Attracting investments in urban infrastructure for Latin American municipalities is a daily challenge, exacerbated by the effects of COVID-19. Already scarce resources are now scarcer, and financing alternatives are limited.

Land value capture, an urban development strategem that has become increasingly common, holds significant promise for the region. In particular, the tax increment financing mechanism (commonly known as TIF) is worthy of our attention. TIF is a land-based finance instrument commonly used by local governments in the United States to turn underutilized land into more productive uses.

What TIF is and how it works

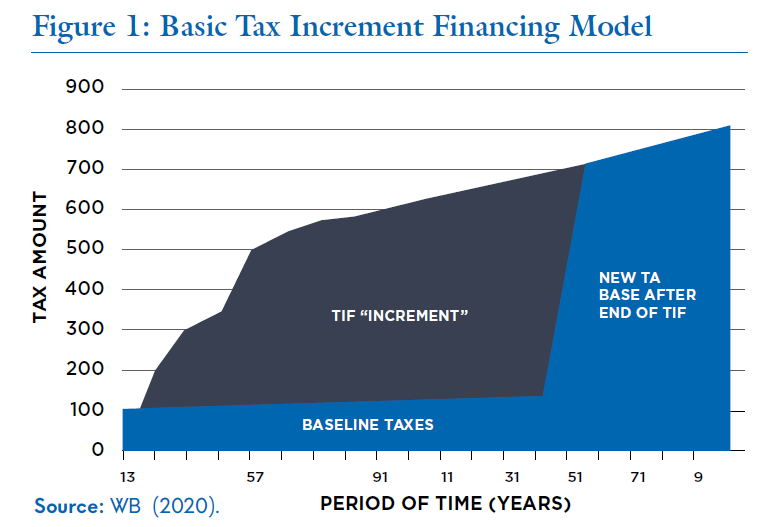

TIF enables local governments to use the expected income from taxation on a designated territory to finance investments needed in urban infrastructure. This allows projects to be structured based on future tax revenues resulting from the development of a specific area and the revenues produced above a specified baseline property value established at the project’s inception.

TIF implementation starts with the local government establishing a "TIF District"—a geographic area whose purpose is to capture a portion of the increase in the property tax value resulting from new infrastructure investments. These resources are collected into a specific fund committed to the repayment of TIF debt obligations. To develop a TIF, the local government uses the property value on a specific date as a baseline. They set a period for the TIF, over which all the expected property value increases relative to the baseline will be considered income that can be reinvested in public infrastructure.

Fortunately, this is a new, viable alternative for municipalities in Latin America. A recent World Bank report supported by PPIAF highlights the collaboration between the government of Colombia and the World Bank to structure innovative instruments that leverage private finance for urban infrastructure and redevelopment projects in low-income neighborhoods, abandoned transport stations, and highly polluted industrial areas.

Why was Colombia ripe to explore this opportunity? We suggest five reasons:

- The country has experienced rapid urbanization resulting in over 75% of the population living in cities today.

- The need for large infrastructure investments exceeds available budgets.

- Colombia has a strong legal and institutional framework conducive to the use and development of innovative financial instruments for cities.

- Colombian legislation already provides basic elements and a wide array of urban development instruments that enable cities to use TIF for urban infrastructure.

- Main cities in Colombia have a steadily growing real estate market and there is interest from developers and the private sector to partake in these types of instruments.

- The cadastral system in Colombia is sufficiently advanced to enable its main cities to accrue future revenues and to capture land-value increments.

What have we done so far?

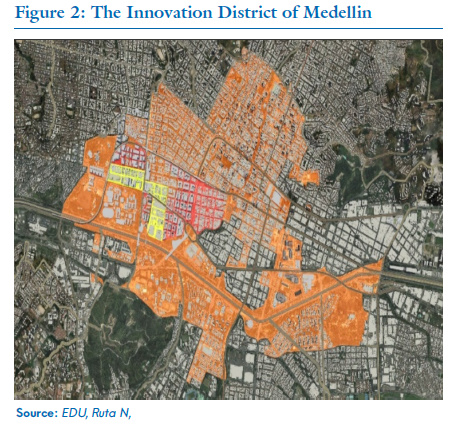

Everything started with the interest of Colombia’s National Planning Department and the city of Medellin to explore financing alternatives for priority projects in urban areas. Because it’s surrounded by mountains, Medellin is geographically constrained and faces a shortage of urban land. This has forced the city to seek densification and a more efficient use of the existing serviced land. The Innovation District of Medellin (IDM) project, a downtown district created as a new hub for innovation and high-tech industries, included mixed-use land and affordable housing.

These were the steps to develop the instrument:

- First, we conducted a real estate market analysis and estimated the potential tax increment revenue arising from the proposed development. In this case, the analysis recommended to scale down the project considering the real potential demand.

- Second, we defined scenarios for the project development in short-, medium-, and long-term phases. Under this process, a TIF District was delimited and scenarios for the issuance of a bond were executed. The city of Medellin defined a TIF for a 16-year term from 2021 to 2035, which it would use to raise tax increment financing. This financing is to happen in a phased approach: short (8 projects), medium (13 projects), and long-term (24 projects)—for a total of 45 units over 16 years.

- Third, for each phase we identified and calculated internal and external urban costs of each project and what would be collected by the property.

- Fourth, we conducted an analysis of the subnational and national legal and regulatory frameworks for this innovative instrument. Further legal analysis was explored to ease restrictions of what we found on the framework.

The final result is the development of a regulatory framework for TIF in Colombia and also eligibility criteria for cities to use it. This is the first time this has been accomplished in Latin America and the Caribbean and the final decree was adopted in November 2020.This is the first time this has been accomplished in Latin America and the Caribbean and the final decree was adopted in November 2020. View this video to learn more about PPIAF and the Colombian government’s work on TIF in Colombia.

Going further, we also have a road map for cities willing to implement TIF as an instrument to finance specific urban redevelopment projects.

We’re excited to share more information about this pioneering work, so feel free to be in touch via the comments section below.

Related Posts

Municipal infrastructure needs more investment: harnessing private capital (responsibly!) will help

Colombia: the roads more traveled

Boosting access to market-based debt financing for subnational entities

Subnational pooled financing: Lessons from the United States

Three ways to partner with cities and municipalities to mobilize private capital for infrastructure

Join the Conversation