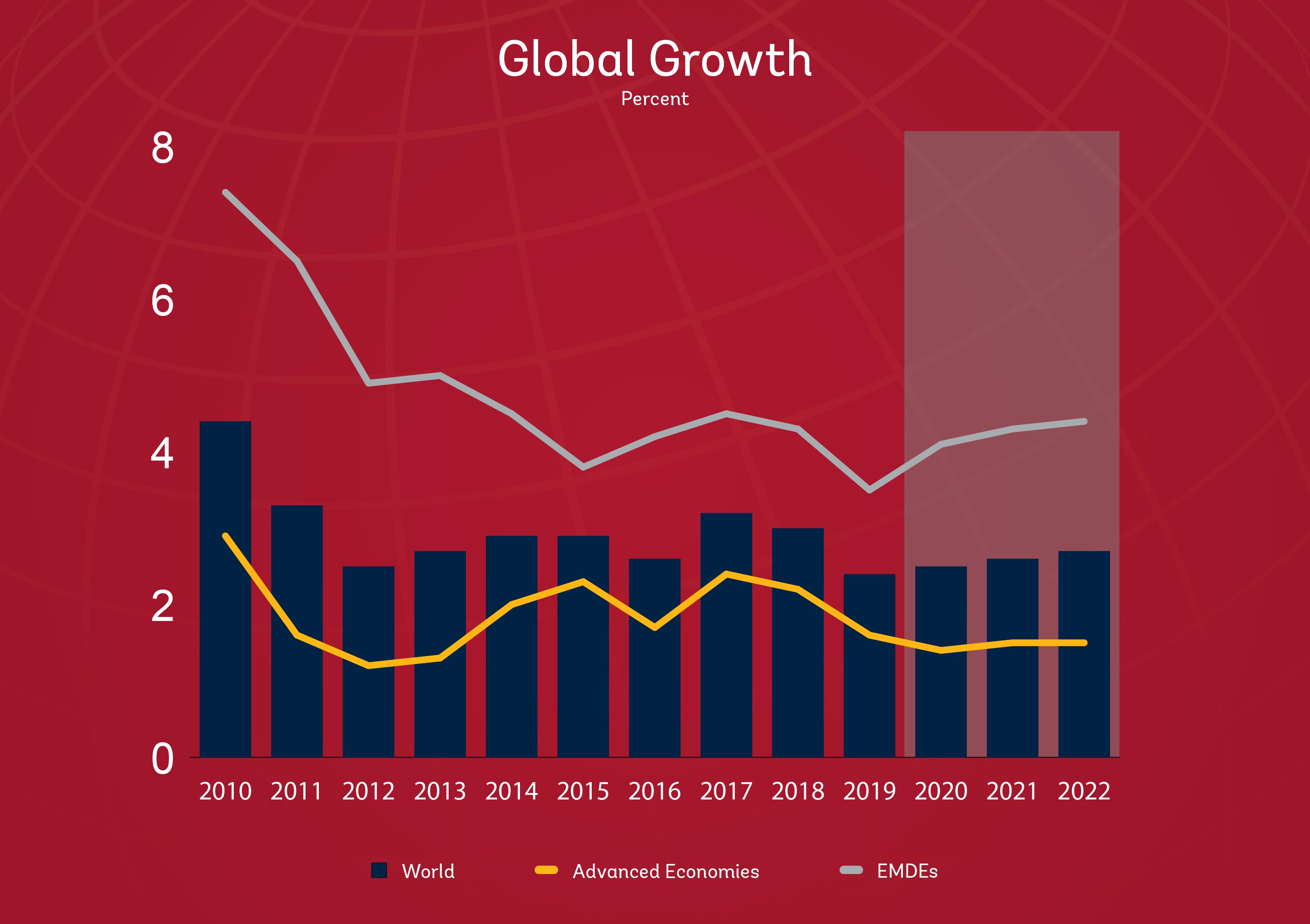

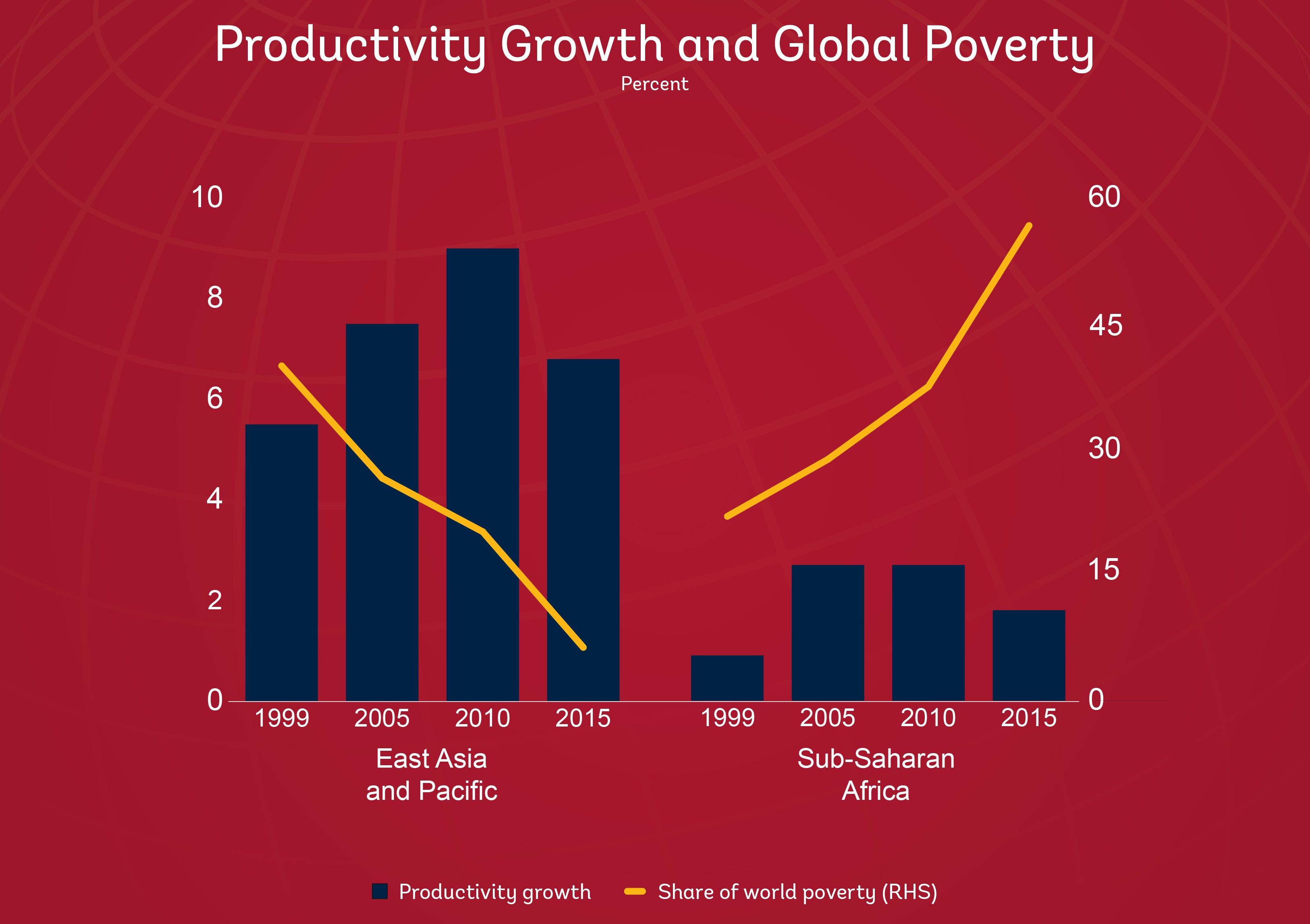

Global growth decelerated markedly last year—a post-crisis low—with key indicators, such as industrial production and trade, declining in parallel. Growth is expected to pick up in 2020, partly reflecting continued support from monetary policy. However, the recovery will hinge on the rebound of a small number of large emerging market and developing economies (EMDEs), most of which are coming out of deep recessions or sharp slowdowns. Even so, EMDE growth will be far from sufficient to make substantial progress in poverty reduction.

1. A post-crisis low in 2019

By most measures, 2019 was the worst year for the global economy since the global financial crisis , with global growth reaching a post-crisis low of 2.4 percent.

Note: Trade measured as the average of exports and imports volumes. Manu. = manufacturing. PMI = Purchasing Managers’ Index. PMI readings above 50 indicate expansion in economic activity; readings below 50 indicate contraction. Last observation is 2019Q3 for GDP, October 2019 for industrial production and goods trade, and November 2019 for PMI.

2. A tepid pickup in 2020

Note: EMDEs = emerging market and developing economies. Shaded areas indicate forecasts. Data for 2019 are estimates. Aggregate growth rates calculated using GDP weights at 2010 prices and market exchange rates.

