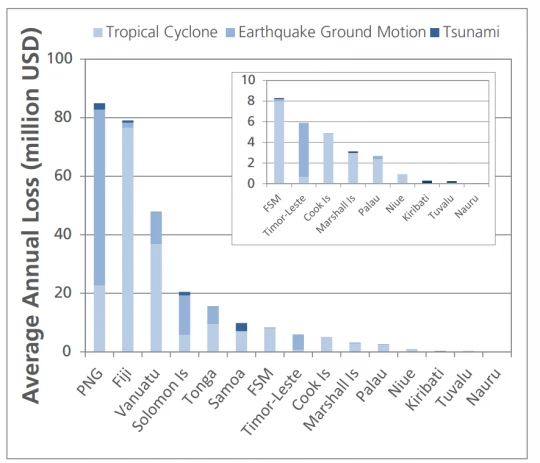

Extreme natural events have affected more than 9.2 million people in the Pacific since 1950 and caused associated damage of about US$3.2 billion. From 2012 to 2014, the region experienced several disasters: two severe floods in Fiji, Tropical Cyclone Evan in Samoa, a magnitude 8.0 earthquake and subsequent tsunami in the Solomon Islands, Tropical Cyclone Lusi in Vanuatu, Tropical Cyclone Ian in Tonga, and a storm surge in the Marshall Islands (see figure 1). Pacific Island Countries (PICs) face critical challenges to attain financial resilience against such disasters. Many PIC Governments have a narrow revenue base, are net importers, and rely on aid as an income stream. This can limit their post-disaster financing options and place constraints on the national budget. Alternatives—such as risk transfers—could be used to reduce the drain on limited public funds.

Source: PCRAFI Country Catastrophe Risk Profile (2012)

The Pacific Catastrophe Risk Insurance Pilot

One initiative aiming to increase the financial resilience of PICs against natural disasters and improve their capacity in meeting post-disaster funding needs without compromising their fiscal balance is the Pacific Catastrophe Risk Insurance Pilot.

First launched on January 17, 2013, the pilot has just entered its third season that will run from November 1, 2014 to October 31, 2015. The extension of the program is a result of a request of the five comprising member states―Cook Islands, the Marshall Islands, Samoa, Tonga, and Vanuatu. Working together, PICs have been able to secure aggregate insurance coverage worth US$43 million against tropical cyclones and earthquakes/tsunamis.

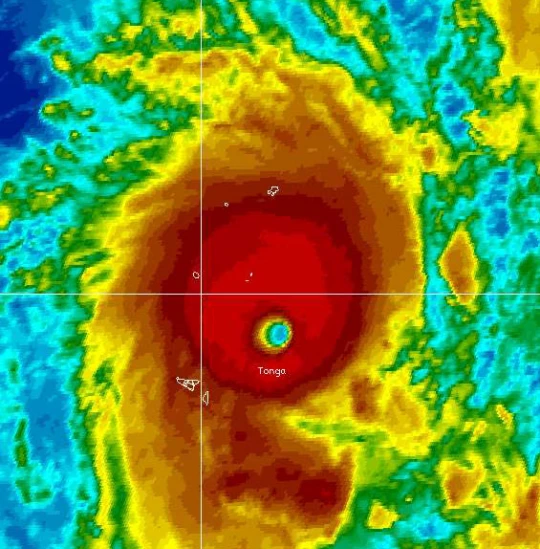

The program has already proven its rapid response capability as Tonga received a payout of US$ 1.27 million on January 23, 2014―two weeks after Tropical Cyclone Ian swept across the nation’s Ha’apai Island group displacing thousands, devastating crops and infrastructure ( see figure 2). According to reports, up to 75 percent of buildings had been damaged in the affected area.

Source: NOAA (January 11, 2014)

The pilot is the first ever scheme in the Pacific to use parametric triggers , linking immediate post-disaster insurance payouts to specific hazard events. Unlike traditional insurance settlements that require an assessment of individual losses on the ground, the pilot’s parametric policies do not pay out based on actual losses incurred. Instead, the payout disbursements are triggered by specific physical parameters for the disaster―such as wind speed and earthquake ground motion―taken from the Joint Typhoon Warning Centre and US Geological Services. This enables a much faster payout than traditional insurance.

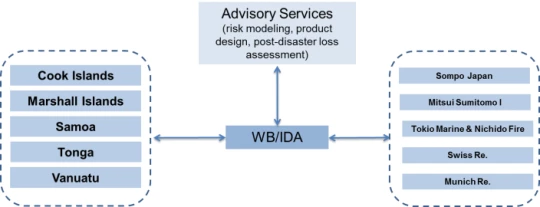

In this scheme, the World Bank Group acts as an intermediary between PICs and a group of reinsurance companies, which were selected through a competitive bidding process ( see figure 3).

Source: World Bank Group (2014)

Lessons Learned

Season three will focus on the addressing the following ‘lessons learned’ from seasons one and two:

- Catastrophe risk insurance should be complemented by other financial products to offer a more comprehensive coverage. Market‐based catastrophe risk insurance products rely on parametric triggers to allow for rapid claims settlement. Consequently they do not cover all financial loss as demonstrated above. Other financial products should be developed to give PICs broader protection against natural disasters and to ensure access to immediate but limited funds in the onset of a disaster.

- The pooling of country catastrophe risk and its placement through an aggregate portfolio resulted in significant cost savings―up to 50 percent reduction in premiums―for participating PICs. The pilot has demonstrated that the international reinsurance market is not only willing to supply catastrophe risk insurance to PICs but to do so at competitive prices. It is estimated that each participating PIC has obtained a 50 percent reduction in their premium as a result of the portfolio approach versus an individual country approach.

- Further institutional capacity building is needed. The 2013 Santa Cruz earthquake in the Solomon Islands did not result in a payout; the level of physical damage caused by this event was relatively low. This event demonstrates that there is a need to better communicate the benefits and limitations of the insurance pilot. The pilot is no designed to cover the government against all disaster losses but rather to cover some portion of the losses from major disasters, such as those that may disrupt the operations of the central government and the provision of basic public services.

The Pilot is complemented by a broader World Bank Disaster Risk Financing and Insurance Program helping PICs to find solutions for financial protection against natural disasters, for example in the area of public financial management of natural disasters. Both form an integral part of the PCRAFI, an initiative of broader World Bank Group support to the Pacific region to develop solutions for disaster risk management and climate change adaptation.

The design of the program builds on leveraging strong partnerships inside and outside of the World Bank Group, in particular the Government of Japan, the Global Facility for Disaster Reduction and Recovery, the Secretariat of the Pacific Community (SPC), the World Bank Groups’ Treasury, Legal Division, International Development Association, and the Finance and Markets, and Urban, Rural, and Social Development Global Practices. Leveraging the expertise across these different institutions and units is key to delivering integrated solutions to clients in the Pacific.

Join the Conversation