Engineer check and control welding robotics automatic arms machine in intelligent factory automotive industrial with monitoring system software.

Engineer check and control welding robotics automatic arms machine in intelligent factory automotive industrial with monitoring system software.

What would motivate you to invest more in North Macedonia?

We posed this question to nine multinational corporations (MNCs) that are manufacturing exporters to the European Union (EU). During 2007-2016, these companies invested €37.20 million and created 20,555 direct jobs in the country, contributing to the integration of North Macedonia into global and European Union regional value chains, as we have highlighted in a previous blog.

Most of the manufacturing MNCs in this survey believe harmonization of import tariffs on key production inputs with European Union levels would be a very important factor for increasing investment. Import tariffs paid on selected products accounted on average for 1.19 percent of sales revenues in 2018 and 2019 for the surveyed firms. Other key issues listed by the firms included tax incentives, access to a competitively priced labor force, and regulatory predictability. These are all consistent with the literature on investment barriers in the Western Balkans region, such as the World Bank Group’s Regional Investor Survey in the Western Balkans Six.

Most firms stated that harmonizing import tariffs with EU levels would have a strong, or very strong, impact on both direct investment and employment. All companies indicated that they would invest more in North Macedonia, instead of other competing locations, if tariff rates were harmonized with the lower EU levels. Three-quarters of companies also indicated that lower tariffs would lead to higher value-added products. They cited several reasons. For instance, lower import tariffs would imply more financial resources for expanding investments and creating additional jobs. Moreover, lower tariffs would make North Macedonia a more attractive export base, compared to competing locations in and outside of the EU, including Bulgaria, Croatia, Czech Republic, Hungary, Morocco, Romania, Serbia, Slovakia, Ukraine, and Tunisia.

The majority of firms interviewed expressed preference for the harmonization of import tariffs with the EU levels instead of the alternative import regimes available in North Macedonia. For instance, under the inward processing regime, companies can import goods from outside the EU for re-exporting, and enjoy either a deferred payment, or a refund of import duties, which are not included under the standard import tariff regime. However, the inward processing regime has several drawbacks that make it a less favorable option according to companies. For example, firms cannot obtain proof of origin (EUR.1 movement certificate), which means that EU importers must pay customs duties. Also, the ultimate use of products before re-exporting is limited to activities such as assembly, installation, and repair, thus limiting value-addition in North Macedonia.

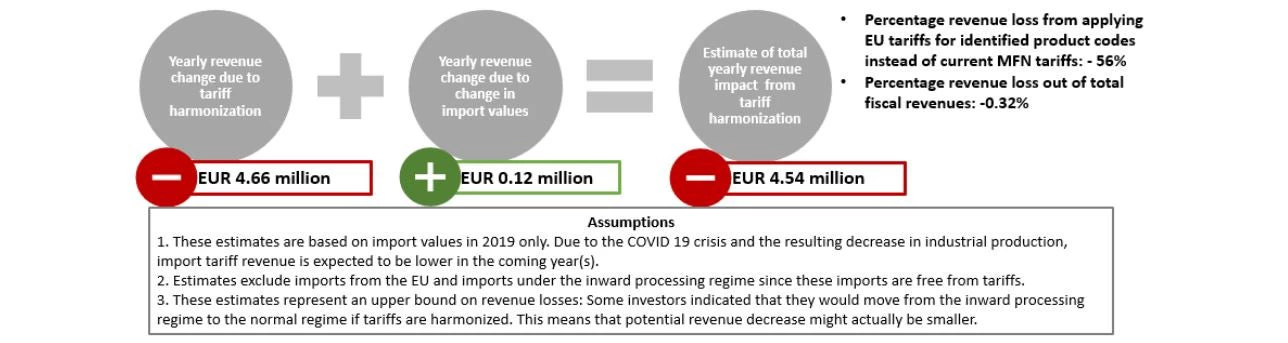

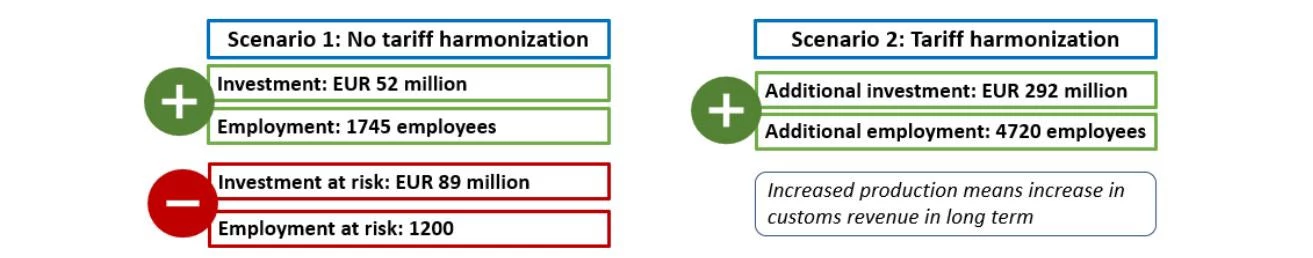

The value for money of the tariff harmonization was analyzed from the perspective of the government. Looking at costs, using 2019 import values, a quick calculation shows an estimated potential loss of €4.54 million in annual revenues from import tariffs for the government. This value would represent 0.32 percent of the total fiscal revenues collected in 2019. On the benefit side, investors stated that if import tariff rates were harmonized, they would invest an additional €292 million and hire 4,720 employees over 2-7 years, which is approximately €40 million and 454 employees annually. (See figures 1 and 2.)

Figure 1: Potential costs of harmonizing import tariffs on target products with EU levels

Figure 2: Potential benefits of harmonizing import tariffs on target products with EU levels

These calculations are subject to some limitations, including the small number of firms responding to the survey and potential selection bias. This means that the estimates of benefits may be higher than realized in practice. Further, the benefits of the tariff harmonization are based on stated intentions by investors, which might not reflect how they would act. Lastly, the estimates don’t take into account external factors, such as prolonged negative impacts from the COVID-19 crisis.

Nevertheless, the analysis points to a positive impact of the tariff harmonization with potential tangible benefits for the Macedonian economy. These would come in the form of potential investment and jobs, while at the same time making the country more cost-competitive compared to other investment locations. These benefits would come at a comparatively small fiscal cost for the government.

In a temporary response to the COVID-19 crisis, the government of North Macedonia aligned, in October 2020, the import tariffs of 33 products with the EU level for one year. This measure is one step closer in finding a lasting solution for the full and permanent harmonization of customs rates, as well as for the general improvement of the investment climate. Additional reforms are under consideration, including further liberalizations of the international trade and investment policy. These will make North Macedonia more business-friendly and attractive to investors.

Join the Conversation