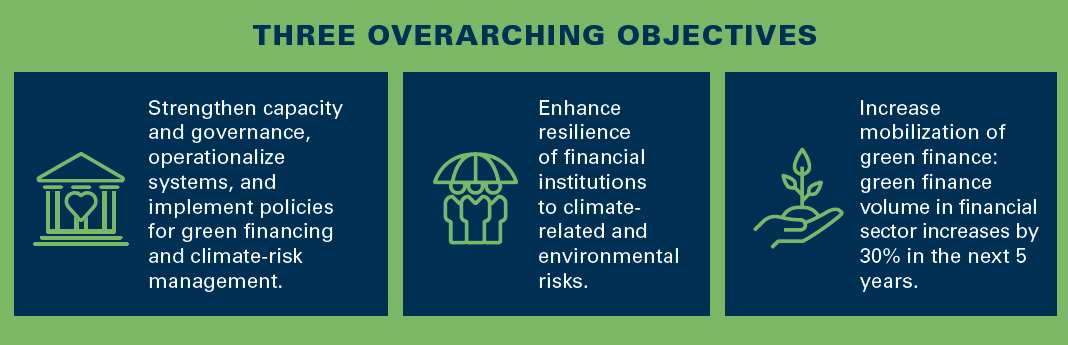

CBJ’s Green Finance Strategy includes : 1) a comprehensive capacity-building program, 2) the first climate risk assessment for Jordan’s financial sector, 3) integration of climate-related considerations into a micro-prudential and financial stability supervisory framework, 4) regulations and guidelines to integrate climate-responsive and environmental factors into all aspects of financial decision-making, including corporate governance structures, risk management and internal controls, disclosure and reporting, and green financing, 5) inclusive green finance, 6) sustainable Islamic finance, and 7) green finance mobilization measures. All the milestones are accompanied by detailed action plans with targets and timelines for their achievement, spanning across the banking sector, insurance, and non-bank financial institutions.

Key Milestones of the CBJ’s Green Finance Strategy 2023-2028

The WB will continue to provide implementation support for the Strategy. The climate risk assessment is underway, and the first phase of a comprehensive green finance capacity-building program is expected to be delivered in the coming months. Also, work on the National Green Taxonomy has commenced.

The following are some of the lessons our team learned from behind the scenes of working on this project:

- Embrace emerging areas of green finance. The CBJ’s Green Finance Strategy has explicit targets in relatively new areas such as inclusive green finance, results-based climate finance, sustainable Islamic finance, low-carbon transition plans, and others.

- Do not forget the green finance demand side to empower the financial sector in driving the transition toward a more resilient and greener economy. Comprehensive and coordinated national green policies are essential to creating demand for green financing.

- Green finance strategy is a strong policy signal affecting the behavior of financial institutions (FIs) and setting the tone for FIs’ proactive preparation to comply with forthcoming green finance regulations and policies.

- Regulators and supervisors can lead by example. The CBJ is establishing a Green Finance and Climate Risk Division and is arranging a green finance capacity building program to be implemented jointly for CBJ’s and FIs’ staff.

- Addressing data gaps is a critical step for evidence-based greening of the financial sector.

- Be flexible and adjust along the way. While green finance and climate risk management are rapidly advancing, practical implementation remains in the early stages across many countries, and there are still many more lessons to be learned along the way.

- Gradual implementation and proportionality are key to greening the financial sector.

The launch event of the CBJ’s Green Finance Strategy convened public, private, and financial sector representatives, international partners, Sustainable Banking and Finance Network representatives, as well as peers from Morocco and Egypt. (Photography by World Bank)

Special thanks to contributing donors to the Jordan Growth MDTF: the United Kingdom, Canada, Kingdom of Netherlands, Germany and Norway with implementation support provided by the Reform Secretariat at MoPIC, as well as to the Climate Support Facility Whole of Economy Program, administered by the World Bank, and to the FIRST Initiative.

Join the Conversation