Fotografía: Sambrian Mbaabu/Banco Mundial, Kenya.

Fotografía: Sambrian Mbaabu/Banco Mundial, Kenya.

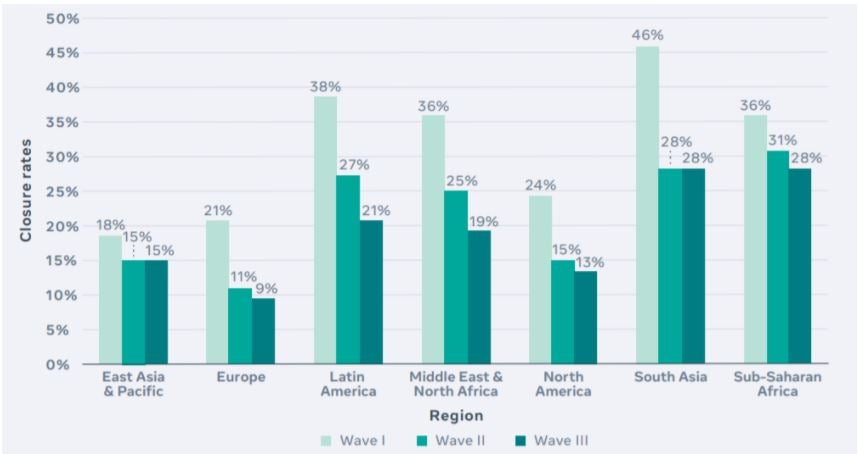

Small and medium-sized enterprises (SMEs) play an essential role in the world economy, especially in developing countries. In many countries, more than 90% of all enterprises are SMEs, which typically have fewer than 250 employees, and a large share of those can be classified as micro firms, with fewer than ten employees, according to the International Labor Organization (ILO). While most businesses around the world are struggling amid COVID-19, SMEs are particularly fragile and may lack sufficient cash to sustain business operations. Recent data shows that 58% of active SMEs reported a reduction in sales compared with the same month last year. Over half (51%) reported sales drop-offs of more than 50%, and many have not survived.

Various measures have been taken by authorities to alleviate pressures created by the pandemic. These have included deferral of tax payments and/or social security contributions, extension of filing deadlines, rate reductions, and exemption or cancelation of tax payments, waiver of interest payments and/or late payment penalties and expedition of refunds.

While most policy and tax measures are applicable to businesses of all sizes, some are specifically targeted at SMEs and could significantly relieve short-term liquidity problems as well as reduce compliance burdens. For example, South Korea reduced corporate income tax for SMEs in designated disaster zones and cut value-added taxes (VAT) for small businesses by increasing the VAT registration threshold. Hungary accelerated VAT refunds for SMEs so businesses can expect refunds in 30 days from filing instead of 75 days. In New Zealand, the threshold for payment of provisional tax was increased to NZ $5,000 to reduce cash-flow pressure on small firms. Italy launched 278 measures between March 5 and April 22, targeting six macro-areas including tax relief and financing measures to support SMEs and their workforce.

Despite these ongoing efforts, and although many economies are reopening, some are facing a second wave of the pandemic, and many firms continue to struggle to be profitable and might even face the risk of insolvency. It is crucial to plan strategically from both tax policy and tax administration perspectives to help firms recover, especially SMEs.

Many governments have taken decisive policy actions to help SMEs over the long term. Chile reduced the corporate income tax rate from 25% to 12.5% for SMEs for the fiscal years 2020, 2021 and 2022. In Japan, the burden of fixed assets tax and city planning tax on depreciable assets and business buildings has been reduced for SMEs to one half or zero for one year of the taxation period for 2021. Australia extended its 50% wage subsidy for eligible small businesses to March 31, 2021 and expanded the scope of this benefit to include more medium-sized businesses, which have fewer than 200 employees.

Tax administration is a field where there is scope to provide further support for small businesses. For example, the pandemic has created demand for e-administration. While accelerating the availability of e-service to taxpayers, authorities could invest in information technology infrastructure to further enable automation and enhance digital capability and risk management capacity. Additionally, many countries have published amendments or new provisions to existing laws and regulations aimed at supporting SMEs (such as Equatorial Guinea and Chile) that will require governments to communicate effectively with businesses to maximize the benefits of these new rules. The Georgian Revenue Service provides assistance through a government telephone hotline, which was developed during the pandemic to address all questions related to the state of emergency and new regulations. Lithuania offers support to individuals and businesses that have experienced financial difficulties because of COVID-19—a one-stop-shop principle has been applied to requests received by the tax administration agency or the State Social Insurance Fund Board (SODRA).

The tax administration authority can also take on new responsibilities to support wider government actions and help address the impact of the COVID-19 pandemic. The Israeli government has been providing business aid grants for SMEs to cover fixed costs that could not be saved, and the Israel Tax Authority (ITA) was involved in the policy and solution design from the outset, based on existing data available in ITA’s systems. Specifically, the model divides small businesses into three groups (based on 2019 turnover data) and sets an "allocation key" to determine compensation rates for different groups. This strengthened the grant system and ensured its smooth implementation.

Since tax administrations have access to data on a vast number of taxpayers, they are able to process and analyze statistical data that may be useful when designing targeted economic measures. In Portugal, the tax administration provides taxpayer information to other government bodies to help them identify taxpayers eligible for subsidies. It is also helping other authorities evaluate taxpayer income shortfalls so they can benefit from rent reduction where appropriate. Collaborating in this manner among different government bodies and sharing internal information can support such processes. However, it is worth mentioning that the tax administration should consider risks related to data and privacy protection and consult with the relevant data protection authorities about sharing third party data.

At the same time, tax authorities should also continuously monitor and analyze the prolonged impact of the crisis. Economies are seeing sharp declines in tax revenue due to slower economic growth and tax policies such as deferred payments and reduced tax rates. In the short term, these policies could help businesses solve cashflow problems and survive, but in the medium to longer term, authorities may need to carefully raise tax revenues to smooth the recovery and to strengthen the resilience of the economy. The focus may shift from providing support to capacity building to adapt the economy to new demands after the pandemic. There may need to be a reconsideration of the current tax structure, a redesign of tax policies, and an expansion of the digitalized tax system.

With the right support, SMEs could significantly boost economic recovery. Governments can seize this opportunity—and bolster long-term fiscal sustainability—with the appropriate tax initiatives. Tax authorities, especially in developing countries where the informal sector is larger, have an important role to play in evaluating and monitoring the needs and challenges of SMEs and providing necessary support.

Join the Conversation