Amongst the cacophony of questions besetting delegates at the recent World Bank-IMF Spring meetings held here in Washington was how to help countries struggling with extremely high borrowing costs address the debt-nature-climate challenge. Most agreed that harmonious outcomes at a required scale will depend on the ability to orchestrate change in our financial system.

In our recent blogs, we have written about performance-related financial instruments – including a sustainability-linked fund (SLF) - - which could be designed to help address these challenges. This blog will focus on another offering, the Concessional Credit-Enhanced SLBs (CCE-SLBs).

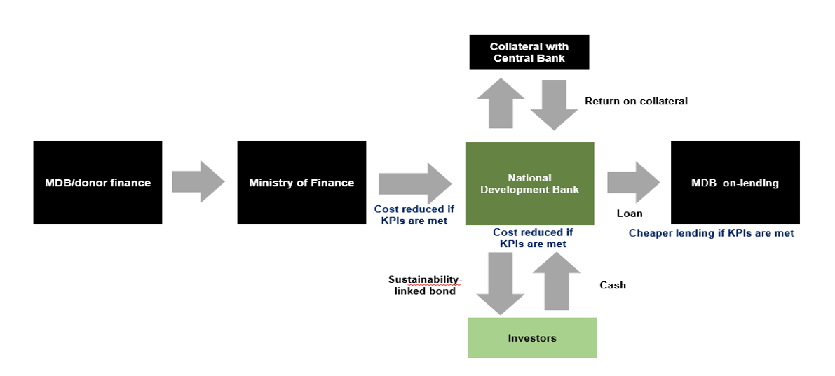

The design of this instrument is anchored in two principles (see Figure 1): leveraging public financing and credit enhancements to mobilize private capital at improved financing terms; and attaching a contingent, sustainability-linked incentive that replicates the effect of interest rate step up/down structures. The interest rate payout would depend on whether key performance indicators (KPIs) are met. These combined principles further the need to use limited concessional and public financing more effectively, while establishing a close link to sustainability commitments.

Figure 1: Illustration of how CCE-SLB can reduce borrowing costs

When it comes to the credit enhancement aspect of the instrument, a promising structure for CCE-SLBs could be one based on high-quality collateral , which would be set aside to compensate investors—at least partially—in case the issuer of the SLB were to default. For bonds issued in domestic markets, this would likely take the form of cash or local currency sovereign bonds, which are usually considered low-risk by local investors and equivalent to a AAA on a local credit rating scale. This could also support domestic capital market development.

For bonds issued in international markets, high-quality collateral, such as US Treasury bonds or bonds issued by multilateral development banks (MDBs) including the World Bank, could be concessionally financed by development partners. Other enhancement mechanisms could also be used, including partial credit guarantees, cash collateral, first-loss subordination, although these would be less standardized.

Issuance at the sovereign level or via National Development Banks in emerging markets could be ideal for these instruments. Figure 2 provides an illustrative example of how a CCE-SLB could be operationalized in a domestic emerging market. A government, receiving concessional finance from an MDB, would choose to promote the country’s sustainability agenda by channeling some of this concessional funding to a domestic development bank to on-lend. To leverage this concessional financing and increase private sector mobilization, the domestic development bank would tap the capital markets by issuing a bond at market rates. Ensuring high governance and risk management standards by the domestic development bank is another critical condition for enhancing market-based financing in its funding structure.

As many domestic development banks are new to the capital market, or may wish to attract new investors, a credit enhancement facility to backstop the issuance of the bond would be set up in the form of an escrow account, which could be located at either the country's central bank or at a domestic commercial bank. The concessional finance provided by the government to the domestic development bank would be held here in the form of cash or high-quality collateral such as a local government bonds.

Figure 2: Concessionally Credit-Enhanced SLBs in practice

The second aspect of the CCE-SLB, which could further reduce the cost of financing, would be the performance payment. The cost of the interest payment to investors holding the SLB would be lowered if KPIs were met. Potentially the government could also join in – also lowering the cost of the lending provided to the national development if ambitious targets are met.

As with any SLB, a credible financing framework is needed. In line with the International Capital Market (ICMA), SLB Principles, this requires a second-party opinion (SPO) issued by a leading rating provider to reinforce the credibility of the proposed KPIs and mitigate concerns about potential greenwashing. The KPIs used in the transaction should be relevant, core, material and ambitious in relation to the issuer's activities. In the case of the domestic development bank, they should also align with the government's sustainable development objectives. They could be social KPIs, such as number of jobs created, women-led firms financed, and projects or firms in key development sectors supported. They could be environmental, such as lending to green sectors or measurable GHG emission reductions. The KPIs must also be measurable or quantifiable, externally verifiable, benchmarkable, and supported by ongoing impact reports.

Consulting the policy and hands-on expertise of international development finance institutions and other development partners could promote high-quality standards for CCE-SLBs. The World Bank is already working with several potential issuers of CCE-SLBs on the design of KPIs and formulation of the CCE-SLB frameworks. Our next blog will outline ways to design feasible but ambitious KPI frameworks – which we believe can help to orchestrate the change our financial markets need to harmoniously support the SDG agenda.

Join the Conversation