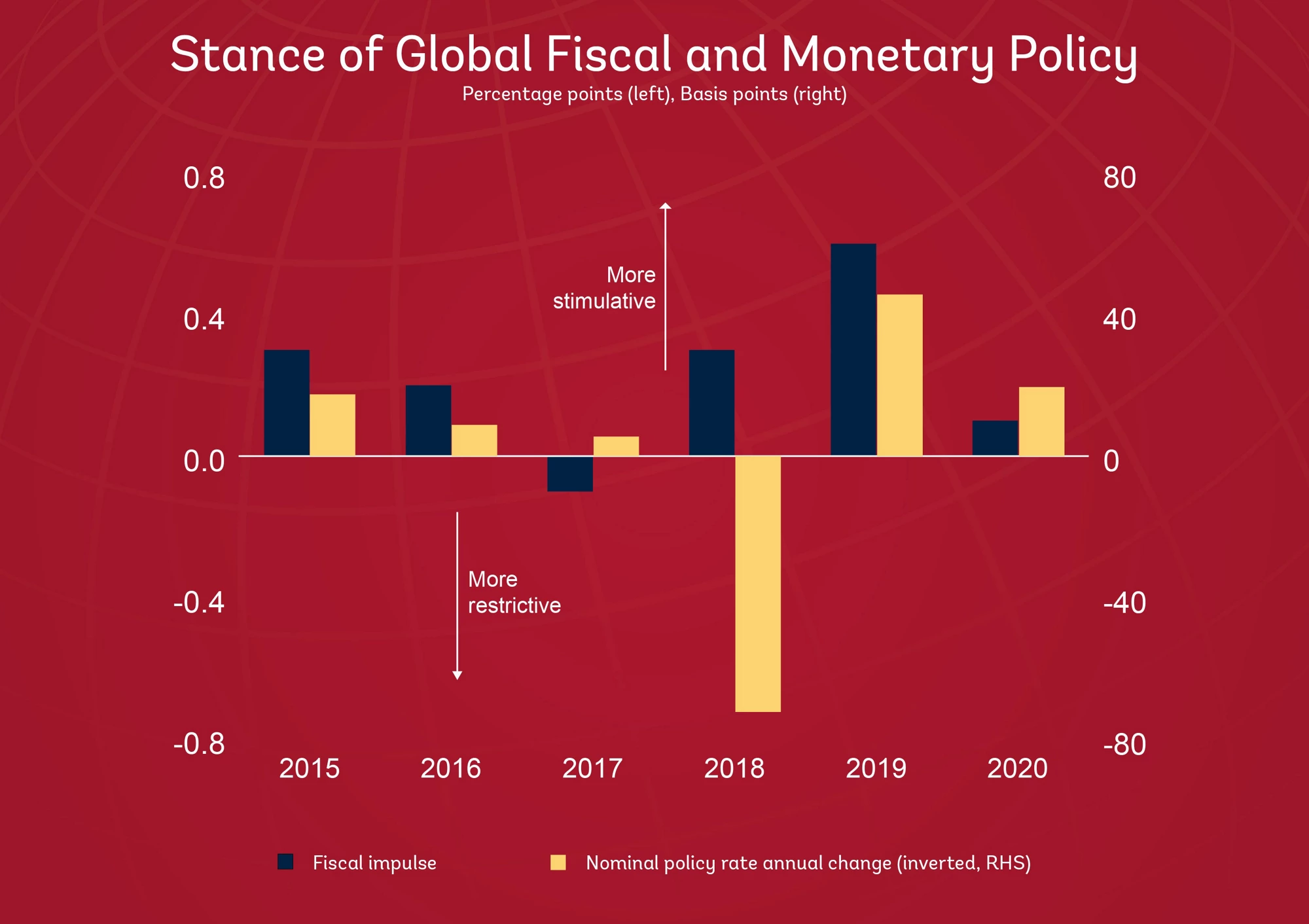

3. An evolving macro policy landscape

In response to subdued activity, macroeconomic policy became more stimulative last year. While monetary policy is expected to remain accommodative, fiscal support is anticipated to fade this year.

Note: Shaded areas indicate forecasts. Data for 2019 are estimates. Aggregates calculated using nominal U.S. dollar GDP weights. Fiscal impulse is the negative change in general government cyclically adjusted primary balance. Policy rates are the December to December change. Sample includes 35 AEs and 77 EMDEs for fiscal impulse and 16 AEs and 21 EMDEs for policy rates. Policy rates for 2020 use the December 2019 Consensus Forecasts report for central bank policy rates. When these are unavailable, the change in short-term yields is used.

