Mozambique Social Assistance Beneficiaries receiving program information during payment event.

Mozambique Social Assistance Beneficiaries receiving program information during payment event.

Based on The Second Social Resilience Dialogues, during government-led Mozambique SP Week 2021.

Across African countries, Social Protection (SP) programs have steadily grown over the past two decades, and especially in response to COVID-19. As a result, countries in the region are leaning towards diversification and innovation to adopt more efficient mechanisms to deliver SP benefits. For instance Zambia, Togo, Ethiopia, and Mozambique.

End-to-end digitization, and improved customer experience are considered critical for an effective SP payments system. Digital payments can help governments reduce costs, and set conditions for timely delivery of assistance, especially in emergency settings. Digital payments allow the opening of more gateways for financial inclusion and the economic empowerment of the vulnerable groups, especially women, who have less access to instruments that enable their financial autonomy. And finally, to enhance the impact of cash transfers by increasing vulnerable groups’ resilience, opportunities, and ultimately their level of well-being. Figure 1.

International evidence shows certain areas can be vital to advancing payment digitization in a country, such as identification and registration (use of existing databases); expanding cash-out points; streamlining processes and identification requirements (Know-Your-Customer) for opening bank accounts; and passing laws that allow 'basic accounts' without maintenance costs.

Figure 1 Path to enhance the impacts of cash transfers through G2P digital payments

In Mozambique, digitization of payments has been central to strengthening SP systems. The Government of Mozambique's (GoM) COVID-19 response enabled a three-fold expansion of the national SP coverage, from 520,000 to 1.7 million households, through the Post-Emergency Direct Social Support Program (PASD-PE). The response is implemented by INAS under MGCAS policy guidance; through the SP Project and the Social Protection and Economic Resilience Project, supported by the World Bank (WB) and the Multi-Donor Trust Fund (MozSP MDTF) funded by the UK, Sweden, and the Netherlands.

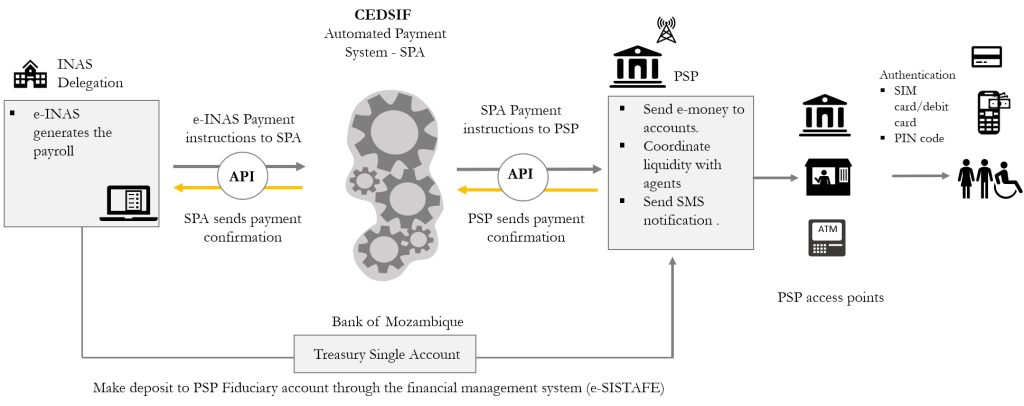

Mozambique is implementing four payment mechanisms: cash delivered through an Offline Payment Application (OPA); smartcards and mobile ATMs; transfers through mobile money wallets with WFP and UNICEF support; and digital payments through the Automated Payments System (Sistema de Pagamentos Automatizado, SPA in Portuguese). The GOM developed the SPA, supported by the Financial Inclusion and Stability Project – positioning Mozambique at the frontier of digital payment systems: end-to-end digital payments. Allowing integration of the INAS information system with mobile money companies and commercial banks, and facilitating the technology for beneficiaries to choose, in a future, the most convenient service provider for them (Figure 2). Preliminary analysis indicates SPA is bringing important cost savings compared to other mechanisms: 1 compared to up to 20 percent of the average cash transfer.

Figure 2: Common infrastructure of the SPA in Mozambique, with multiple programs + multiple service providers

The GoM is committed to digitizing payments and expanding financial inclusion for the most vulnerable. Digital payments reached about 77,000 beneficiaries in the COVID-19 response phase 1, and is expected to continue growing for emergency and regular programs. However, like in many countries, more work is needed to make the current G2P digital payments environment more conducive. The main challenges are regulatory financial and legal restrictions (required documents to open bank accounts); population's low financial inclusion (43 percent of population), especially for women; and limited formal financial access points (in half of the localities). Other structural challenges are the low Social Registry coverage (less than 30 percent of vulnerable population); low connectivity (40 percent of localities without network); and low coverage of the population registry (39 percent of population without ID).

Preliminary data from an assessment of the COVID-19 response show important opportunities to adopt digital payments, especially in urbanized areas. About 80 and 71 percent of respondents already own a cellphone and a mobile money account respectively, 70 percent have a national ID, and 55 percent prefer to receive the benefit directly into a mobile account (compared to cash or other means).

In collaboration with MGCAS/INAS, the WB is developing the Digital Payments Readiness (DPR) policy tool to inform the expansion of digital payments. Based on pre-identified features the DPR assigns a level of readiness (low, medium, high) at the locality level for determining the most appropriate payment approach (e.g. digital payments with multiple or single mechanism, partially digitized, or manual). See Map. The DPR tool can be easily updated and uses national data on financial services location, network coverage, and the 2017 Census. These efforts are part of broader analytical efforts, supported through the MozSP MDTF and G2Px Initiative – to draw lessons from the payment mechanisms implemented by MGACAS/INAS and develop tools for the scale-up of digital payments.

Join the Conversation