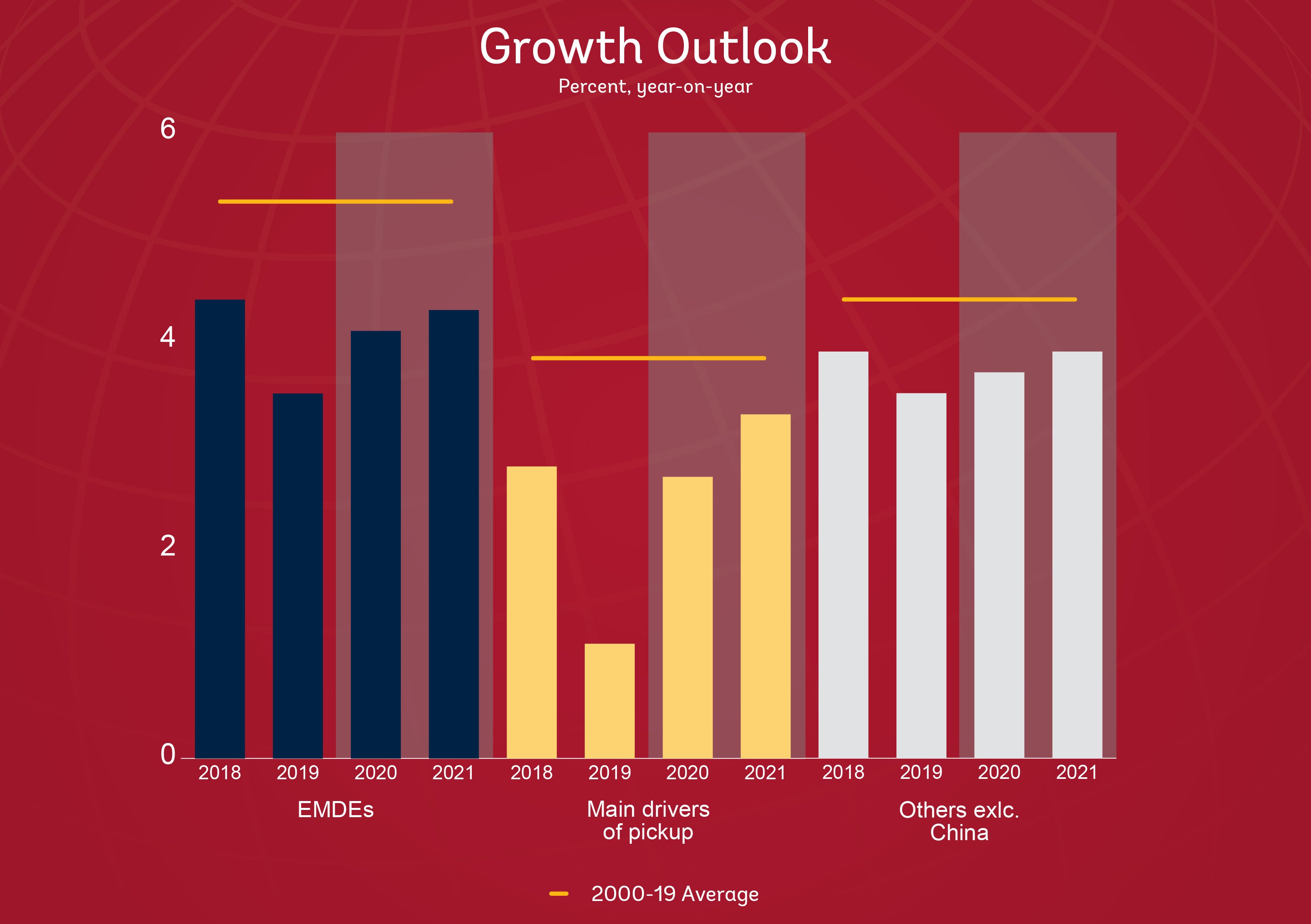

4. A fragile rebound in EMDEs

The recovery will not be broad-based. Instead, it will mostly be driven by a pickup in a small number of large EMDEs emerging from deep recessions or sharp slowdowns.

Note: Green lines indicate 2000-19 simple averages. “Main drivers of pickup” includes the eight largest EMDEs that account for 90 percent of the acceleration in EMDE growth between 2019 and 2020 (Argentina, Brazil, India, Iran, Mexico, the Russian Federation, Saudi Arabia, and Turkey). Aggregate growth rates calculated using GDP weights at 2010 prices and market exchange rates. Shaded areas indicate forecasts.

5. Insufficient per capita growth to reduce poverty

Note: Productivity is defined as output per worker. Sample includes 29 advanced economies and 74 EMDEs. Aggregate growth rates calculated using GDP weights at 2010 prices and market exchange rates. Poverty is defined as the extreme poor living at or below $1.90 per day, in 2011 PPP terms.

RELATED

Report: Global Economic Prospects

Global Growth: Modest Pickup to 2.5% in 2020 amid Mounting Debt and Slowing Productivity Growth

Join the Conversation